Income Tax Login and Registration Guide Income Tax Department

For every tax payer in India, it is mandatory to be a registered user on the website of the Income Tax Department in India. Once you are registered it gives you easy access to your last years IT returns, refund status, and also e-verification.

Requirements to Register on the Income Tax Portal

To register on the income tax portal following information is required:

-

Valid Mobile Number

-

Valid PAN Card number

-

Current Address

-

Valid email address

Minors and those barred under the Indian Contract Act, 1872 are not eligible to register themselves on the income tax portal. The step to login and register on the Income Tax site is discussed below.

Step by Step Process to Register on the Income Tax Department Portal

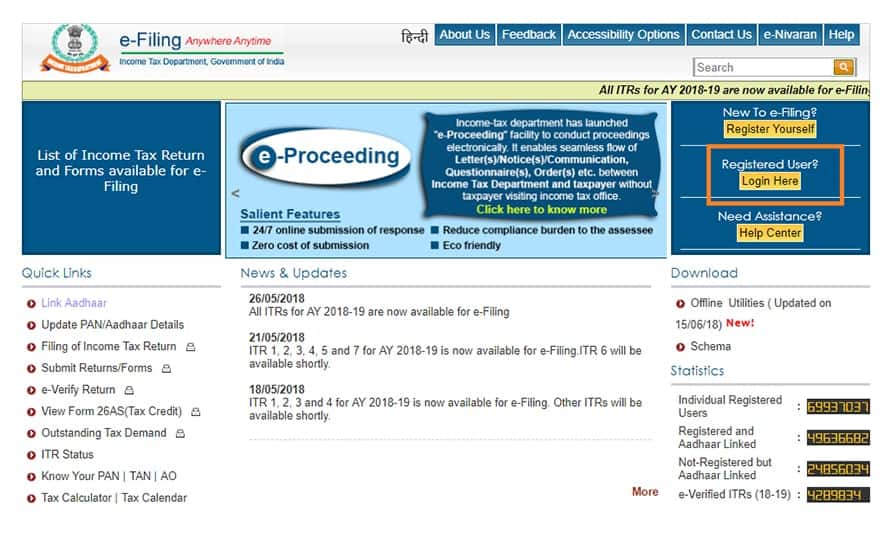

Step 1: Visit the e-Filing Portal of the Income Tax Department

Go to the homepage and click on Register Yourself located on the pages right side.

Step 2: Select the User Type

Once you click the register button, you can select the user type as Individual/HUF. Please note that your User ID will be your PAN Card Number for Income tax login. Click to continue.

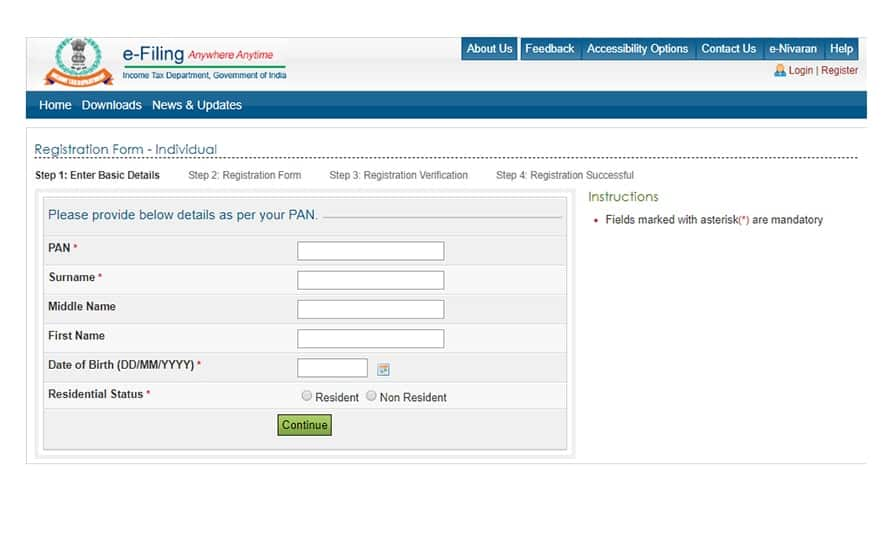

Step 3: Enter the Basic Details

Provide the following information:

-

PAN Number

-

Date of Birth

-

Surname, First Name, and Middle Name

-

Residential Status

After filling all the details correctly, click on continue

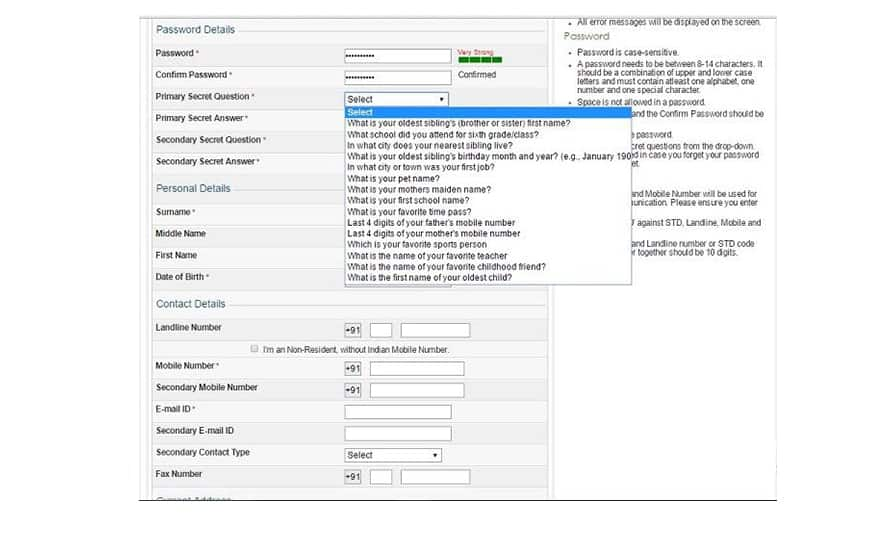

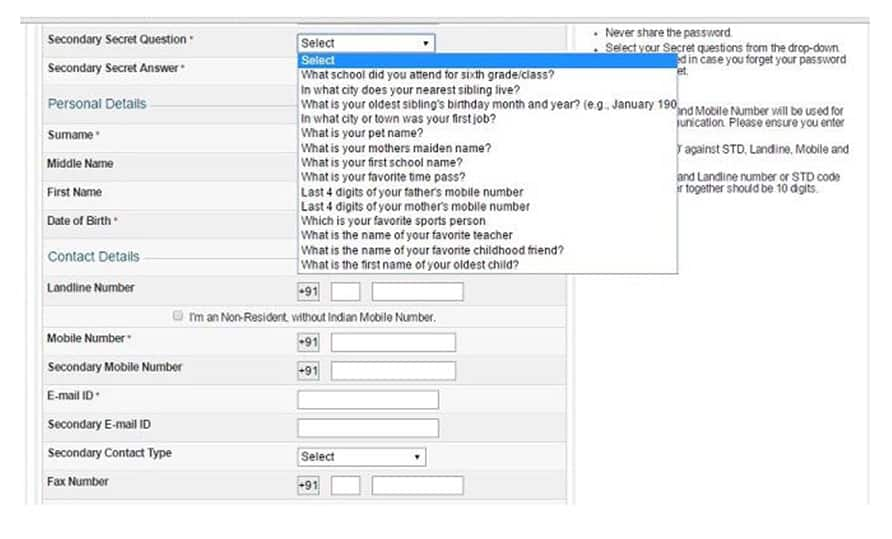

Step 4: Fill in the Registration Form

Mandatory Information:

-

Contact Details

-

Password Details

-

Current Address

-

Click on Submit

After filling all the details correctly, click on submit.

Step 5: Verification

Once you submit the duly filled form, residents will receive a one-time six digit password on your mobile number and your registered email ID. Non-residents will receive the OTP on the registered email id only

This OTP expires within 24 hours and is required to verify your details successfully. Failure to do so within 24 hours would require you to initiate the entire registration process again.

To complete the Income tax login and registration process you need to provide the following information:

-

Valid PAN Card Number

-

Valid Mobile Number

-

Valid Email Address

Registrations Process for Other than Individual and HUF

To complete the Income tax login and registration process you need to provide the following information:

-

Valid PAN Card Number

-

Valid Mobile Number

-

Valid Email Address

Other than Individual and HUF users can perform the below steps for income tax registration on the income tax portal:

-

Visit the Income Tax Departmente-Filing website

-

Click on the Register Yourself button on the right side

-

Select other than HUF/ Individualin the User Type

-

Company

-

Firm

-

Artificial Juridical Person

-

Body of Individuals

-

Local Authority

-

Trust

-

Government

-

Association of Persons (AOP)

-

The Sub-User type as per the Permanent Account Number

-

Click Continue

-

-

Provide the following information:

-

PAN of the Entity/Organization

-

Name of the Organization

-

Date of Incorporation

-

the Type of company

-

Click Continue

-

-

Fill in the following details:

-

Password Details

-

Address of the Entity/Organization

-

Personal and Contact Details of the Principal Contact

-

Click Submit

-

Once the Registration is completed

A six digit OTP will be sent to your registered mobile number and email id, and for non-residents, it is sent only in the email id. For income tax login you can use the username and password to check your tax details, refund status, and other ITR details.

Step by Step Process to Login on the Income Tax Department Portal

Once you are registered on the website of the income tax department, you can use its login credentials for logging in to the portal. Below are the steps to follow for logging in to the income tax department portal:

-

Step 1: Visit the official website of the ITD, i.e. https://www.incometax.gov.in/ and select the Login Here option provided on the home page.

-

Step 2: You will then be redirected to the new webpage. On this webpage, you will be needed to provide your User ID. Note: your PAN card is your user id.

-

Step 3: Now to proceed, click Continue, provide your password and provide confirmation for secure access message.

For filing your ITR (Income Tax Returns) at the website of Income Tax Department, you have to register yourself before login on its official website.

˜Top 5 plans based on annualized premium, for bookings made in the first 6 months of FY 24-25. Policybazaar does not endorse, rate or recommend any particular insurer or insurance product offered by any insurer. This list of plans listed here comprise of insurance products offered by all the insurance partners of Policybazaar. For a complete list of insurers in India refer to the Insurance Regulatory and Development Authority of India website, www.irdai.gov.in

*All savings are provided by the insurer as per the IRDAI approved insurance plan.

^The tax benefits under Section 80C allow a deduction of up to ₹1.5 lakhs from the taxable income per year and 10(10D) tax benefits are for investments made up to ₹2.5 Lakhs/ year for policies bought after 1 Feb 2021. Tax benefits and savings are subject to changes in tax laws.

¶Long-term capital gains (LTCG) tax (12.5%) is exempted on annual premiums up to 2.5 lacs.

++Source - Google Review Rating available on:- http://bit.ly/3J20bXZ

- SIP Calculator

- Income Tax Calculator

- Compound Interest Calculator

- NPS Calculator

- Show More Calculator