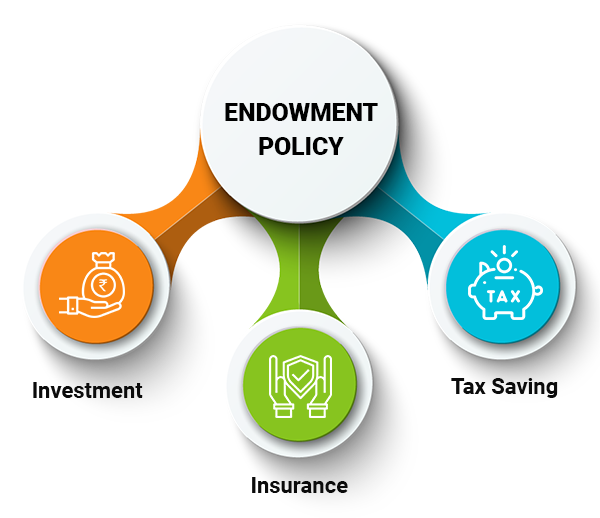

What is an Endowment Policy?

An endowment policy is a life insurance plan that combines both protection and savings. It offers financial security by providing a lump sum payment either upon the policy's maturity or in the event of the policyholder's death during the term. This dual benefit makes it a valuable tool for achieving long-term financial goals such as education, buying a home, or retirement planning while safeguarding loved ones

-

Save upto ₹46,800 in tax under Sec 80C^

-

Inbuilt Life Cover

-

Tax Free Returns^

Fully Tax-Free, Life Cover Included

How Does an Endowment Policy Work?

Below are the steps on how this savings plan works:

- Premium Payment: You pay regular premiums with flexibility—monthly, quarterly, half-yearly, yearly, or lump sum.

- Investment Component: A portion of your endowment plan premium is invested to help grow your savings.

- Customization: You can customise the sum assured and plan type to match your financial goals.

- Maturity Amount: At the end of the policy term, you receive a fixed and predetermined sum, which is unaffected by market changes.

- Life Coverage: In case of death during the term, the beneficiary receives the sum assured, which is the sum assured plus any bonuses.

Best Endowment Plans in India 2026~

| Endowment Policies | Entry Age (Min-Max) | Maturity Age (Min-Max) | Premium Paying Term (PPT) |

| Private Insurer | |||

| SBI Life - Shubh Nivesh | 18 years | 60 years | 10 to 30 years |

| HDFC Life Sanchay Plus | 18 years | 60 years | 5, 6, 10 and 12 years |

| Axis Max SWP-Long Term Income | 18 years | 60 years | 5,6,8,10 and 12 years |

| Axis Max SWAG-Long Term Wealth | 18 years | 60 years | 5, 6, 8, 10 and 12 years |

| ICICI Pru GIFT Pro- Increasing Income with ROP | 18 years | 60 years | 5, 6, 7, 8, 9, 10, 11 and 12 years |

| Bajaj Allianz Guaranteed Wealth Goal - Second Income with ROP | 18 years | 60 years | 5, 6, 7, 8, 10 and 12 years |

| Aditya Capital Assured Income Plus – Income with Lumpsum Benefit | 18 years | 60 years | 5, 6, 8, 10 and 12 years |

| Canara HSBC iSelect GFP-LTI with ROP | 18 years | 65 years | 5, 7 and 10 years |

| Star Union Dai-ichi Life Jeevan Ashray | 18 | 70 years | Equal to term or 10 years |

| India First Life Mahajeevan Plus | 5 | 70 years | 5/7/9/10/12/15 years |

| Shriram Life New Shri Life Plan | 30 days | 75 years | 5 - 25 years |

| Reliance Nippon Life Endowment Plan (Regular Premium) | 5 years | 75 years | Equal to policy term (10–25 yrs) |

| Ageas Federal Life Guaranteed Savings Plan | 2 years | 55 years | Single Pay (7/10 years policy) |

| Bharti Axa Life Super Endowment Plan | 8 years | 75 years | 8–15 years |

| Edelweiss Tokio Life Premier Guaranteed Income Plan | 18 years | 23–99 years (depends on variant) | 5, 8, 10, 12 years |

| Future Generali Life New Assured Wealth Plan | 18 years | 71 years | Limited Pay (option-dependent) |

| Pramerica Life Smart Income Plan | 8 years | 75 years | 5, 8, 10, 12 years |

| Bandhan Life Premier Endowment Insurance Plan | 18 years | 60 years | 8 years (for 10-year term PT) |

| Aviva Life Wealth Builder Endowment Plan | 5 years | 67 years | Single, 5/10 years |

| Go Digit Life Endowment Plan | 18 years (typically) | 85 years | Regular/Limited/Single Pay |

| CreditAccess Life Nitya Sanchay Micro Endowment | 18 years | 75 years | Policy Term = PPT |

| Public Insurer | |||

| LIC Jeevan Utsav | 18 years | 50 years | 5 to 16 years |

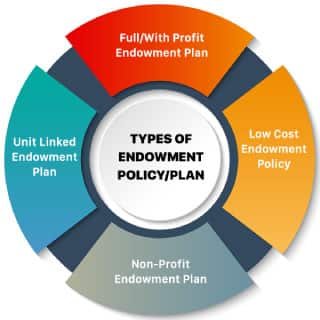

Types of Endowment Policy

-

Unit Linked Endowment Plan

A Unit Linked Endowment Plan seamlessly blends life insurance with market-based investments. Your premiums are allocated between providing life cover and investing in a selection of market-linked funds. You can actively manage and switch between these funds to align with your investment goals. The potential returns depend on how your chosen funds perform, offering opportunities for growth but also carrying associated risks.

-

Full/With Profit Endowment

This traditional endowment policy invests your premiums and, over time, accumulates bonuses. These bonuses, declared by the insurer based on their profits, are added to your assured sum and become guaranteed once announced. This approach combines guaranteed insurance coverage with the potential for steadily growing returns.

-

Low-Cost Endowment

Designed primarily to help repay a mortgage or loan, the Low-Cost Endowment offers life insurance cover while targeting enough savings to settle your outstanding debt by the end of the policy term. Its structure allows for lower premiums compared to standard endowment plans, making it an affordable solution for borrowers seeking both protection and savings.

-

Non-Profit Endowment

A Non-Profit Endowment policy focuses on delivering a fixed, guaranteed payout at the end of the term or a death benefit, with no additional bonuses. This plan prioritizes certainty by providing a clear, predetermined maturity amount or benefit to your beneficiaries.

-

Guaranteed Policy

Guaranteed endowment policies assure a specific sum will be paid to you on maturity or to your beneficiaries in the event of your passing. Face value is provided regardless of market conditions. While this policy may include non-guaranteed bonuses, its primary advantage lies in the security of the guaranteed payout, combined with the possibility of extra returns if bonuses are declared.

-

Limited Premium Payment Endowment Policy

This policy allows you to enjoy endowment benefits while paying premiums for only a limited period. Coverage remains active for the entire policy term, making it appealing for those who want comprehensive protection and savings without a long-term payment commitment.

-

Money-Back Endowment Policy

Money-Back Endowment Policies provide periodic payouts throughout the policy duration, instead of a single lump sum at maturity. This structure adds liquidity to your insurance-savings plan, ensuring you receive regular cash benefits while still maintaining life cover for the entire term.

Benefits of Endowment Policy

Endowment policies give you the following benefits:

-

Reversionary Bonus

A reversionary bonus is an annual addition to the sum assured of your policy. Once declared and added, it becomes a permanent part of your policy benefits and is payable at maturity or upon the death of the insured. This bonus cannot be withdrawn or reduced as long as the policy remains active until one of these events.

-

Terminal Bonus

A terminal bonus is a one-time, lump sum reward paid at the end of the policy term—either upon maturity or on the occurrence of a claim (such as the policyholder’s death). It reflects the long-term investment performance of the insurer and is given as an extra benefit for remaining invested for the full policy term.

-

Optional Rider Benefits

To enhance your endowment plan, you can choose from several rider options:

- Accidental Death Rider: Pays an additional sum assured to your beneficiaries if you pass away due to an accident, boosting your family’s financial protection.

- Critical Illness Cover: Provides a lump sum payout upon the diagnosis of a specified critical illness (e.g., cancer, heart attack, kidney failure), offering financial support during medical crises.

- Disability Cover: Offers financial assistance in the event of permanent or partial disability, either as a lump sum or regular income, depending on the policy terms. This helps support living expenses during periods of disability.

- Hospital Cash Benefit: Gives you a daily cash allowance for each day of hospitalization, helping to defray extra medical or incidental expenses during your stay.

- Waiver of Premium: Waives all future premiums if you suffer permanent disability or a critical illness specified in the policy. This ensures your policy stays active, and you continue to receive benefits without paying additional premiums.

-

Policy Benefits

- Maturity Benefits

When you survive until the end of the policy term, you receive the sum assured along with the accumulated bonuses—a guaranteed payout that makes these plans attractive for long-term savings. Notably, this maturity amount is tax-free under Section 10(10D) of the Income Tax Act, provided the total annual premium does not exceed ₹2.5 lakh. - Death Benefits

If the policyholder passes away during the policy term, the nominee or beneficiary receives the death benefit, which generally includes the full sum assured plus any accrued bonuses up to the date of death. The payout is made irrespective of the number of premiums paid, ensuring financial security for the policyholder's loved ones.

- Maturity Benefits

Features of Endowment Policies

Salient features of the endowment policy are:

- Dual Benefit: This policy provides both life insurance cover and savings, ensuring financial protection and a lump sum payout at policy maturity.

- Maturity Benefit: Offers a guaranteed lump sum amount at the end of the policy term if the policyholder survives the term.

- Death Benefit: If the policyholder dies during the term, the nominee receives the sum assured along with any bonuses.

- Bonus Additions: Participating policies may earn bonuses based on the insurer's profits, enhancing the maturity or death benefit.

- Flexibility: Options to choose premium payment terms (monthly, quarterly, yearly) and policy tenure based on individual needs.

- Loan Facility: After a certain period, you can take out loans against the policy, offering liquidity in times of need.

- Rider Options: Additional riders, like accidental death or critical illness, can be added for enhanced protection.

- Tax Benefits: You are tax-exempted on both the premium payments and maturity or death benefits under Section 80C and Section 10(10D), respectively.

Limitations of an Endowment Plan

There are a few limitations associated with an Endowment insurance policy, which are mentioned below:

- Compared to other investment options like ULIPs, mutual funds or NPS, endowment plans typically offer lower returns.

- The premiums for endowment plans are generally higher than term insurance policies due to the savings component.

- Once the premium payment term and policy tenure are selected, it offers limited flexibility to change or adjust them.

- Requires a long-term financial commitment, making it less suitable for those seeking short-term goals or liquidity.

All savings are provided by the insurer as per the IRDAI approved insurance plan. Standard T&C Apply

What Happens When an Endowment Policy Matures?

-

Sum Assured: Upon the maturity of an endowment policy, you are entitled to receive the sum assured, which is the guaranteed amount set during the policy purchase.

-

Bonuses: If you have chosen a profit-based plan, any bonuses or additional profits accumulated over the policy term are included in the final payout.

-

Tax-Free Benefits: The maturity amount received by you is generally exempt from taxes under Section 10(10D) of the Income Tax Act, provided certain conditions, such as premium limits, are satisfied.

All savings are provided by the insurer as per the IRDAI approved insurance plan. Standard T&C Apply

Who Should Buy the Endowment Policy?

-

People Seeking Dual Benefits: Suitable for those who want both life insurance and a savings component in a single plan.

-

Financially Disciplined Individuals: Endowment plans offer a disciplined route to build a corpus for dependents in case of financial contingencies

-

Long-Term Savers: Small businesspersons, salaried individuals, lawyers, and doctors should consider buying endowment plans for long-term financial goals

-

Tax-Saving Investors: Great for individuals looking to save on taxes, as the premiums paid and the maturity benefits are eligible for tax deductions.

-

Risk-Averse Individuals: Endowment plans are ideal for risk-averse individuals who do not mind settling for fewer returns and are not super-rich.

Why Should an Individual Buy an Endowment Policy?

-

Endowment policies provide a disciplined means of saving money for future needs.

-

An additional advantage is life-risk coverage for the family and dependents of the policyholder.

-

Returns may be lesser, but they are risk-free for a certain sum assured.

-

Tax benefits can be availed under Sections 80C and 10(10D), subject to certain conditions.

-

Risk-averse investors prefer endowment plans.

-

It offers life insurance coverage to the insured in case of an unforeseen event.

-

It offers the maturity amount to the policyholder if she/he survives the policy term.

What to See Before Buying an Endowment Policy?

One should see the following things before purchasing an endowment plan:

-

Begin Early Planning: Making investments at an early age offers a long horizon to invest. It promotes disciplined saving and offers better returns through compounding.

-

Review the Flexibility Option: Choose based on your income. Regular pay options suit salaried individuals, while single-pay options work for those with irregular incomes.

-

Know Different Types of Endowment Policies: Know the different endowment plans. Part of the premium goes to life insurance, and the rest is invested based on whether the plan is profit-based or non-profit.

-

Select a Plan that Offers Riders: A lot of insurance companies offer additional benefits like accidental death benefit or critical illness.

-

Bonuses: Bonuses depend on the insurer’s profits and are distributed at the end of each policy year.

-

Non-Guaranteed and Guaranteed Returns: Endowment policies offer both guaranteed and non-guaranteed returns, giving you the benefit of savings and risk-free insurance.

Claim Process of Endowment Plan

The beneficiary should inform the insured about the death soon after the death of the policyholder. As soon as the insurer gets to know about the loss, a claim form is forwarded to the nominee.

Fill out the Claim Form:

-

To claim the death benefit, the beneficiary/nominee of the policyholder/assignee or legal heirs must sign the claim form.

-

The last treating doctor who checked the insured should provide the loss statement.

-

The hospital authorities where the insured received treatment should provide the certificate.

-

A witness statement and death certificate from someone present during cremation are required.

-

If the insurance company requires a discharge voucher, it should be filled out and provided.

For effective and fast sanction of the death benefit, an additional form, as mentioned below, should be provided:

-

Post Mortem’s certified copy, police investigation report, and First Information Report – in the situation of the death of the policyholder was unnatural.

-

Employer’s e-certificate, if the insured was working in an organization.

Term Plan vs. Endowment Plan

The key differences between an endowment policy and term plan are as follows:

| Feature | Term Plan | Endowment Plan |

| Purpose | Pure protection; offers life cover only | Combines life cover with savings |

| Premium | Lower premiums | Higher premiums |

| Maturity Benefit | No maturity benefit (unless a rider is added) | Provides a lump sum on policy maturity |

| Death Benefit | The death benefit is paid if the insured passes away during the policy term | Death benefit along with savings component paid to beneficiaries |

| Investment Component | No investment component | Offers savings and investment along with life cover |

| Suitable For | People looking for affordable life cover | People looking for life cover plus savings or investment |

| Policy Term | Typically shorter (5-30 years) | Can be long-term (10-30 years) |

| Tax Benefits | Available under Section 80C and 10(10D) | Available under Section 80C and 10(10D) |

Endowment Policy Vs ULIPs

The common differences between an endowment assurance policy and ULIP plans are:

| Parameter | Endowment Policy | ULIP Plans |

| Definition | A life insurance policy that combines insurance coverage and a savings component | A life insurance policy that provides insurance coverage along with market-linked investment options |

| Return on Investment | Fixed returns with guaranteed bonuses | Varies based on the market performance of the underlying investment |

| Maturity Benefit | Guaranteed sum assured along with accrued bonuses | Market-linked returns based on the fund's performance |

| Death Benefit | Sum assured + accrued bonuses | Higher of the sum assured or fund value |

| Tax Benefits | Deductions on premiums paid and tax-free maturity amount up to a certain limit. | Premiums up to Rs. 1.5 lakhs are eligible for tax deductions under Section 80C. The maturity amount is tax-free under Section 10(10D) if annual premiums paid are less than Rs. 2.5 lakhs. |

| Liquidity | Limited options for withdrawal before maturity | The flexibility of fund withdrawal after the lock-in period also allows fund switching. |

| Risk | Low-risk investment option | The risk profile depends on the chosen market-linked funds |

| Ideal for | Risk-averse investors looking for guaranteed returns | Investors willing to take on market risks and seeking higher returns |

Documents Required for Endowment Plan

Mentioned below is the list of documents required for an endowment assurance policy in different situations:

- Documents Required for Application: Filled application form, Applicant's photograph, Address proof, and Income proof.

- Documents Required for Maturity Claim: Signed discharge voucher and Original endowment policy document.

- Documents Required for Death Claim: Death certificate, Completed claim form, Original endowment policy document, Assignment or reassignment deeds (if applicable), and Signed and witnessed discharge form.

Are Endowment Plans Tax-Free?

There are two types of tax benefits for endowment plans that policyholders, nominees, and potential buyers should know.

-

Premium Deduction: You can claim a deduction on the premiums paid in your endowment assurance policy under Section 80C of the Income Tax Act 1961. The deduction is limited to a maximum of Rs 1.5 lakhs per year.

-

Benefits Exemption: Under Section 10(10D) of the Income Tax Act 1961, tax exemption can be claimed on the benefits received from the endowment plan. This includes both the maturity benefit and the death benefit. However, specific conditions must be satisfied to qualify for this exemption.

Which Endowment Policy to Choose for Different Situations?

The following table presents an overview of the best endowment assurance policy types for different situations:

| Situation | Best Endowment Policy Type |

| Guaranteed Payouts with Low Risk | Guaranteed Endowment Policy |

| Higher Returns with Market Exposure | Unit-Linked Endowment Policy |

| Long-Term Savings with Life Cover | With Profit Endowment Policy |

| Flexible Premiums and Coverage | Limited Premium Pay Endowment Policy |

| High Liquidity Needs | Money Back Endowment Policy |

| Tax Benefits | Unit-Linked Endowment Policy |

˜The insurers/plans mentioned are arranged in order of highest to lowest first year premium (sum of individual single premium and individual non-single premium) offered by Policybazaar’s insurer partners offering life insurance investment plans on our platform, as per ‘first year premium of life insurers as at 31.03.2025 report’ published by IRDAI. Policybazaar does not endorse, rate or recommend any particular insurer or insurance product offered by any insurer. For complete list of insurers in India refer to the IRDAI website www.irdai.gov.in

Disclaimer: *The Guaranteed Returns are dependent on the policy term and premium term availed along with the other variable factors. 6.9% rate of return is for an 18 years old, healthy male for a policy term of 20 years and premium term of 10 years with Rs.10,000 monthly installment premium. All plans listed here are of insurance companies’ funds. The tax benefits under Section 80C allow a deduction of up to ₹1.5 lakhs from the taxable income per year and 10(10D) tax benefits are for investments made up to ₹2.5 Lakhs/ year for policies bought after 1 Feb 2021. Tax benefits and savings are subject to changes in tax laws.

*All savings are provided by the insurer as per the IRDAI approved

insurance plan.

+ Trad plans with a premium above 5 lakhs would be taxed as per

applicable tax slabs post 31st march 2023

#Discount offered by insurance company. Standard T&C Apply

^Section 80C allows annual deductions of up to ₹1.5 lacs from the taxable income. Section 10(10D) provides tax-free maturity benefits for investments of up to ₹2.5 Lacs/ year, on policies bought after 1 Feb 2021. Tax benefits and savings are subject to changes in tax laws.

++Source - Google Review Rating available on:- http://bit.ly/3J20bXZ

- SIP Calculator

- Income Tax Calculator

- Compound Interest Calculator

- NPS Calculator

- Show More Calculator

Investment plans articles

Explore the popular searches and stay informed

- LIC

- Investment Plan

- Annuity Plan

- Child Plan

- Pension Plan

- ULIP Plan

- Child Investment Plan

- SIP

- LIC Calculator

- SIP Calculator

- SBI SIP

- ULIP Calculator

- Sukanya Samriddhi Yojana

- Best SIP Plans

- Retirement Planning

- SBI SIP Calculator

- HDFC SIP Calculator

- Sukanya Samriddhi Yojana Interest Rate

- NPS Interest Rate

- Deferred Annuity Plans

- SBI Annuity Deposit Scheme Calculator

- Immediate Annuity Plans

- Post Office Child Plan

- Prime Minister Schemes For Boy Child

- Government Schemes for Girl Child

- 50k Pension Per Month

- Atal Pension Yojana Calculator

- Best Pension Plan in India

- CIBIL Score

- 1 Crore Term Insurance

- Best Term Insurance Plan

- Term Insurance for Women

- Term Insurance for NRI

- Term Insurance

- Term Insurance Calculator

- Life Insurance

- Term Insurance with Return of Premium

- Whole Life Insurance

- Term Insurance vs Life Insurance

- What is Term Insurance

- Life Insurance Calculator

- 5 Crore Term Insurance

- 2 Crore Term Insurance

- 50 Lakh Term Insurance

- Term Insurance for Housewife

- Benefits of Term Insurance

- Term Insurance Terminology

- Medical Tests for Term Insurance

- Term Insurance for Self Employed

- Claim Settlement Ratio

- 10 Crore Term Insurance

- Term Insurance for Smokers

- 1.5 Crore Term Insurance

- Zero Cost Term Insurance

- Home Loan Insurance Calculator

- FIRE Calculator

- EMI Calculator