What is an Endowment Policy?

An endowment plan is a life insurance policy that offers both life cover and savings. The policy helps to create a risk-free savings corpus and provides financial protection to the family in case of any unforeseen event. You regularly pay premiums to the insurance company. In return, the company promises to pay a lump sum at maturity or upon the death of the insured.

-

Save upto ₹46,800 in tax under Sec 80C^

-

Inbuilt Life Cover

-

Tax Free Returns^

Fully Tax-Free, Life Cover Included

What is an Endowment Plan?

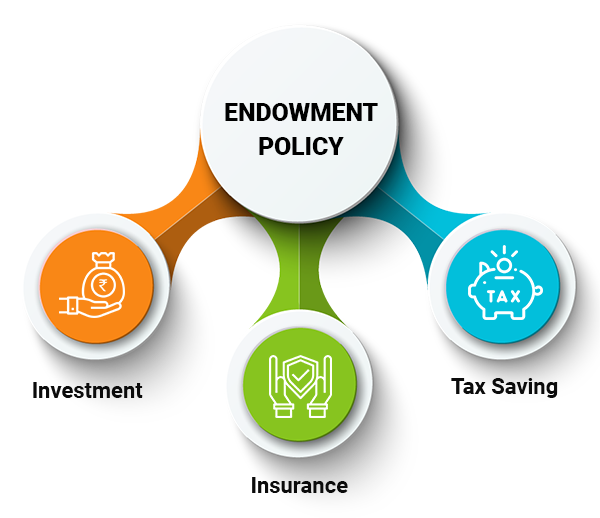

An endowment policy is a type of life insurance policy that combines the dual benefits of providing a predetermined sum assured in case of the unfortunate demise of the insured person during the policy term and a maturity benefit if the insured survives until the end of the policy term.

An endowment plan is a savings plan that offers financial protection and a way to build wealth over time. It can serve as a valuable tool for building a financial safety net to support short-term and long-term financial goals.

Now that you have learnt about what an endowment plan is, let us help you understand its working.

How Does an Endowment Policy Work?

Learn about the workings of an endowment insurance policy from the steps mentioned below:

-

Premium Payment: You pay regular premiums with flexibility—monthly, quarterly, half-yearly, yearly, or lump sum.

-

Investment Component: A portion of your endowment plan premium is invested to help grow your savings.

-

Customization: You can customise the sum assured and plan type to match your financial goals.

-

Maturity Amount: At the end of the policy term, you receive a fixed and predetermined sum, which is unaffected by market changes.

-

Life Coverage: In case of death during the term, the beneficiary receives the sum assured, which is the sum assured plus any bonuses.

Best Endowment Plans≈ in India 2025

| Endowment Policies | Entry Age (Min-Max) | Maturity Age (Min-Max) | Policy Term (PT) | Premium Paying Mode | Minimum Sum Assured | Maximum Sum Assured | Premium Paying Term (PPT) |

| ABSLI Vision Endowment Plus Plan | 1-60 years | N/A | 10/ 40 years | Yearly, Half-yearly and monthly | Rs. 1,00,000 | No Limit | 7/ 10/ 15/ 20 years |

| AEGON Life Premier Endowment Policy | 18 - 55 years | 60 years | 10 Years | Yearly, Half- Yearly or Monthly | 10 times of annual premium | N/A | 8 years |

| Aviva Dhan Nirman Endowment Policy | 4 - 50 years | 75 years | 18/ 21/ 25/ 30 years | Yearly, Half-yearly, quarterly and monthly | Rs. 20,0000 | Rs. 10,00,0000 | 14/ 15/ 16/ 18 years |

| Bajaj Allianz Endowment Policy | 1 - 60 years | 18 - 75 years | 15 - 30 years | Yearly, Half-yearly, quarterly and monthly | Rs. 1,00,000 | No Upper Limits | 5 years |

| Bharti AXA Life Elite Advantage Plan | 6-65 years | 10 Year PT: 75 years; 12 Year PT: 77 years | 10/ 12 years | Yearly, Half-yearly, quarterly and monthly | Depending Upon the Premium Amount | No Limit | 5 Years for a 10-year policy 7/ 12 years for 12-year policy |

| Canara HSBC Jeevan Nivesh Plan | 18-55 years | 80 years | Limited: 10/ 15/ 20/ 25 years; Regular: 15/ 20/ 25/ 30 years |

Monthly or annually | Annual Mode Rs. 3,00,000 and Monthly Mode Rs. 5,00,000 | No Limit | 5,7 or 10 years; Regular Pay |

| Edelweiss Tokio Single Pay Endowment Assurance Plan | Option A: 8-40 years: Option B: 8-70 years |

Death Benefit A: 18-50 years: Death Benefit: 18-80 years |

10/15 years | Single Pay | Option A: Rs. 4,00,000; Option B: 50,000 |

No Limit | Single |

| Exide Life Jeevan Uday Plan | 0-55 years | 18 - 70 years | 10, 15 or 20 years | Half-yearly or Yearly | Rs. 42,000 | No Limit | 10 years |

| Future Generali Assure Plus | 3-55 years | 18 - 70 years | 10 - 30 years | Yearly, half-yearly, quarterly and monthly | Rs. 1,00,000 | No Limit | 5-9/ 10-25/ 26-30 years |

| HDFC Life Endowment Assurance Policy | 18 - 60 years | 75 years | 10 - 30 years | Yearly, Half-yearly, quarterly and monthly | N/A | N/A | Same as PT |

| HDFC Life Sampoorn Samriddhi Plus | 30 days-60 years | 18 years- 75 years | 15 years- 40 years | Yearly, half-yearly, quarterly and monthly | Rs.65,463 | No upper limit | PT-5 years |

| ICICI Pru Savings Suraksha | 0-60 years | 18-70 years | 10-30 years | Yearly, half-yearly, and monthly | Depending upon the age, 7 or 10 times of the annual premium | No Limit | 5,7, 10, 12 years or equal to the policy term |

| IDBI Federal Endowment Policy | 18 - 55 years | 18 - 100 years | Premium paying term+ Payout period | Yearly, Half-yearly, quarterly and monthly | Rs. 10,000 | No upper limits | 12 - 30 years |

| IndiaFirst Maha Jeevan Plan | 5-55 years | 20-70 years | 15-25 years | Yearly, half-yearly, and monthly | Rs. 50, 000 | Rs. 2,00,00,000 | Same as PT |

| Kotak Classic Endowment Policy | 0 - 60 years | 18 - 75 years | 15 - 30 years | Yearly, Half-yearly, quarterly and monthly | Rs. 61,071 | No Upper Limits | Regular: Same as PT; Limited: 7 - 15 years, or PT - 5 years |

| Kotak Premier Endowment Policy | 18 - 60 years | 70 years | 10 - 30 years | Yearly, half-yearly, quarterly and monthly | Rs. 61, 317 | No Limit | Regular: Same as PT; Limited: 5/ 7/ 10/ 15 years. |

| LIC New Endowment Policy | 8 - 55 years | 75 years | 12 - 35 years | Yearly, Half-yearly, quarterly and monthly | Rs 1,00,000 in multiples of 5,000 | No Upper Limit | 12 - 35 years |

| Max Life Whole Life Super Plan | 10-60 years | 100 years | 100 years minus (-) Entry Age | Yearly, Half-yearly, quarterly and monthly | Rs. 50,000 | No Limit | 10, 15 or 20 years |

| PNB MetLife Bhavishya Plus Plan | 20-45 years | 69 years | 12-24 years | Yearly, Half-yearly, or monthly | Rs. 92, 320 | Rs. 5,00,000 | Same as PT |

| Pramerica Life Roz Sanchay | 16-Year PT: 8 - 50 years; 21-Year PT: 8-45 years |

66 years | 16 or 21 years | Yearly, Half-yearly, or monthly | 16-Year PT: Rs. 80,000; 21-Year PT: Rs. 1,20,000 |

Rs. 5,00,00,000 | 16-Year PT: 12 years; 21-Year PT: 16 years |

| Reliance Endowment Policy | 18 - 59 years | 64 years | 10 - 25 years | Yearly, Half-yearly, quarterly and monthly | Rs. 25,000 | No limit | Same as PT |

| Reliance Nippon Life Super Endowment Plan | 8-60 years | 22- 75 years | 14/ 20 years | Monthly, Quarterly, Half-yearly and yearly | Rs. 1 Lakh | No Upper Limit | 7/ 10 years |

| Sahara Dhan Sanchay Jeevan Bima | 14-50 years | 70 years | 15-40 years | Yearly, half-yearly, quarterly and monthly | Rs. 50, 000 | No Limit | Same as PT |

| SBI Life Endowment Policy | Regular: 18-55 years; Single: 18 - 60 years |

65 years | Regular: 5/ 10 years; Lumpsum | Yearly, Half-yearly, quarterly and monthly | Rs. 75,000 | No Limits | Single Pay; Regular: Same as PT |

| SBI Life Smart Bachat | OptionA: 6-50 years; Option B: 18-50 years |

65 years | 12-25 years | Yearly, half-yearly, quarterly and monthly | Rs.1,00,000 Lakh | No Upper Limit | 6, 7, 10 and 15 years |

| Shriram New Shri Life Plan | 30 days-60 years | 18-75 years | 10/ 15/ 20/ 25 years | Yearly, half-yearly, quarterly and monthly | Rs. 50,000 | No Limit | 8/ 10/ 15/ 20/ 25 years |

| SUD Life Jeevan Safar Plus | 18-55 years | 70 years | 13-30 years | Yearly, half-yearly, quarterly and monthly | Rs. 3,00,000 | Rs. 100,00,00,000 | Regular: Same as PT; Limited: 10 years |

| TATA AIA Life Insurance Fortune Guarantee Plan | SA I: 0-50 years; SA II: 0-70 years |

SA I: 70 years; SA II: 80 years |

Regular/ Limited: 10- 40 years,or PPT to 40 years; SA I/ SA II: 5-20 years; |

Yearly, Half-yearly, quarterly or monthly | 10 times the annual premium | N/A | Single Pay I (SA I); Single Pay II (SA II); Regular/ Limited: 5-10 years, or 11-20 years |

Disclaimer: ≈ Policybazaar does not endorse, rate or recommend any particular insurer or insurance product offered by any insurer. This list of plans listed here comprise of insurance products offered by all the insurance partners of Policybazaar. The sorting is done in alphabetical order (Fund Data Source: Value Research). For a complete list of insurers in India refer to the Insurance Regulatory and Development Authority of India website, www.irdai.gov.in

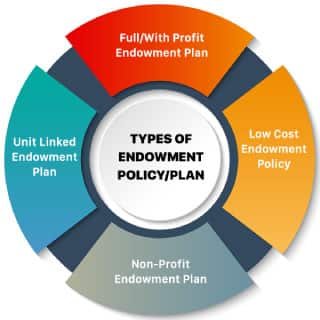

Types of Endowment Policy

-

Unit Linked Endowment Plan

A Unit Linked Endowment Plan is a combination of insurance and investment. Your premium payments are split between life insurance coverage and investments in various market-linked funds. You can switch between funds to manage your investment strategy. The returns of this endowment insurance policy depend on the performance of your chosen funds, so there is potential for growth and some risk.

-

Full/With Profit Endowment

This is a traditional endowment insurance policy in which the insurer invests your premiums. Over time, your policy accumulates bonuses, which are added to the sum assured. These bonuses are based on the insurer's profits and are guaranteed once declared.

-

Low-Cost Endowment

This type of endowment plan is specifically designed to repay a mortgage or loan by the end of the policy term. It provides life cover and aims to accumulate enough savings to cover the outstanding debt. The premiums are lower than traditional endowment plans, making it a more affordable option.

-

Non-Profit Endowment

In a Non-Profit Endowment plan, you receive a guaranteed sum at the end of the policy term without any additional bonuses. In this savings plan, the focus is on providing a fixed maturity amount or a death benefit.

-

Guaranteed Policy

Guaranteed endowment insurance policies ensure that a specified sum of money is provided to you or your beneficiaries. This payout is guaranteed even in your absence. The face value of an endowment policy will be given to the policyholder on the "maturity date" or to the beneficiary of this life insurance policy, even in case of the demise of the insured person. The bonuses under the policy are not guaranteed. Thus with an endowment insurance policy, you get the dual advantage of guaranteed policy benefits and non-guaranteed bonuses.

-

Limited Premium Payment Endowment Policy

This type of endowment life insurance plan requires you to pay premiums for a limited period, but the coverage continues for the entire term. It is ideal if you want the benefits of an endowment policy without committing to long-term premium payments.

-

Money-Back Endowment Policy

A Money-Back Endowment Policy offers periodic payouts during the policy term instead of a lump sum at the end. It combines the benefits of an endowment plan with the liquidity of getting regular payouts.

Benefits of Endowment Policy

Endowment policies give you the following benefits:

-

Additional Bonus on Endowment Policy

There are various types of bonuses declared by an insurance company. A bonus is an extra amount of money that is paid to you by the insurer in addition to your sum assured. You are entitled to share a profit in these profits of the insurer only if you hold a With-Profit Endowment Policy, and the insurer has surplus funds after payment of claims, costs, and expenses in a particular year. The bonuses of an endowment insurance policy are classified as:

-

Reversionary Bonus: A reversionary bonus is an annual bonus added to your policy's sum assured. It is declared each year and becomes a permanent part of your policy once added as it cannot be withdrawn if the policy runs to maturity or to the death of the insured.

-

Terminal Bonuses: A terminal bonus is a one-time bonus paid at the end of the policy term. It is given as a final reward for holding the policy until maturity or in case of a claim, reflecting the long-term performance of the insurer’s investments.

-

-

Rider Benefits

You can purchase the following rider benefits with his/her endowment plan:

-

Accidental Death Rider: This rider provides an additional sum assured to the beneficiary in case the policyholder dies due to an accident. It enhances the financial security of the family by offering extra coverage over the base policy amount.

-

Critical Illness Cover: The Critical Illness Rider provides a lump sum amount to the policyholder on detection of critical illnesses such as heart attack, cancer, kidney failure, etc. Taking this rider.

-

Disability Cover: This is one of the most useful riders as it provides financial help to the policyholder in case of permanent or partial disability. Depending on the policy terms, it can provide a lump sum payout or regular income to support the policyholder during their period of disability.

-

Hospital Cash Benefit: The Hospital Cash Benefit rider provides a daily cash allowance if the policyholder is hospitalized. This benefit helps cover additional expenses during the hospital stay, reducing the financial burden of medical treatment.

-

Waiver of Premium: With this rider, the policyholder is not liable to pay any premium for his/her endowment plan if he/she suffers from permanent disability or critical illness. The insurance company waives off the remaining premium payments, ensuring that the policy remains active and the benefits continue.

-

-

Maturity Benefits

Upon surviving the policy term or upon its end or maturity, the insured receives the sum assured plus a bonus for the policy term. This payout is guaranteed if the policyholder survives the policy term, making it an attractive option for long-term savings. The amount receivable upon maturity is tax-free under Section 10(10D) if the total annual premium paid is below Rs. 2.5 lakhs. This is the maturity benefit under an endowment policy.

-

Death Benefits

In the unfortunate event of the policyholder's demise during the policy term, the beneficiary receives the death benefit, which typically includes the sum assured. This amount is paid out regardless of how many premiums have been paid. Along with the sum assured, any accumulated bonuses up to the date of death are also paid to the beneficiary.

Features of Endowment Policies

Salient features of the endowment policy are:

-

Dual Benefit: This policy provides both life insurance cover and savings, ensuring financial protection and a lump sum payout at policy maturity.

-

Maturity Benefit: Offers a guaranteed lump sum amount at the end of the policy term if the policyholder survives the term.

-

Death Benefit: If the policyholder dies during the term, the nominee receives the sum assured along with any bonuses.

-

Bonus Additions: Participating policies may earn bonuses based on the insurer's profits, enhancing the maturity or death benefit.

-

Flexibility: Options to choose premium payment terms (monthly, quarterly, yearly) and policy tenure based on individual needs.

-

Loan Facility: After a certain period, you can take out loans against the policy, offering liquidity in times of need.

-

Rider Options: Additional riders, like accidental death or critical illness, can be added for enhanced protection.

-

Tax Benefits: You are tax-exempted on both the premium payments and maturity or death benefits under Section 80C and Section 10(10D), respectively.

Limitations of an Endowment Plan

There are a few limitations associated with an Endowment insurance policy, which are mentioned below:

-

Compared to other investment options like ULIPs, mutual funds or NPS, endowment plans typically offer lower returns.

-

The premiums for endowment plans are generally higher than term insurance policies due to the savings component.

-

Once the premium payment term and policy tenure are selected, it offers limited flexibility to change or adjust them.

-

Requires a long-term financial commitment, making it less suitable for those seeking short-term goals or liquidity.

All savings are provided by the insurer as per the IRDAI approved insurance plan. Standard T&C Apply

What Happens When an Endowment Policy Matures?

-

Sum Assured: Upon the maturity of an endowment policy, you are entitled to receive the sum assured, which is the guaranteed amount set during the policy purchase.

-

Bonuses: If you have chosen a profit-based plan, any bonuses or additional profits accumulated over the policy term are included in the final payout.

-

Tax-Free Benefits: The maturity amount received by you is generally exempt from taxes under Section 10(10D) of the Income Tax Act, provided certain conditions, such as premium limits, are satisfied.

All savings are provided by the insurer as per the IRDAI approved insurance plan. Standard T&C Apply

Who Should Buy the Endowment Policy?

-

People Seeking Dual Benefits: Suitable for those who want both life insurance and a savings component in a single plan.

-

Financially Disciplined Individuals: Endowment plans offer a disciplined route to build a corpus for dependents in case of financial contingencies

-

Long-Term Savers: Small businesspersons, salaried individuals, lawyers, and doctors should consider buying endowment plans for long-term financial goals

-

Tax-Saving Investors: Great for individuals looking to save on taxes, as the premiums paid and the maturity benefits are eligible for tax deductions.

-

Risk-Averse Individuals: Endowment plans are ideal for risk-averse individuals who do not mind settling for fewer returns and are not super-rich.

Why Should an Individual Buy an Endowment Policy?

-

Endowment policies provide a disciplined means of saving money for future needs.

-

An additional advantage is life-risk coverage for the family and dependents of the policyholder.

-

Returns may be lesser, but they are risk-free for a certain sum assured.

-

Tax benefits can be availed under Sections 80C and 10(10D), subject to certain conditions.

-

Risk-averse investors prefer endowment plans.

-

It offers life insurance coverage to the insured in case of an unforeseen event.

-

It offers the maturity amount to the policyholder if she/he survives the policy term.

What to See Before Buying an Endowment Policy?

One should see the following things before purchasing an endowment plan:

-

Begin Early Planning: Making investments at an early age offers a long horizon to invest. It promotes disciplined saving and offers better returns through compounding.

-

Review the Flexibility Option: Choose based on your income. Regular pay options suit salaried individuals, while single-pay options work for those with irregular incomes.

-

Know Different Types of Endowment Policies: Know the different endowment plans. Part of the premium goes to life insurance, and the rest is invested based on whether the plan is profit-based or non-profit.

-

Select a Plan that Offers Riders: A lot of insurance companies offer additional benefits like accidental death benefit or critical illness.

-

Bonuses: Bonuses depend on the insurer’s profits and are distributed at the end of each policy year.

-

Non-Guaranteed and Guaranteed Returns: Endowment policies offer both guaranteed and non-guaranteed returns, giving you the benefit of savings and risk-free insurance.

Claim Process of Endowment Plan

The beneficiary should inform the insured about the death soon after the death of the policyholder. As soon as the insurer gets to know about the loss, a claim form is forwarded to the nominee.

Fill out the Claim Form:

-

To claim the death benefit, the beneficiary/nominee of the policyholder/assignee or legal heirs must sign the claim form.

-

The last treating doctor who checked the insured should provide the loss statement.

-

The authorities of the hospital where the insured received treatment should provide the certificate.

-

A witness statement and death certificate from someone present during cremation are required.

-

If the insurance company requires a discharge voucher, it should be filled out and provided.

For effective and fast sanction of the death benefit, an additional form, as mentioned below, should be provided:

-

Post Mortem’s certified copy, police investigation report, and First Information Report – in the situation of the death of the policyholder was unnatural.

-

Employer’s e-certificate, if the insured was working in an organization.

Term Plan vs. Endowment Plan

The key differences between an endowment policy and term plan are as follows:

| Feature | Term Plan | Endowment Plan |

| Purpose | Pure protection; offers life cover only | Combines life cover with savings |

| Premium | Lower premiums | Higher premiums |

| Maturity Benefit | No maturity benefit (unless a rider is added) | Provides a lump sum on policy maturity |

| Death Benefit | The death benefit is paid if the insured passes away during the policy term | Death benefit along with savings component paid to beneficiaries |

| Investment Component | No investment component | Offers savings and investment along with life cover |

| Suitable For | People looking for affordable life cover | People looking for life cover plus savings or investment |

| Policy Term | Typically shorter (5-30 years) | Can be long-term (10-30 years) |

| Tax Benefits | Available under Section 80C and 10(10D) | Available under Section 80C and 10(10D) |

Endowment Policy Vs ULIPs

The common differences between an endowment assurance policy and ULIP plans are:

| Parameter | Endowment Policy | ULIP Plans |

| Definition | A life insurance policy that combines insurance coverage and a savings component | A life insurance policy that provides insurance coverage along with market-linked investment options |

| Return on Investment | Fixed returns with guaranteed bonuses | Varies based on the market performance of the underlying investment |

| Maturity Benefit | Guaranteed sum assured along with accrued bonuses | Market-linked returns based on the fund's performance |

| Death Benefit | Sum assured + accrued bonuses | Higher of the sum assured or fund value |

| Tax Benefits | Deductions on premiums paid and tax-free maturity amount up to a certain limit. | Premiums up to Rs. 1.5 lakhs are eligible for tax deductions under Section 80C, and the maturity amount is tax-free under Section 10(10D) if annual premiums paid are less than Rs. 2.5 lakhs. |

| Liquidity | Limited options for withdrawal before maturity | The flexibility of fund withdrawal after the lock-in period also allows fund switching. |

| Risk | Low-risk investment option | The risk profile depends on the chosen market-linked funds |

| Ideal for | Risk-averse investors looking for guaranteed returns | Investors willing to take on market risks and seeking higher returns |

Documents Required for Endowment Plan

Mentioned below is the list of documents required for an endowment assurance policy in different situations:

-

Documents Required for Application: Filled application form, Applicant's photograph, Address proof, and Income proof.

-

Documents Required for Maturity Claim: Signed discharge voucher and Original endowment policy document.

-

Documents Required for Death Claim: Death certificate, Completed claim form, Original endowment policy document, Assignment or reassignment deeds (if applicable), and Signed and witnessed discharge form.

Are Endowment Plans Tax-Free?

There are two types of tax benefits for endowment plans that policyholders, nominees, and potential buyers should know.

-

Premium Deduction: You can claim a deduction on the premiums paid in your endowment assurance policy under Section 80C of the Income Tax Act 1961. The deduction is limited to a maximum of Rs 1.5 lakhs per year.

-

Benefits Exemption: Under Section 10(10D) of the Income Tax Act 1961, tax exemption can be claimed on the benefits received from the endowment plan. This includes both the maturity benefit and the death benefit. However, specific conditions must be satisfied to qualify for this exemption.

Which Endowment Policy to Choose for Different Situations?

The following table presents an overview of the best endowment assurance policy types for different situations:

| Situation | Best Endowment Policy Type |

| Guaranteed Payouts with Low Risk | Guaranteed Endowment Policy |

| Higher Returns with Market Exposure | Unit-Linked Endowment Policy |

| Long-Term Savings with Life Cover | With Profit Endowment Policy |

| Flexible Premiums and Coverage | Limited Premium Pay Endowment Policy |

| High Liquidity Needs | Money Back Endowment Policy |

| Tax Benefits | Unit-Linked Endowment Policy |

˜Top 5 plans based on annualized premium, for bookings made in the first 6 months of FY 24-25. Policybazaar does not endorse, rate or recommend any particular insurer or insurance product offered by any insurer. This list of plans listed here comprise of insurance products offered by all the insurance partners of Policybazaar. For a complete list of insurers in India refer to the Insurance Regulatory and Development Authority of India website, www.irdai.gov.in

Disclaimer: *The Guaranteed Returns are dependent on the policy term and premium term availed along with the other variable factors. 7.1% rate of return is for an 18 years old, healthy male for a policy term of 20 years and premium term of 10 years with Rs.10,000 monthly installment premium. All plans listed here are of insurance companies’ funds. The tax benefits under Section 80C allow a deduction of up to ₹1.5 lakhs from the taxable income per year and 10(10D) tax benefits are for investments made up to ₹2.5 Lakhs/ year for policies bought after 1 Feb 2021. Tax benefits and savings are subject to changes in tax laws.

*All savings are provided by the insurer as per the IRDAI approved

insurance plan.

+ Trad plans with a premium above 5 lakhs would be taxed as per

applicable tax slabs post 31st march 2023

#Discount offered by insurance company. Standard T&C Apply

^Section 80C allows annual deductions of up to ₹1.5 lacs from the taxable income. Section 10(10D) provides tax-free maturity benefits for investments of up to ₹2.5 Lacs/ year, on policies bought after 1 Feb 2021. Tax benefits and savings are subject to changes in tax laws.

++Source - Google Review Rating available on:- http://bit.ly/3J20bXZ

- SIP Calculator

- Income Tax Calculator

- Compound Interest Calculator

- NPS Calculator

- Show More Calculator

Investment plans articles

Explore the popular searches and stay informed

- LIC

- Investment Plan

- Annuity Plan

- Child Plan

- Pension Plan

- Child Investment Plan

- SIP

- SIP Calculator

- SBI SIP

- ULIP Calculator

- Sukanya Samriddhi Yojana

- Best SIP Plans

- Retirement Planning

- SBI SIP Calculator

- HDFC SIP Calculator

- Sukanya Samriddhi Yojana Interest Rate

- NPS Interest Rate

- Deferred Annuity Plans

- SBI Annuity Deposit Scheme Calculator

- Immediate Annuity Plans

- Post Office Child Plan

- Prime Minister Schemes For Boy Child

- Government Schemes for Girl Child

- 50k Pension Per Month

- Atal Pension Yojana Calculator

- Best Pension Plan in India

- 1 Crore Term Insurance

- Best Term Insurance Plan

- Term Insurance for Women

- Term Insurance for NRI

- Term Insurance

- Term Insurance Calculator

- Life Insurance

- Term Insurance with Return of Premium

- Whole Life Insurance

- Term Insurance vs Life Insurance

- What is Term Insurance

- Life Insurance Calculator

- 5 Crore Term Insurance

- 2 Crore Term Insurance

- 50 Lakh Term Insurance

- Term Insurance for Housewife

- Benefits of Term Insurance

- Term Insurance Terminology

- Medical Tests for Term Insurance

- Term Insurance for Self Employed

- Claim Settlement Ratio

- 10 Crore Term Insurance

- Term Insurance for Smokers

- 1.5 Crore Term Insurance

- Zero Cost Term Insurance