Indian Tax System for FY 2023-24

The Indian tax system is a framework that governs the taxation of individuals and entities in India. It encompasses various direct and indirect taxes levied by the central and state governments to generate revenue for the country's development and welfare programs.

What is Tax?

Taxes are termed as an obligatory contribution made by individuals or corporations falling under the tax slab, to the Government of India. From local to national, taxes are applicable on all levels in India and are considered to be one of the major sources of income for the Government.

The government levies taxes on the citizens of the country to produce income for business projects, enhance the country’s economy, and lift the standard of living of the nationals. The government’s authority to levy tax in our country is drawn from the Constitution of India that deals with the supremacy to levy taxes to the State as well as Central governments. All the taxes levied within the country require being backed by an escorting law passed by the State Legislature or the Parliament.

What are the Different Types of Taxes in India?

In broader terms, there are two types of taxes namely, direct taxes and indirect taxes. The implementation of both taxes differs. You pay some of them directly, like the cringed income tax, corporate tax, wealth tax, etc., while you pay some of the taxes indirectly, like sales tax, service tax, value added tax, etc.

| Taxes | ||

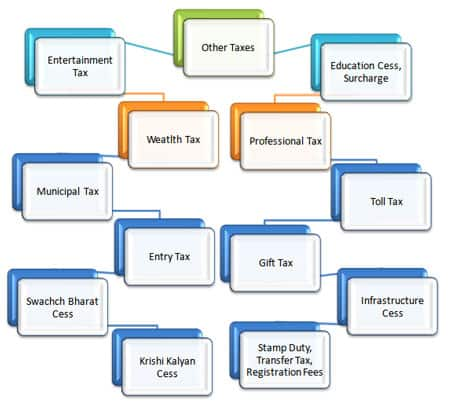

| Direct Taxes | Indirect Taxes | Other Taxes |

| Income Tax | Sales Tax | Property Tax |

| Wealth Tax | Goods & Services Tax (GST) | Professional Tax |

| Gift Tax | Value Added Tax (VAT) | Entertainment Tax |

| Capital Gains Tax | Custom Duty | Education Cess |

| Securities Transaction Tax | Octroi Duty | Toll Tax |

| Corporate Tax | Service Tax | Registration Fees |

The above-mentioned taxes are some of the main taxes levied by the government on Indian citizens.

Direct Tax

What is Direct Tax?

Direct tax is a type of tax levied on individuals or entities (corporate and non-corporate) directly by the government. These taxes are imposed on the basis of the taxpayer's ability to pay, meaning that those with higher incomes or more valuable assets typically pay more in direct taxes.

Direct Tax cannot get transferred to any other person or entity. There is only one such federation that winks at the direct taxes, i.e. the Central Board of Direct Taxes (CBDT) governed by the Department of Revenue.

What are the Different Types of Direct Taxes in India?

-

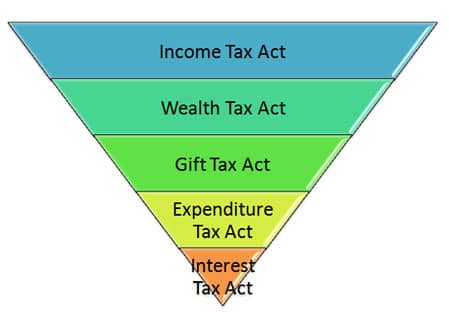

Income Tax Act:

The Income Tax Act is also called the IT Act, 1961. The income taxed by this act can be generated from any source such as profits received from salaries and investments, owning a property or a house, a business, etc. The IT Act also defines the tax benefit you can avail of on a life insurance premium or a fixed deposit. It also decides the savings from your income via investments and the tax slab for your income tax.

-

Wealth Tax Act:

If the net wealth of an individual exceeds Rs. 30 lakhs, then 1% of the exceeded amount is payable as a tax. It was put to an end in the budget that was announced in 2015. Since then, it has been substituted with a surcharge of 12% on individuals that generate an income of more than Rs. 1 crore p.a. It is also applicable to companies which have generated revenue of over Rs. 10 crores p.a.

-

Gift Tax Act:

The Gift Tax Act, established in 1958, initially imposed a 30 percent tax on gifts like shares, jewelry, and property. However, this tax was discontinued in 1998. Under the current rules, gifts from family members and local authorities are tax-exempt. Gifts from others exceeding Rs. 50,000 are taxable in full.

-

Corporate Tax:

Corporate tax is a direct tax levied on the profits of companies registered in India. The current corporate tax rate in India is 30% for domestic companies and 40% for foreign companies. There are also various deductions and exemptions available to companies, which can reduce their effective tax rate.

-

Securities Transaction Tax (STT):

Securities Transaction Tax (STT) is a tax levied on the purchase and sale of securities, such as stocks, mutual funds, and derivatives, on recognized stock exchanges in India. The STT rate varies depending on the type of security being traded. For example, the STT rate for equity shares is 0.1%, while the STT rate for futures contracts is 0.005%.

-

Capital Gains Tax (CGT):

Capital gains tax is a tax on profits earned from the sale of assets, such as stocks, bonds, real estate, or other investments. The CGT rate in India depends on the holding period of the asset and the type of asset being sold. For example, short-term capital gains (STCG) on equity shares are taxed at 15%, while long-term capital gains (LTCG) on equity shares are exempt from taxation.

New Tax Slab of Income Tax for Financial Year 2023-2024

Here is a list of tax slabs applicable as per the age group of Individuals and HUFs of India:

Tax slab for HUF and individual taxpayers who are below 60 years:

| Annual Taxable Income | Applicable Tax Rate |

| Up to ₹3,00,000 | NIL |

| ₹3,00,001 to ₹6,00,000 | 5% (Tax rebate under section 87A) |

| ₹6,00,001 to ₹9,00,000 | 10% (Tax rebate under section 87A up to Rs. 7,00,000) |

| ₹9,00,001 to ₹12,00,000 | 15% |

| ₹12,00,001 to ₹15,00,000 | 20% |

| Above ₹15,00,000 | 30% |

| A surcharge of 10% is levied on income above Rs. 1 crore, and a health and education cess of 4% is applicable on all taxable income. | |

Indirect Tax

What is Indirect Tax?

The taxes levied on goods and services are referred to as indirect taxes. They are different from direct taxes as they are not imposed on an individual who shells out them directly to the Indian government, they are, as an alternative, imposed on the products and an intermediary, the individual selling the product, collects them. The most common examples of indirect taxes are Sales Tax, Taxes levied on imported goods, Value Added Tax (VAT), etc. Such taxes are imposed by summating them with the price of the product or service that is likely to push the price of the product up.

What are the Different Types of Indirect Taxes?

The most common forms of indirect taxes are as under:

-

Sales Tax:

Sales tax is a consumption tax levied on the sale of goods and services. It is typically a percentage of the retail price of the item being purchased. Sales tax is collected by the seller and then remitted to the government.

-

Service Tax:

Service tax is charged at a rate of 15%, and is applicable to services provided by companies. Individual service providers pay when bills are settled, while firms pay upon invoicing, regardless of bill payment. Restaurants charge service tax on 40% of the total bill to avoid ambiguity.

-

Goods and Service Tax (GST):

GST is a consumption-based tax levied on goods and services at each stage of the supply chain. It can be offset against the GST charged on subsequent supply, using the tax credit method. GST is a significant reform in India's indirect tax structure.

-

Value Added Tax (VAT):

VAT, or commercial tax, is imposed at all supply chain stages, excluding zero-rated items like food and essential drugs. VAT is imposed by state governments, each determining its own tax rates on goods sold within the state.

-

Customs Duty and Octroi:

Customs duty is applied to imported goods, ensuring taxation on products entering the country. Octroi, imposed by state governments, serves a similar purpose but focuses on goods crossing state borders within India.

-

Excise Duty:

Excise duty, also known as Central Value Added Tax (CENVAT), is imposed on manufactured goods in India. It differs from customs duty as it applies only to domestically produced goods. The Central Excise Rule mandates payment of duty on excisable goods, restricting their movement without duty payment from the manufacturing point.

What are the Advantages and Disadvantages of Direct and Indirect Taxes?

-

Advantages of Direct Taxes:

-

Based on the ability to pay, higher incomes contribute more.

-

Direct payments reduce the risk.

-

Less influenced by consumer spending changes.

-

-

Disadvantages of Direct Taxes:

-

Complex calculations and record-keeping.

-

High rates may discourage investment.

-

-

Advantages of Indirect Taxes:

-

Collected at point of sale, often hidden.

-

Less direct impact on economic decisions.

-

Easily adjusted to consumer spending changes.

-

-

Disadvantages of Indirect Taxes:

-

This places a higher burden on low-income households.

-

Difficulty in understanding the actual tax amount.

-

FAQ's

-

What category does Property Tax fall into?

Property Tax is a direct tax paid by a property owner to the municipal corporation. Because it is non-transferable and paid by the property owner, it is considered a direct tax. -

What type of tax is Corporation Tax?

Corporation Tax is a direct tax, levied on a company's profits, whether foreign or domestic. Corporate tax rates range from 15% to 40%. -

What kind of tax was Kharaj?

Kharaj was an Islamic tax on agricultural land, mainly paid by non-Muslims during the 7th and 8th centuries. Alauddin Khilji imposed a 50% kharaj tax in northern India during that time. It ranged from one-third to half of the produce. -

Is Gift Tax a direct or indirect tax?

Gift Tax is a direct tax under the Income Tax Act. Gifts exceeding Rs. 50,000 are taxable at normal slab rates. -

What category does customs duty fall into?

Customs duty is an indirect tax that applies to some exported and all imported goods. The aim is to tax every product entering India. Import tax is the tax on imported goods, while export duty is levied under the Customs Act 1962 and includes protective duty, essential custom duty, anti-dumping duty, education cess, and more.

˜Top 5 plans based on annualized premium, for bookings made in the first 6 months of FY 24-25. Policybazaar does not endorse, rate or recommend any particular insurer or insurance product offered by any insurer. This list of plans listed here comprise of insurance products offered by all the insurance partners of Policybazaar. For a complete list of insurers in India refer to the Insurance Regulatory and Development Authority of India website, www.irdai.gov.in

*All savings are provided by the insurer as per the IRDAI approved insurance plan.

^The tax benefits under Section 80C allow a deduction of up to ₹1.5 lakhs from the taxable income per year and 10(10D) tax benefits are for investments made up to ₹2.5 Lakhs/ year for policies bought after 1 Feb 2021. Tax benefits and savings are subject to changes in tax laws.

¶Long-term capital gains (LTCG) tax (12.5%) is exempted on annual premiums up to 2.5 lacs.

++Source - Google Review Rating available on:- http://bit.ly/3J20bXZ

- SIP Calculator

- Income Tax Calculator

- Compound Interest Calculator

- NPS Calculator

- Show More Calculator

Explore the popular searches and stay informed

- LIC

- Investment Plan

- Annuity Plan

- Child Plan

- Pension Plan

- Child Investment Plan

- SIP

- SIP Calculator

- SBI SIP

- ULIP Calculator

- Sukanya Samriddhi Yojana

- Best SIP Plans

- Retirement Planning

- SBI SIP Calculator

- HDFC SIP Calculator

- Sukanya Samriddhi Yojana Interest Rate

- NPS Interest Rate

- Deferred Annuity Plans

- SBI Annuity Deposit Scheme Calculator

- Immediate Annuity Plans

- Post Office Child Plan

- Prime Minister Schemes For Boy Child

- Government Schemes for Girl Child

- 50k Pension Per Month

- Atal Pension Yojana Calculator

- Best Pension Plan in India

- 1 Crore Term Insurance

- Best Term Insurance Plan

- Term Insurance for Women

- Term Insurance for NRI

- Term Insurance

- Term Insurance Calculator

- Life Insurance

- Term Insurance with Return of Premium

- Whole Life Insurance

- Term Insurance vs Life Insurance

- What is Term Insurance

- Life Insurance Calculator

- 5 Crore Term Insurance

- 2 Crore Term Insurance

- 50 Lakh Term Insurance

- Term Insurance for Housewife

- Benefits of Term Insurance

- Term Insurance Terminology

- Medical Tests for Term Insurance

- Term Insurance for Self Employed

- Claim Settlement Ratio

- 10 Crore Term Insurance

- Term Insurance for Smokers

- 1.5 Crore Term Insurance

- Zero Cost Term Insurance