1

Feeling Inadequately Insured? 3 Ways To Extend Your Health Insurance CoverWhat's New

New Business Premiums of Private Sector Life Insurers Shows Recovery Signs In June

Riding on the back of the government’s unlock measures, and rising awareness around the importance of life insurance, new business premiums (NBP) of life insurers from the private sector has shown tremendous recovery in June.

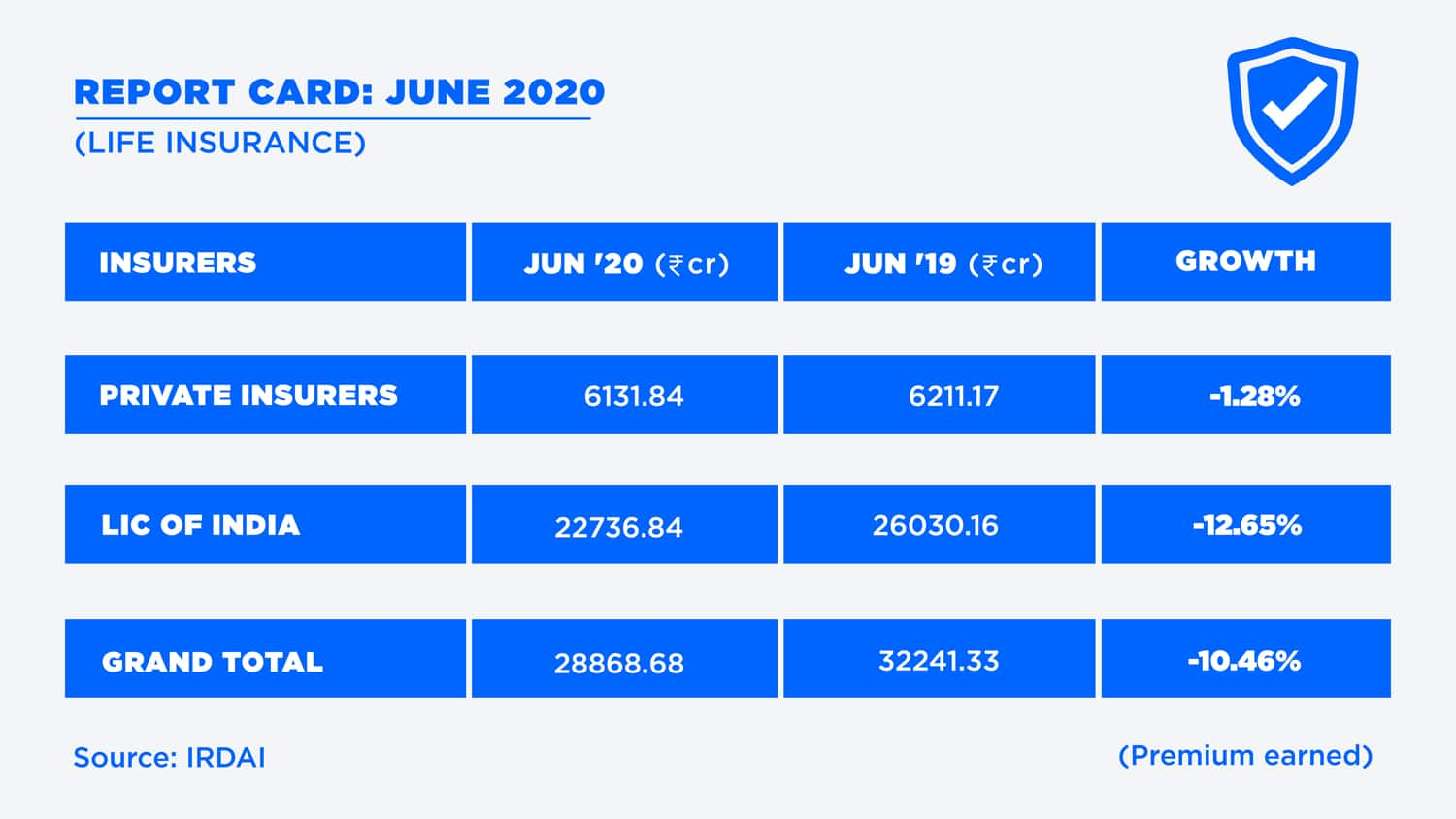

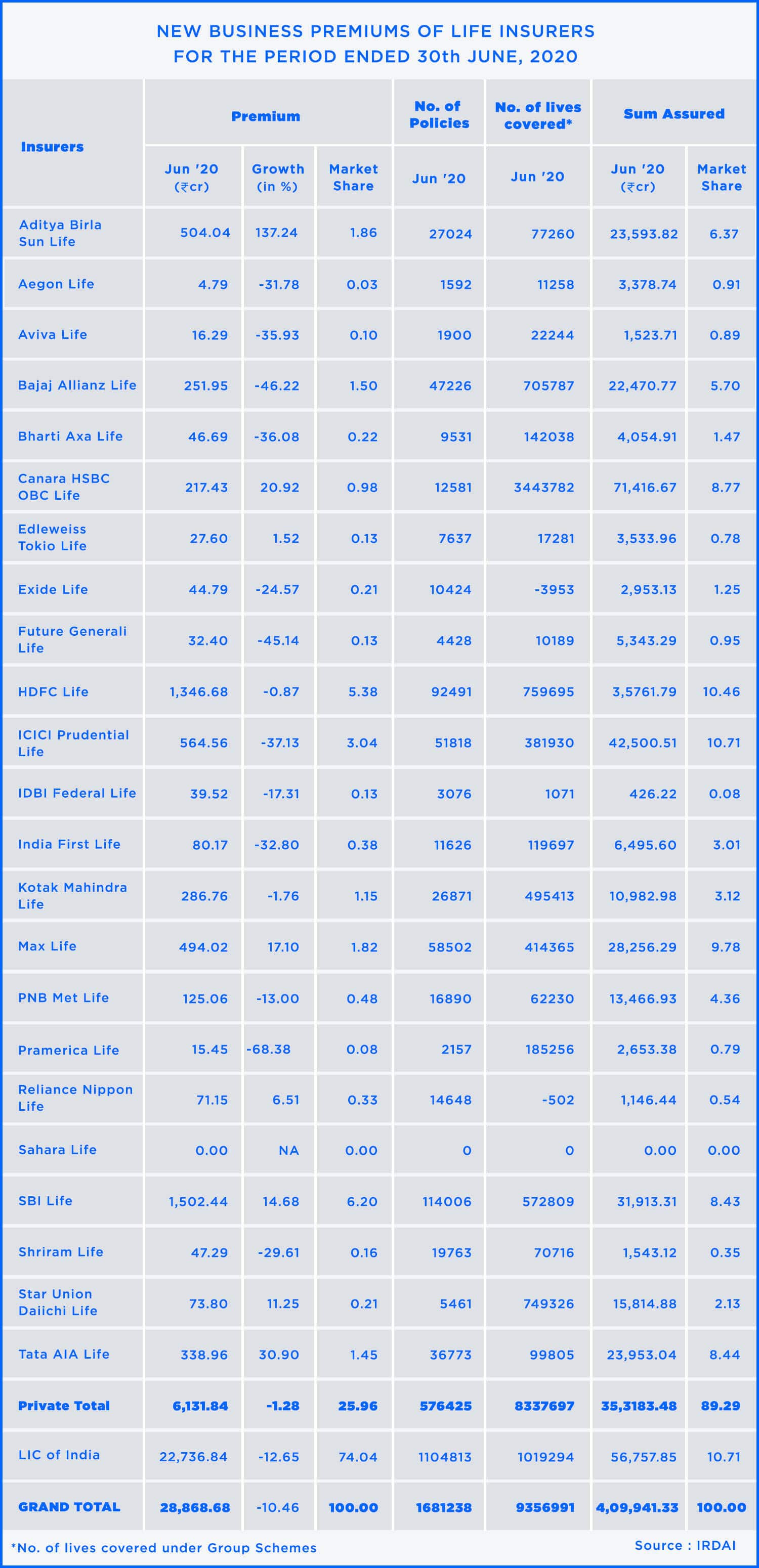

On a year-on-year basis, the NBP of private insurers declined by 1.28% in June as compared to a decline of 28.26% in May and 33.26% in April this year.

State-owned Life Insurance Corporation also showed recovery in NBP as it saw a decline of 12.65% for the month of June (YoY) as compared to 24.34% in May and 32.01% in April this year.

NBP is the premium acquired by insurance companies from new policies for a particular year.

Overall in June 2020, life insurers earned NBP to the tune of Rs 28,868.68 crores vs Rs 32,241.33 crores, the same period a year ago. For the same period, private insurers earned NBP to the tune of Rs 6131.84 crores as compared to Rs 6211.17 crores for the same period a year ago.

((relatedarticle_1))

Some of the leading private players like Aditya Birla Sun Life showed growth of 137.24% in NBP for the month of June compared to the same period a year ago. While TATA AIA Life showed a growth of 30.90%, Canara HSBC OBC Life - 20.92%, Max Life- 17.10% and SBI Life-14.68%.

On the whole, NBP of all life insurance companies (state-owned companies and private companies) is on the recovery side. For the month of June, Life insurance companies witnessed a decline of 10.46%.

While, in April and May, NBP of life insurance companies declined 32.6% and 25.4% respectively. In the first quarter of FY21, NBP of life insurers declined by 18.64% as compared to the first quarter of FY20 (Rs 49,335.44 cr from Rs 60,637.22 cr).

(Article edited by: Sunny Lamba)

((newsletter))