Although, buying a life insurance plan is a simple and easy process there are various factors that decide the premium rate of the policy. Some of these factors are age, income, health history (self & family), profession, habits, etc. Having any bad habits not only increases the risk to one’s life, but also eventually increases the premium amount of the policy. So, read on and check how these 5 habits and factors determine if you need to buy a life insurance policy:

If the insured is addicted to smoking and drinking, then his/her life expectancy automatically decreases as s/he is more prone to lung and respiratory diseases as well as critical illnesses as a result of organ damage. Thus, having a life insurance policy is very significant for those individuals who are in the habit of smoking and drinking. While the premium amount of their life insurance policy will be higher for such individuals, it also provides financial protection to the family of the insured in case of any eventuality, which is a valuable investment.

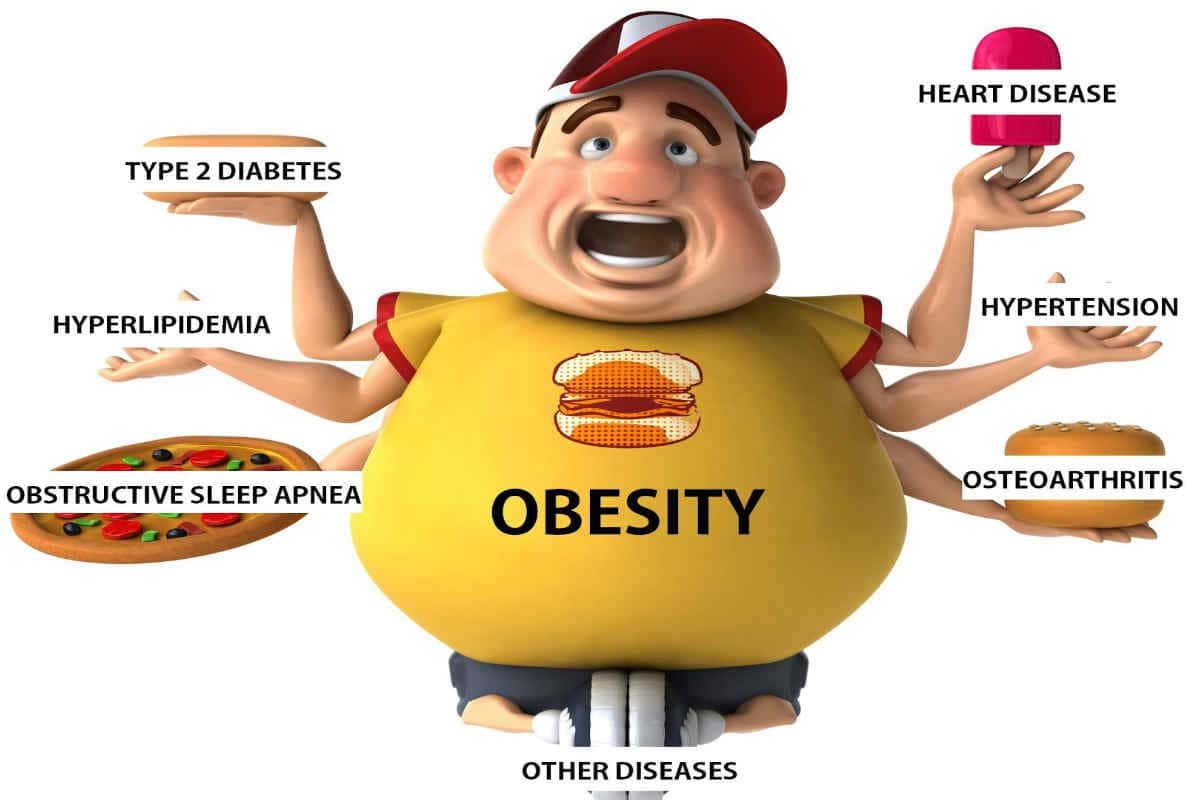

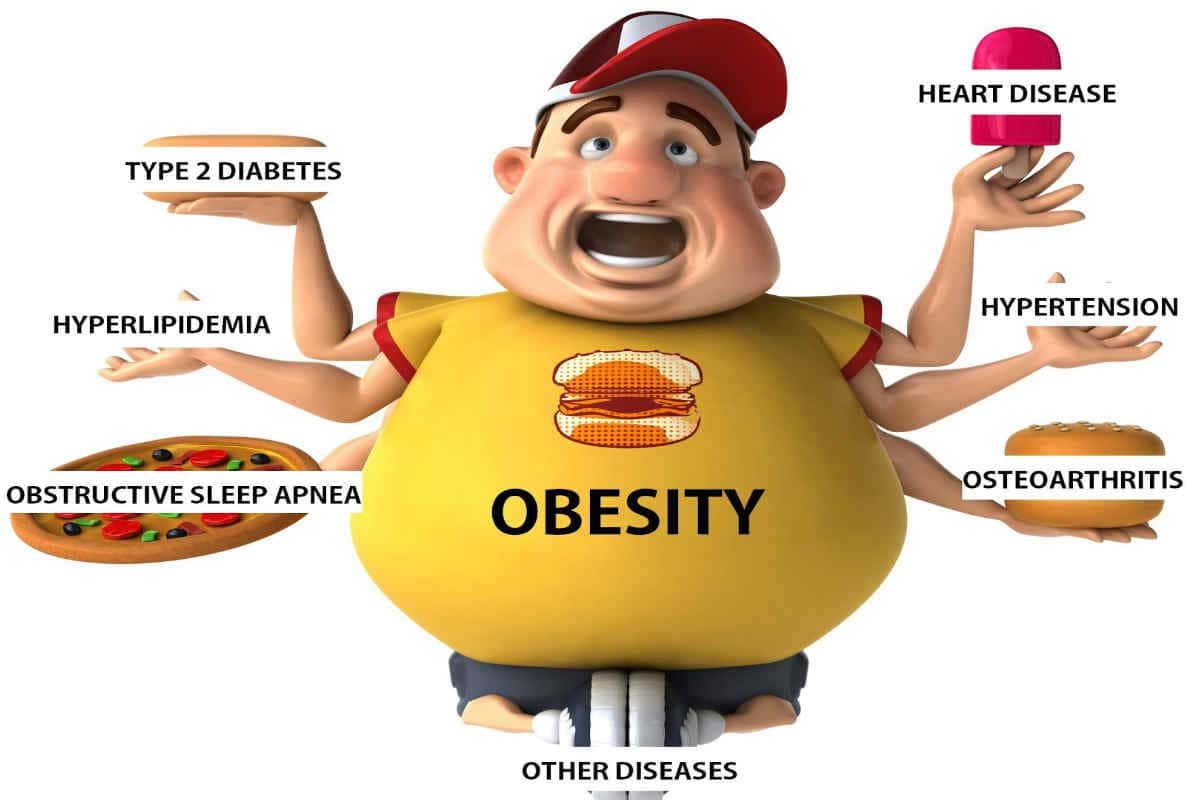

The weight of an individual is another important factor that not only determines overall health of the person, but also decides how important it is to have a policy. In case, you are on the heavier side or suffer from obesity, then you are more likely to be affected with numerous health issues. This also holds true in case you are underweight and deficient of the necessary nutrients required for a healthy body. So, with the increase in risk that accompanies over and underweight people, it is important to have a life insurance plan so that your family can have a financial buffer in case something happens to you. Moreover, you can also take a critical illness rider along with your life insurance policy to provide an extra coverage in case you are diagnosed with any type of critical illnesses.

The age of a person is one of the most important factors that decide whether one should have a life insurance policy or not. Buying a life insurance policy at a young age not only saves an individual from paying high premiums, but also has many add-on benefits. The earlier one buys a life insurance policy, the higher the coverage that he/she can avail with a minimum premium amount. Moreover, the insured can also create a financial nest-egg for their family, so that they can be financially secured in case of an eventuality. Consequently, with the increase in age, the risk factor of the insurer also increases and so do the premiums for the life insurance policy. Even if one has to pay higher premiums for a life insurance policy, he/she should definitely have one, so that they can deal with any type of emergency situation.

Nowadays, people’s lifestyles are changing drastically and are becoming more stressful and hectic. As a result, their health is adversely affected. Working for prolonged hours, poor diet, consumption of junk food, lack of exercise, etc. increases the risk of diseases. These days, it is very important for an individual to evaluate various health-related factors and undergo medical check-ups regularly. Similarly, it is equally significant to have a life insurance policy in order to have wholesome financial protection and safeguard the future of one’s family.

Any person who enjoys participating in adventure sports like bungee jumping, trekking, car racing, skydiving, etc. is at a high risk of meeting with accidents. So, even though a life insurance policy costs an arm and a leg, an adventure sports enthusiast should definitely have a life insurance policy so that they can deal with any unpredictable circumstance.

Conclusion

So, with the help of the above mentioned points it must be clear that if any of these habits or factors applies to you, you should consider buying a life insurance plan. In order to choose the most beneficial plan, you can also compare life insurance plans online and select a plan according to your suitability and affordability.

Note: Check all the best term insurance plan in India.

Note: You should also check the benefits of term life insurance if you are planning to purchase the term insurance plan.