Link Your PAN with Your Bank Account

The Income Tax (IT) Department of Indian will issue refunds only via e-mode to the taxpayer’s bank accounts starting from March’ 2019 and the taxpayers have to link the PAN card with their accounts for the same. The IT department said that the income tax refunds will be sent directly to the bank accounts of the taxpayers through the e-refund process from March of this year. Since only e-refunds will be entertained, one has to link his/her bank’s account with his/her Permanent Account Number (PAN).

The department further adds that the account could be current, cash, savings, or overdraft and a taxpayer is also needed to validate his/her account with the e-portal of the Income Tax Department to get the tax refund.

Till now, the taxpayers were getting the refunds from the Income Tax Department either through the cheques (account payee) or in their bank accounts according to the class of the taxpayers. However, now only the refunds will be credited to the bank accounts (linked to the PAN) of the taxpayers through e-refund mode.

So, if a taxpayer’s bank account is not linked with his/her PAN, then it is suggested to get it done by going to the bank branch and providing all the relevant information there.

If the bank of a taxpayer is integrated with the e-filing portal of the Income Tax Department, then pre-validation can easily be done through Electronic Verification Code (EVC) and via net-banking.

According to an advertisement given by the IT- Department in Times of Indian on 26th February’ 2019, if the bank account of a taxpayer is not integrated with the e-filing portal, then the IT-Department will itself validate the bank account through the details provided by the taxpayer.

The e-mode of an income tax return is introduced by the department to make this process swift, secure, and direct.

If one has not pre-validated his/her bank account for getting the e-refund from the Income Tax Department, then he/she can follow the below steps to do the same:

-

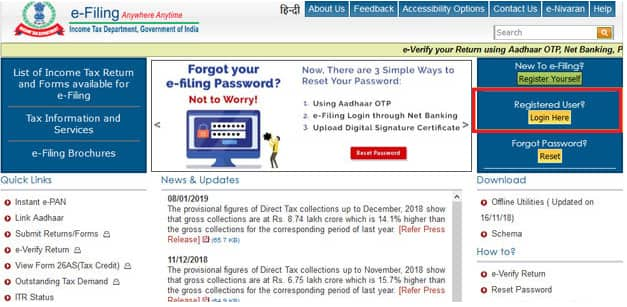

Step 1: Go to the IT-Department’s e-filing portal by clicking the link www dot incometaxindiaefiling dot gov dot in

-

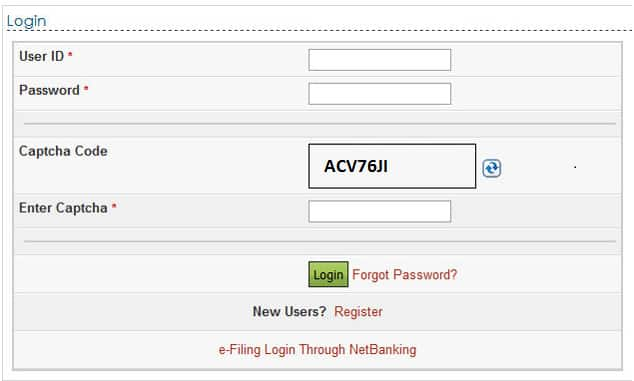

Step 2: Select the ‘Login Here’ option and provide the details that are asked on the next page. Here ‘User ID’ is the ‘PAN’ of the taxpayer.

-

Step 3: Upon login, go to the ‘Profile Settings’ and select ‘Pre-Validate Your Bank Account’.

-

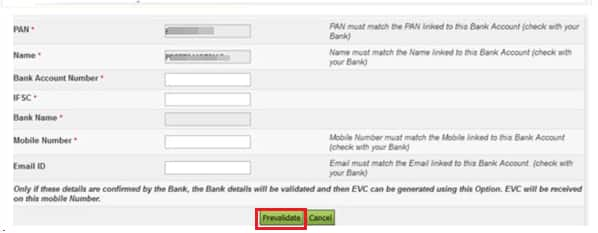

Step 4: The taxpayer is now required to provide his/her bank details, i.e. IFSC code, bank account number, the name of the bank, email id, mobile number, etc. For successful pre-validation, it is required to provide the same name, mobile number, PAN, and email id as provided in the details of the bank account for pre-validating the bank details successfully.

-

Step 5: Click ‘Prevalid’ button. Upon clicking this button, the Income Tax Department shows information on the screen with the information as the request for pre-validating the bank account is put forward. The state of the pre-validation is sent to the registered mobile number and email id of the taxpayer. However, one can always go to the ‘Profile Settings’ option and select ‘Pre-Validate your bank account’ choice for checking the current status of your account.

An individual can remove or add a bank account only after completion of 24 hours. The website shows the failed status if the validation process is failed at the bank. In addition to this, the bank will not allow any change of email id or mobile number without revalidation by the bank.

Recently, the Aadhar-PAN linking has been made ‘compulsory’ for those who are filing the income tax return and the process has to be finished before 31st March’ 2019.

According to recent data update, the Income Tax Department has issued 42 Crore PAN cards so far of which approximately 23 Crore PAN cards have been linked with the Aadhar card. Aadhar card is issued by the Unique Identification Authority of India (UIDAI) to the Indian residents, while PAN is a 10-digit code that is alphanumeric issued by the Income Tax Department of India to an individual, entity, or firm.

Final Words

In this way, this is one of the most important news for all the taxpayers as in order to get the income tax refund, they have to link their bank’s account with the PAN. The step of the e-refund mode is taken to enhance the smoothness and safety of the process of an income tax refund to the relevant and authentic bank accounts.

˜Top 5 plans based on annualized premium, for bookings made in the first 6 months of FY 24-25. Policybazaar does not endorse, rate or recommend any particular insurer or insurance product offered by any insurer. This list of plans listed here comprise of insurance products offered by all the insurance partners of Policybazaar. For a complete list of insurers in India refer to the Insurance Regulatory and Development Authority of India website, www.irdai.gov.in

*All savings are provided by the insurer as per the IRDAI approved insurance plan.

^The tax benefits under Section 80C allow a deduction of up to ₹1.5 lakhs from the taxable income per year and 10(10D) tax benefits are for investments made up to ₹2.5 Lakhs/ year for policies bought after 1 Feb 2021. Tax benefits and savings are subject to changes in tax laws.

¶Long-term capital gains (LTCG) tax (12.5%) is exempted on annual premiums up to 2.5 lacs.

++Source - Google Review Rating available on:- http://bit.ly/3J20bXZ

- SIP Calculator

- Income Tax Calculator

- Compound Interest Calculator

- NPS Calculator

- Show More Calculator

Income Tax articles

Explore the popular searches and stay informed

- LIC

- Investment Plan

- Annuity Plan

- Child Plan

- Pension Plan

- Child Investment Plan

- SIP

- SIP Calculator

- SBI SIP

- ULIP Calculator

- Sukanya Samriddhi Yojana

- Best SIP Plans

- Retirement Planning

- SBI SIP Calculator

- HDFC SIP Calculator

- Sukanya Samriddhi Yojana Interest Rate

- NPS Interest Rate

- Deferred Annuity Plans

- SBI Annuity Deposit Scheme Calculator

- Immediate Annuity Plans

- Post Office Child Plan

- Prime Minister Schemes For Boy Child

- Government Schemes for Girl Child

- 50k Pension Per Month

- Atal Pension Yojana Calculator

- Best Pension Plan in India

- 1 Crore Term Insurance

- Best Term Insurance Plan

- Term Insurance for Women

- Term Insurance for NRI

- Term Insurance

- Term Insurance Calculator

- Life Insurance

- Term Insurance with Return of Premium

- Whole Life Insurance

- Term Insurance vs Life Insurance

- What is Term Insurance

- Life Insurance Calculator

- 5 Crore Term Insurance

- 2 Crore Term Insurance

- 50 Lakh Term Insurance

- Term Insurance for Housewife

- Benefits of Term Insurance

- Term Insurance Terminology

- Medical Tests for Term Insurance

- Term Insurance for Self Employed

- Claim Settlement Ratio

- 10 Crore Term Insurance

- Term Insurance for Smokers

- 1.5 Crore Term Insurance

- Zero Cost Term Insurance