1

Feeling Inadequately Insured? 3 Ways To Extend Your Health Insurance CoverWhat's New

Term and Health Insurance Top Priority amidst Covid-19 Situation: Policybazaar Study

Over 90% of Indians believe that Health and Term insurance is important for their financial safety and mental wellbeing. They agree that it is very important to stay protected, especially, fearing the Covid situation. The findings are a part of the annual survey conducted by Policybazaar.com to celebrate National Insurance Awareness Day: 2021.

The survey was conducted to understand the impact of COVID-19 on insurance awareness and purchase behaviour of Indians in the last 15 months. Policybazaar surveyed over 6,000 existing customers who bought Term, Health, and Motor insurance from the platform. The survey was fielded to respondents between June 18th – 21st, 2021.

Health Insurance

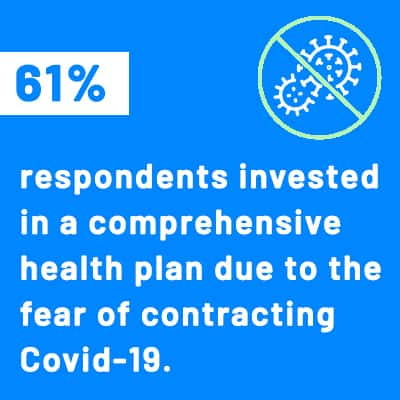

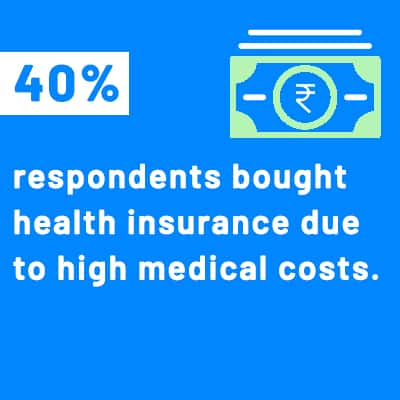

Motivated by the fear of contracting COVID-19 infection, 61% of the respondents invested in a comprehensive health plan followed by 10% of respondents who went for COVID-specific policies. As per the survey findings, high medical costs (40%), fear of COVID-19, and tax-saving benefits were the primary reasons that triggered people to buy a health cover. Nearly one-fourth of respondents received covid claims for treatment at home/ domiciliary, while claims approved for those treated at hospital stood at 77%.

((calculator))

Since the onset of the pandemic, there has been a significant increase in porting requests. This is majorly because people are looking for policies with higher sum insured and better features. The survey findings reveal that 7 out of 10 people wish to port their health policies to a different insurer for a higher sum insured and better features like zero co-payment, no room-rent capping, and lower waiting periods.

Term Insurance

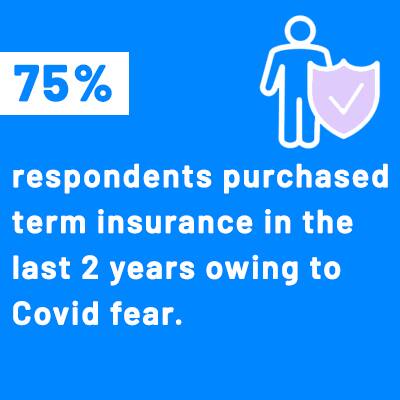

When it comes to life insurance, the findings revealed over 3/4th of respondents purchased term insurance in the last 2 years owing to Covid fear. Nearly 9 in 10 respondents who purchased a term plan considered it as a means to protect their family’s financial future and not merely as a tax-saving instrument (2%). The survey findings denote that 72% of respondents bought their first term plan online from Policybazaar. When choosing the sum assured 60% of Indians bought a term plan cover ranging between Rs. 50 Lakh - Rs. 1 Crore, 25% chose a cover above Rs. 1 Crore.

((relatedarticle_1))

Ideally, the sum assured of your term plan should be 15 – 20 times your annual income and the policy tenure will be until your retirement age. Interestingly, 6 out of 10 Indians buy a term plan with cover up to 61 – 81 years of age – the most common retirement age in India.

"During unprecedented times like these, it is important to understand our customer’s outlook towards insurance products and serve them with the right solutions specific to their needs. A well-insured nation is always better equipped to deal with economic uncertainties. It is evident that protection products are becoming the foundation of financial planning especially considering the impact of COVID-19. The pandemic has definitely accelerated awareness around insurance and the quest to buy the right insurance plans”, said Sarbvir Singh, CEO, Policybazaar.com.

Motor Insurance

COVID-19 outbreak seemed to have influenced the purchase behaviour of customers, as 95% now preferred to renew their car insurance online, while only 5% preferred the offline mode. In the last 15 months, over 80% of respondents renewed their motor insurance while the remaining 20% chose to skip the renewal. Following which they missed out on renewal benefits like no-claim bonus and lower premiums.

Keeping in mind the nationwide lockdown, Policybazaar came up with Third Party + Fire + Theft motor insurance policy to ensure coverage of vehicles at affordable premiums. Almost 6 in 10 people bought this plan for cheaper premium and less usage – the two key features of the plan. The findings convey nearly 70% of Indians chose a comprehensive cover for their vehicle and not just the mandatory third-party cover.

((newsletter))