1

Q3 FY24: PB Fintech posts strong numbers, PAT positive with 43% revenue growthDecoding Insurance

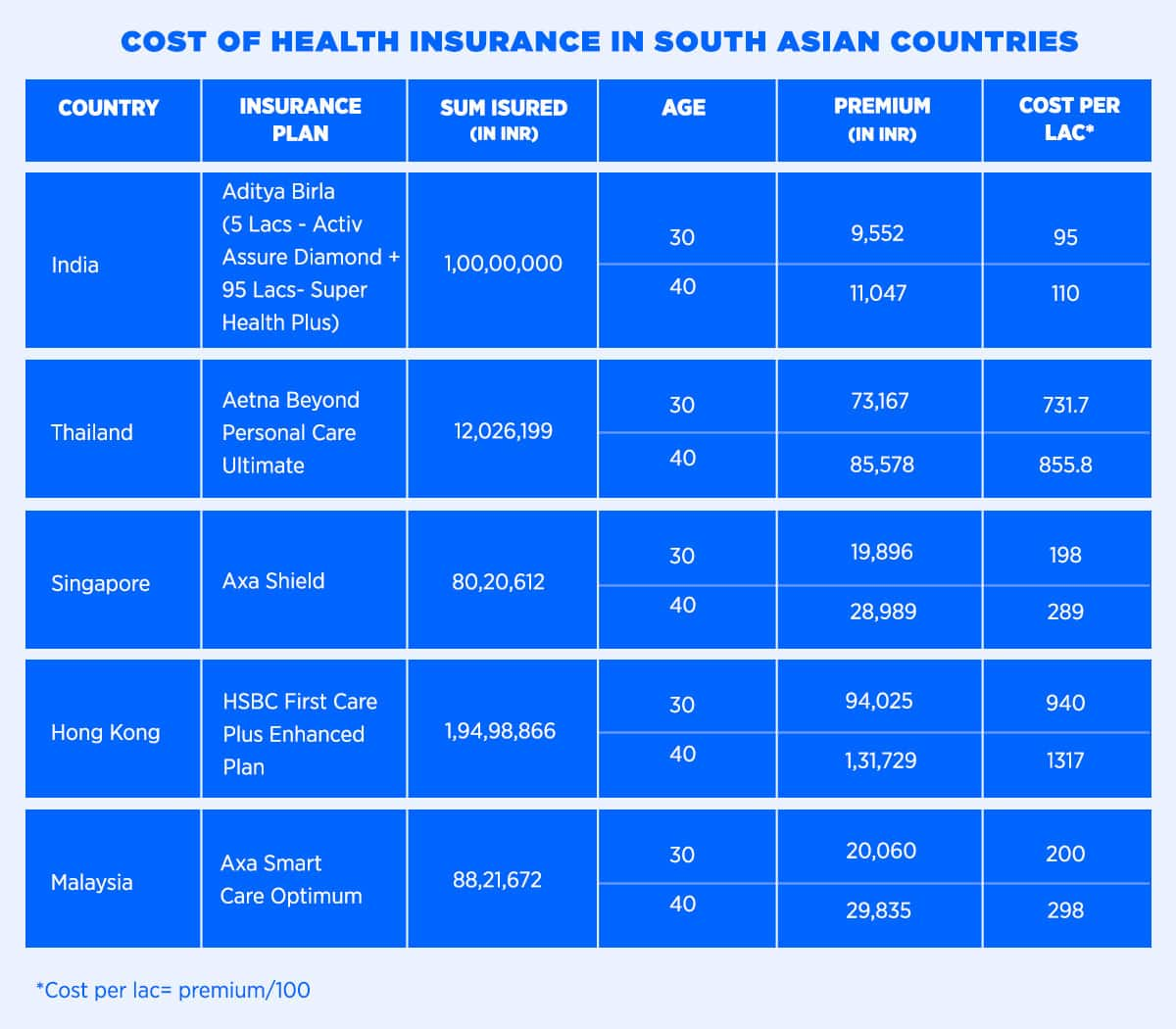

Buying Health Insurance In India Is Significantly Cheaper Than SE Asia

Following the guidelines issued by the Insurance Regulatory and Development Authority of India (IRDAI), health insurance companies in India are all set to launch several new and revamped products. These products will have features that will also address the new reality of the Covid-19 pandemic.

Last year, the insurance regulator issued the new guidelines to address the changing consumer needs, standardize the products, and eradicate some of the ambiguities from health insurance policies. Among the notable changes is the inclusion of some of the important and major diseases such as Alzheimer’s, Parkinson’s, HIV/AIDS, and morbid obesity by the insurers in their new offerings. The new-age plans will also cover age-related ailments including cataract surgery and knee-cap replacements.

Off late consumer sentiment seems to be shifting significantly in the wake of Covid-19. Consumers have realized that buying a comprehensive health cover is a vital aspect of financial planning to save themselves from uncertainties of life especially in today’s environment when Covid-19 has caused a global public health crisis.

((relatedarticle_1))

Incorporating these new features could also mean a likely rise of up to 5-25% in the insurance premiums. So, does it make sense to make health insurance more expensive in a country where insurance penetration remains abysmally low?

A small increase in premium when compared to the much wider coverage the new policies would offer is a great bargain. And despite the increase, the cost of health insurance in India is far more affordable compared to other Southeast Asian countries.

For example, a health insurance plan for a 30-year-old individual in India with a cover of Rs 1 crore — that covers pre and post-hospitalization, pre-existing diseases, daycare treatments, health checkups, private room eligibility, and ambulance charges — costs only about Rs 9,550 a year. The same cover for a 40 and 45-year-old costs Rs 11,047 and Rs 13,290, respectively.

To put the cost into perspective, a heart bypass surgery in India can cost between Rs 3,00,000-4,10,000 ($4,000-5,500)

Let us look at what a similar insurance package costs in some key Southeast Asian countries:

Thailand

For a 30-year-old individual, a health insurance cover of THB 5,000,000 (around Rs 1 crore), costs THB 30,420 (Rs 74,388) per year. For a 40-year old THB 35,580 (Rs 87,006); and THB 47,436 (Rs 1,15,999) for a 50-year old. In Thailand, bypass surgery can cost close to $15,000, which is around three times more than India.

Singapore

In Singapore, a standard health insurance plan for a 30-year-old costs S$372 (Rs 19,896) per year for which the maximum payout per year is S$150,000 (Rs 80,20,612). This covers inpatient and outpatient treatment in a public hospital ward only. For a 40-year-old person, the premium turns out to be S$542 (Rs 28,989) per year.

Heart bypass surgery is one of the most expensive hospital procedures in Singapore. In fact, the median cost of coronary bypass surgery at a private hospital is around S$75,398 (Rs 41,21,580). Many patients face even larger bills, with 25% of patients paying over S$88,942 (Rs 48,61,954).

Hong Kong

A health insurance plan for a 30-year-old person in Hong Kong, with a maximum annual benefit limit of HK$ 20,00,000 (Rs 1,94,98,866) will cost HK$ 9,644 annually (Rs 94,025 ). For a 40-year-old, the premium turns out to be HK$ 13511 annually (Rs 1,31,729). The cost of heart bypass surgery in Hong Kong is $10,197 (Rs 7,63,046.6).

Malaysia

For a 30-year-old individual, hospitalization expenses in Malaysia with an annual limit of up to RM5,00,000 (Rs 88,21,672) costs RM1,137 (Rs 20,060) per year. While for a 40-year-old person, the cost is RM 1691 (Rs 29,835) per year. Heart bypass surgery in Malaysia can cost $12,000 (8,97,966).

(Article edited by: Sunny Lamba)

((newsletter))