Types of Bike Insurance Policies

Bike insurance is a mandatory cover for all two wheeler owners. However, with so many options available, making the right choice can be difficult. Insurance companies offer different types of bike insurance policies. You can read the article below to understand different types of bike insurances and compare and buy the right policy.

What is Bike Insurance & Why Do You Need It?

A bike insurance provides financial and legal protection to a two wheeler such as bikes, moped, scooty, EV, etc, against several unforeseen circumstances. There are 3 main types of bike insurance policies depending on their coverage.

Apart from being a legal mandate, a comprehensive bike insurance policy offers the required insurance coverage against third-party liabilities and own damages. You must buy a bike insurance policy as it will reduce your financial burden, provide legal protection and also cover losses to both 3rd party and your bike (in case of OD and Comprehensive Plans)

What are the Different Types of Bike Insurance Policies?

There are three types of 2-wheeler insurance policies available in India. You can either buy a third-party, comprehensive or a standalone own-damage bike insurance policy.

-

Third-Party Bike Insurance Policy

In India, having a third-party bike insurance is mandatory for two-wheeler owners. This policy takes care of the losses caused to the third party, property, or life in case of an accident. This type of bike insurance does not cover loss or damage caused to your own vehicle. It is a liability cover policy for 3rd party damages and losses.

-

Comprehensive Bike Insurance Policy

A comprehensive bike insurance policy covers both the own damages and third-party liabilities. A comprehensive type of bike insurance gives protection against burglary or theft and damage caused by accidents, natural calamities, and manmade disasters. Moreover, under this plan, you can also purchase add-on covers for specific circumstances by paying a little extra premium.

-

Standalone Own-damage Bike Insurance Policy

As the name suggests, the Own-damage (OD) bike insurance policy gives coverage to your own vehicle caused due to natural calamities, manmade disasters, accidents, fire, and theft. This policy can only be purchased if you just have the mandatory third-party bike insurance policy.

Difference between Bike Insurance Policies

The table below highlights the key differences between types of bike insurance policies. You can compare and buy out of various third party, own-damage cover, and comprehensive bike insurance policy.

| Points of Basis | Third-party Bike Insurance Cover | Own damage Bike Insurance Cover | Comprehensive Bike Insurance Cover |

| Legal Requirement | YES | NO (Optional) | NO (Suggested for Extensive Protection) |

| Coverage | Only 3rd Party Damages | Only covers damages caused to your own bike | Offers Wider Coverage to both own damage and third-party liability |

| Bike Insurance Premium | Lowest Premium | Moderate Premium | Higher Premium due to Extensive Coverage |

| Availability of Add-Ons | NA | Available | Available |

| Ideal Cover For | Basic Coverage (Law Mandate) | Those who already have a 3rd party insurance and want coverage for their own bike | People looking for Extensive Protection |

What is Covered Under Two-Wheeler Insurance Policy?

The type of bike insurance you choose will determine what it covers and what it does not. You must choose the right bike insurance policy depending upon your requirements. You can check the full list of inclusions and exclusions below to make a better decision.

Inclusions

- The following is covered in all types of bike insurance policies:

- Damages due to natural calamities like floods, landslides, earthquakes, etc.

- Damages from manmade disasters like fire, strikes, terrorism, riots, vandalism, etc.

- Losses are covered if the insured bike is stolen or is a total loss

- Coverage for third-party liabilities such as death, disability, or property damage

- Damages are covered in case of an accident, housebreaking or fire explosion.

Exclusions

A list of exclusions where you won't receive any compensation under your comprehensive bike insurance policy is given below.

- Damages caused due to electrical or mechanical breakdown

- Damages occurring when the rider was under the influence of any intoxicating substances or alcohol

- Damages that happen when the rider was not holding any of the valid documents such as DL, RC, PUC certificate, and a valid bike insurance policy

- Loss arising out of the contractual liabilities

- Damages caused due to regular wear and tear.

Factors Affecting Bike Insurance Premium

Each type of bike insurance policy has a different premium. The following factors affect the bike insurance policy premium.

-

Insured's Declared Value (IDV)

IDV is the maximum amount the insurer will pay during the claim settlement.

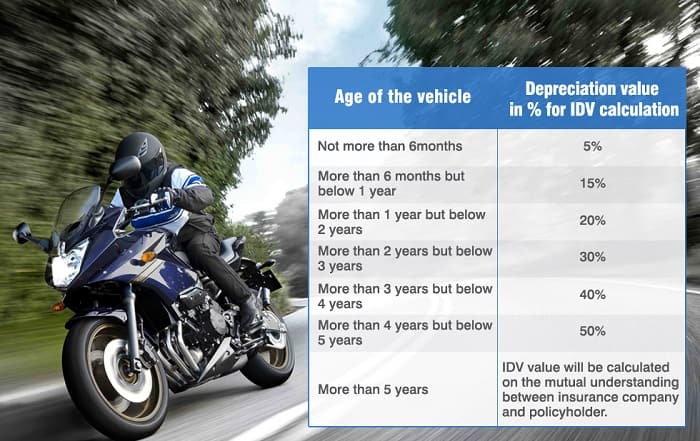

Calculation of IDV

IDV = Manufacturer's listed selling price - Depreciation

It is calculated based on the manufacturer's listed selling price of the brand & model and then adjusted as per the standard depreciation rates.

The table given below will give you a better understanding of the correlation between depreciation value and IDV calculation:

-

Bike Engine's Capacity (CC)

With the increase in the CC of two-wheelers, there would be a rise in the premium. The IRDA has specified third-party premium rates based on the cubic capacity of the bike's engine. Below is a table showing the premium rates for various cubic capacities:

Engine Capacity in CC Third-party Bike Insurance Premium Annual Rates (in ₹) For less than 75CC 538 In between 75CC - 150CC 714 In between 150CC - 350CC 1366 For more than 350CC 2804 -

Geographical Location

According to the India Motor Tariff, the country is divided into Zone A and Zone B. Zone A includes cities like Bangalore, Chennai, Ahmedabad, New Delhi, Mumbai, and Kolkata. At the same time, Zone B covers the rest of the country. The premium rates are higher in cities under Zone A than in Zone B.

-

Vehicle Age

Premium rates increase with the age of the vehicle. Simply put, the older your car gets, the higher the premium you pay to maintain it as the value of its parts gets depreciated.

Is Comprehensive Bike Insurance Worth the Extra Cost?

As a bike owner, you might be wondering if comprehensive bike insurance is the best 2 wheeler insurance or not. While, undoubtedly, a comprehensive bike insurance is one of the best 2 wheeler insurance plan, it comes at a cost. Due to an increased coverage, the premium of a comprehensive bike insurance is the highest. Let us see why having a comprehensive coverage is actually worth the extra cost of premium.

- Enhanced Protection: Comprehensive bike insurance policy covers not just third-party liabilities but also damages caused to your own bike due to theft, fire, and natural disasters, etc. Hence buying a comprehensive policy will save you money in case of any loss or damage caused to your own bike.

- Customiza vldw vle vklremtion Possible: You can opt for add-ons like zero depreciation, roadside assistance, engine protection, and more, which allows you to tailor your 2 wheeler insurance policy as per your needs and offers you to customize it as per budget and requirement.

- Peace of Mind: Since a comprehensive bike insurance policy offers coverage against both third party liabilities and covers damages caused to your own vehicle as well, it saves you from both legal obligations and your bike’s safety. Having a comprehensive bike insurance keeps your mental peace intact as you can now ride stress free.

How to Buy Two-Wheeler Insurance Policy Online?

Buying a 2-wheeler insurance online from Policybazaar.com is quite simple and hassle-free. By following the below steps, you can buy bike insurance online:

- Visit the official website of Policybazaar Insurance Brokers Private Limited

- Enter your bike details and personal information asked in the two-wheeler insurance section

- Compare and select the plan offered by bike insurance companies of India

- Select any add-on cover (if required)

- At last, pay the premium through UPI, banking cards, or net banking.

How to File Bike Insurance Claims?

In case of any mishap, you can raise a claim against the damages caused to the insured bike. To raise a claim, you must contact your insurer through phone or mail and then file a claim within the stipulated time. Your insurer will ask you to fill out the application form along with an FIR (in case of theft) or submit mandatory documents (in case of an accident). After this, the surveyor will examine the damage and send your vehicle for repairs.

Either the insurer will settle the bill with a network garage in case of cashless settlement or reimburse the bill amount directly to your bank account if you have opted for a non-cashless settlement process.

FAQs

-

Q. What are the 3 types of bike insurance?

Ans: The three main types of bike insurance policies include Third-party Bike Insurance Cover, Own damage Bike Insurance Cover, and Comprehensive Bike Insurance Cover. 3rd Party insurance only covers 3rd party damages and liabilities, whereas an OD policy will only cover damages caused to the insured bike. Comprehensive bike insurance offers extensive protection and covers both 3rd party and own damages. It comes with various add ons but will also have a slightly higher premium amongst the three bike insurance policies. -

Q. Which type of insurance is best for a bike?

Ans: If you are looking for an extensive cover, then you can opt for a comprehensive bike insurance policy as it will cover damages caused to your own bike, third-party liabilities, and even has the option for various add-ons to increase protection. -

Q. Which insurance is compulsory for a 2 wheeler?

Ans: As per the Motor Vehicle Act of 1988, all two wheeler owners must mandatorily have at least a third-party bike insurance policy. A 3rd party bike insurance will provide coverage for third-party liabilities such as injuries, death, and property damage. -

Q. What is zero dep bike insurance?

Ans: Zero depreciation bike insurance does not consider or include the two-wheeler’s depreciation and maintains the Insured Declared Value (IDV) as good as a new vehicle. It does not consider the depreciation of your bike, scooter, moped, or any insured 2 wheeler. Zero dep is an add on cover ensuring a better claim for the damaged bike. -

Q. Can we skip buying any type of bike insurance in India?

Ans: No, you cannot ride a two wheeler without an active bike insurance. As per the law, having at least a 3rd party bike insurance is mandatory. Driving without a valid insurance can lead to a fine of ₹2000 (₹4000 in case of a repeated offense) or an imprisonment for 3 months.

^The renewal of insurance policy is subject to our operations not being impacted by a system failure or force majeure event or for reasons beyond our control. Actual time for a transaction may vary subject to additional data requirements and operational processes.

^The buying of Insurance policy is subject to our operations not being impacted by a system failure or force majeure event or for reasons beyond our control. Actual time for transaction may vary subject to additional data requirements and operational processes.

#Savings are based on the comparison between highest and the lowest premium for own damage cover (excluding add-on covers) provided by different insurance companies for the same vehicle with the same IDV and same NCB.

*TP price for less than 75 CC two-wheelers. All savings are provided by insurers as per IRDAI-approved insurance plan. Standard T&C apply.

*Rs 538/- per annum is the price for third party motor insurance for two wheelers of not more than 75cc (non-commercial and non-electric)

#Savings are based on the comparison between the highest and the lowest premium for own damage cover (excluding add-on covers) provided by different insurance companies for the same vehicle with the same IDV and same NCB.

*₹ 1.5 is the Comprehensive premium for a 2015 TVS XL Super 70cc, MH02(Mumbai) RTO with an IDV of ₹5,895 and NCB at 50%.

*Rs 457/- per annum is the price for the third-party motor insurance for private electric two-wheelers of not more than 3KW (non-commercial).The list of insurers mentioned are arranged according to the alphabetical order of the names of insurers respectively.Policybazaar does not endorse, rate or recommend any particular insurer or insurance product offered by any insurer. The list of plans listed here comprise of insurance products offered by all the insurance partners of Policybazaar. For complete list of insurers in India refer to the Insurance Regulatory and Development Authority of India website www.irdai.gov.in