Bike Insurance Companies

Buying bike insurance is one of the ways to protect your two-wheeler from unexpected expenses caused by various unforeseen circumstances. With various trusted bike insurance companies in India, choosing the right insurer can make all the difference between a smooth claim experience and endless hassles. From different Claim Settlement Ratios (CSR) to available cashless garage networks, each bike insurance company offers unique features. Comparing these aspects helps you find a policy that fits your budget and gives your bike an ultimate level of protection.

Why is Choosing the Right Bike Insurance Company Important?

Finding the right bike insurance company is not just about choosing the one with the lowest premium. The insurer you select determines how quickly and smoothly your claims will be settled and how efficient the company will be during your tough times.

A reliable two wheeler insurance company ensures:

- Hassle-Free Claims: Companies with high Claim Settlement Ratios, usually more than 90%, help process your claims quickly.

- Wider Garage Network: A bike insurance company with a strong network of cashless garages makes repairs easier and faster, especially during emergencies.

- Better Coverage Options: Choosing a bike insurance company which offers a wide range of add-ons and benefits to protect your bike against theft, breakdowns, or accidental damage is considered a wise decision.

- Peace of Mind: Knowing that your bike insurer is trustworthy gives you a sense of freedom to ride without worrying about unforeseen repair costs.

Hence, choose the right company for enhanced coverage at an affordable premium and reliability to avoid delays or disputes during claims settlement.

How to Compare Two Wheeler Insurance Companies Effectively?

With so many insurers in the market, choosing the best bike insurance company can feel overwhelming. The key is to compare them using the correct parameters. Here are the most critical factors you should consider before making a decision.

Key Factors to Consider Before Buying Bike Insurance

Claim Settlement Ratio (CSR)

Cashless Garage Network

Premium Rates & Coverage Options

Add-On Availability

Customer Reviews & Service Ratings

17+ Bike Insurance Companies in India

Here’s a list of the most trusted two-wheeler insurers in India. This table explains their cashless garage network:

| Public Insurer Bike Insurance Companies | Cashless Garages |

|---|---|

| The New India Assurance Co Ltd | 1173+ |

| United India Insurance Co Ltd | 500+ |

| National Insurance Co Ltd | 900+ |

| The Oriental Insurance Co Ltd | 3100+ |

| Private Insurer Bike Insurance Companies | Cashless Garages |

|---|---|

| ICICI Lombard General Insurance Co Ltd | 6200+ |

| Bajaj Allianz General Insurance Co Ltd | 4500+ |

| Go Digit General Insurance Ltd | 1400+ |

| Cholamandalam MS General Insurance Co Ltd | 6912+ |

| IFFCO-Tokio General Insurance Co Ltd | 4300 |

| HDFC Ergo General Insurance Co Ltd | 2000+ |

*Disclaimer: The insurers/plans mentioned are arranged in order of highest to lowest gross direct premium income for motor insurance(total) by non-life insurers within India segment wise as per “Gross Direct Premium Income Underwritten By Non-Life Insurers Within India (Segment Wise) : for the period upto March 2025 (Provisional & Unaudited ) In FY 2024-25”, published by General Insurance Council. Policybazaar does not endorse, rate or recommend any particular insurer or insurance product offered by any insurer. The insurers/plans mentioned are offered by Policybazaar’s insurer partners offering motor insurance plans on our platform for complete list of insurers in India refer to the IRDAI website www.irdai.gov.in

What is the Bike Insurance Claim Settlement Ratio?

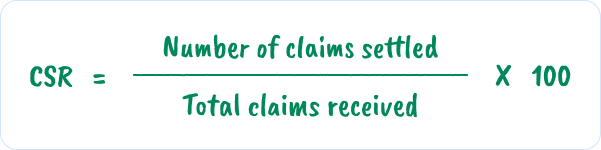

In the insurance industry, a bike insurer's claim settlement ratio refers to a percentage showing the number of claims settled by the company during a period. It is a numerical representation reflecting the company's ability to pay claims and financially aid policyholders.

A high CSR (above 90%) indicates that the company is reliable, quick in processing claims, and supportive during emergencies.

Here is the formula to calculate the CSR of a particular bike insurance company:

How Do You Select the Most Suitable Bike Insurance Company in India?

With several bike insurance providers available in the Indian insurance industry, finding the right two wheeler insurance plan is quite challenging. This is because the needs of every individual are different. For some people, a two wheeler insurance company with a vast network of cashless workshops is suitable, while for others, insurers with the highest claim settlement ratio are the best.

In this way, a 2-wheeler insurance company can become the most suitable for you by many parameters. Therefore, below is a list of pointers that you must consider while buying a two wheeler insurance policy:

Network of Cashless Garage

Claim Settlement Ratio

Availability of Add-ons

24*7 Customer Assistance

Choosing the Right Coverage: Comprehensive Bike Insurance vs Third-Party Bike Insurance

When comparing insurers, you must understand which type of bike insurance policy you will buy.

Comprehensive Bike Insurance: It covers both third-party liability (damage to others) and own damage (your bike's repair costs). It also allows you to buy add-on covers for enhanced protection. This is recommended for new, high-value, or frequently used bikes, as it provides complete protection.

Third-Party Bike Insurance: It is a mandatory policy that only covers damage to third parties, people or property. It is affordable, but it does not protect your own bike. This is suitable for older bikes with low market value, where repair costs may exceed the bike's worth.

Must-Have Bike Insurance Add-Ons for Better Protection

While comparing insurers, pay attention to the add-ons they offer. Some of the most valuable ones include:

- Zero Depreciation Cover: It ensures you get the full cost of replaced parts without depreciation cuts.

- Engine Protection Cover: It covers expensive engine repairs due to waterlogging, oil leaks, or breakdowns.

- Roadside Assistance: It provides emergency help like towing, fuel delivery, or minor repairs if your bike breaks down mid-journey.

- Consumables Cover: It pays for items like engine oil, nuts, bolts, or brake oil, which are usually excluded from standard policies.

Latest Two-Wheeler Insurance Rules in India 2026

Comparing bike insurance online is one of the smartest ways to invest in the right manner to get the best coverage and save money. Here is a step-by-step process to compare two wheeler insurance online efficiently:

- All two wheelers must have at least third-party bike insurance.

- Failing to hold valid two wheeler insurance can result in a ₹2,000 fine or imprisonment up to 3 months.

- New bikes must be insured with a 5-year third-party plan at the time of purchase.

- Driving without bike insurance violates the Motor Vehicles Act, 1988.

How to Read Policy Terms & Avoid Hidden Costs?

Insurance documents are full of details that many people skip, leading to unpleasant surprises later. While comparing insurers, carefully check for:

- Exclusions: Situations where the insurer will not pay (e.g., drunk driving, wear & tear, riding without a license).

- Deductibles: The portion of the claim you must pay from your pocket before the insurer steps in.

- Claim Procedures: How easy or difficult is filing and tracking a claim?

- Add-On Conditions: Restrictions or limits that may apply to certain covers.

FAQs Bike Insurance Add-Ons

Q.1 Which is the bike insurance company in India?

Ans:Currently, 17+ bike insurance providers are available at Policybazaar.com and offer different types of bike insurance policies along with multiple add-on covers. However, the bike insurance company is not the same for all. It depends on an individual’s budget and requirements. At Policybazaar.com, you can compare plans offered by top bike insurance providers as per their claim settlement ratio with various other factors depending upon your needs.Q.2 Which insurance is better for bikes?

Ans: Keeping in mind the features & benefits, a comprehensive bike insurance is the best option as it covers both third-party liabilities and damages to your own bike, including theft, fire, and natural disasters.Q.3 Can I change my bike insurance provider?

Ans: If you are dissatisfied with your current bike insurance company, you can easily switch from one to another. However, the best time to change your insurance provider is during bike insurance renewal.Q.4 Can You Switch Your Bike Insurance Companies?

Ans: Yes, you can switch insurers during policy renewal without losing your No Claim Bonus (NCB). Most online platforms allow easy portability with just a few clicks.Q.5 What is the best insurance company for motorcycles?

Ans: The best insurance company for motorcycles depends on your needs. However, choose a company which has fast claims, strong service, and affordable premiums.Q.6 What is the full form of IDV?

Ans: IDV stands for Insured Declared Value. It's the maximum claim amount you receive if your bike is stolen or totally damaged.Q.7 Which is one of the cheapest bike insurance companies in India?

Ans: The premium of your bike insurance policy depends on many factors, like the IDV of your bike, the number of add-ons that you have opted for, the type of insurance policy, the location of RTO, etc. Therefore, the most affordable bike insurance policy depends on these factors.Q.8 Define the two-wheeler insurance rule in India.

Ans: According to the Motor Vehicle Act, all two-wheeler owners must have at least a third-party two-wheeler insurance policy in India. If you do not have at least a 'third-party bike insurance' for your two-wheeler, you must pay a fine of ₹ 2,000 or/and imprisonment of up to 3 months. In addition, new two-wheeler owners are required to have a long-term third-party bike insurance plan with a validity of five years.Q.9 Define the two-wheeler insurance rule in India.

Ans: According to the Motor Vehicle Act, all two-wheeler owners must have at least a third-party two-wheeler insurance policy in India. If you do not have at least a 'third-party bike insurance' for your two-wheeler, you must pay a fine of ₹ 2,000 or/and imprisonment of up to 3 months. In addition, new two-wheeler owners are required to have a long-term third-party bike insurance plan with a validity of five years.Q.10 How do you calculate the claim settlement ratio for bike insurance?

Ans: The formula to calculate the claim settlement ratio is the total number of claims settled divided by the total number of claims received in a year, multiplied by 100.Q.11 What are the 3 types of bike insurance?

Ans: The three types of bike insurance are:1. Third-Party Insurance- Mandatory legal cover.

2. Own Damage Insurance-Covers damages to your bike.

3. Comprehensive Insurance- Combines both of the above coverage, along with optional add-ons.