Parents basically invest for certain major goals like education, marriage and for giving a better and comfortable lifestyle to their children. Each goal has a different time frame so parent must separate them to choose the most appropriate investment to reach that goal. Every parent wants to give the best they can give to their child and for that they should start thinking as early as possible.

The sooner you should start saving the better will be the corpus to fulfill the set goals. 2.8% parents start saving when their child crosses 12 years of age. These parents can face hurdles in getting enough corpuses on reaching the goal.

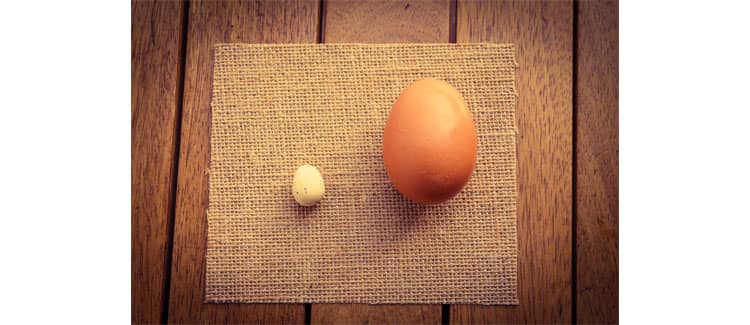

For instance, Mr. Gupta started savings when his son, Aaditya reaches the age of 12 years. After 6 years, Aaditya will be ready for his higher education. The average cost of a graduate course today is Rs 5 lakhs. The current inflation rate in India is 6.73%. So, after 6 years the cost of the same course will be Rs 7.3 lakhs. Mr. Gupta needs to save around 1 lakh per year to reach that goal. In this growing world with lots of expenses for a middle class family with an average of two children, saving one lakh per year is not that easy as it seems to be. If Mr. Gupta would have started saving when aaditya was 1 year old then he would be required to save just Rs 40, 555 per year i.e, Rs 3379 per month which is not a big deal. By saving early, Mr. Gupta would have had better and more expensive avenues opened for his son’s education that what he might have at his disposal right now.

Before investing, every parent wants to be clear about the returns those investments will reap in future. What will be the risks and benefits? How taking risk can be beneficial for them? All these questions click in the mind of parents whenever they think about investment options.

Higher the risk, higher will be the returns. A monthly investment of Rs 10,000 per month will grow to Rs 7.32 lakh after 5 years at the rate of 8%. The same investment at the rate of 15% will grow to Rs 8.62 lakh in the same time period. In 15 years, this investment will grow to Rs 33.76 lakh at the rate of 8% and to Rs 60.92 lakh at the rate of 15%.

Parents must gather minor to major information regarding investment and must go through if not all then the necessary basic things of market, finance and investment. Start by estimating the cost of raising your child. The estimated cost needed to raise a child according to ET Wealth is Rs 54.75 lakh. It includes the cost of healthcare, entertainment, clothing, education, food, housing, transport and miscellaneous.

So, first make yourself rich with knowledge then go for the suitable investment Plans.

*All savings are provided by the insurer as per the IRDAI approved insurance plan. Standard T&C Apply

We bring here the top five long-term investment plans for your child to make his/her future secure and bright.

1. CHILD PLANS: A child insurance plan gives a lump-sum amount to the child in case of policyholder's death and all future premiums are waived off. After that also, the insurance company continues investing money on behalf of the policyholder. The child will be given the money at specific intervals of time according to the policy. 26% parents have invested in child insurance plans that drain away the risk on the education of the child if the parent is no more.

4. PUBLIC PROVIDEN FUND (PPF)/ DEBT FUND OR FIXED DEPOSIT (FD): PPF is the most popular tax-saving investment plan and long term investment scheme which can be opened in post office or banks. The interest rate on the PPF is market linked now and one can invest up to Rs 1 lakh in a year. It matures in 15 years but the tenure can be extended in blocks of 5 years after maturity. Through FDs, you can receive regular income by the interest payments that are made every month or quarter. It is a very safe investment but this investment can't beat inflation.

5. STOCKS & ETFs: Stocks are risky assets but they have many advantages over other investment options. Stocks give the highest return over the long term. It's a liquid investment. ETFS are much like stocks. They hold assets like stocks, commodities or bonds close to their Net Set Values over the course of the trading day. Through ETFs, you can invest in entire countries or sectors. These are transparent and cost effective investments.