-

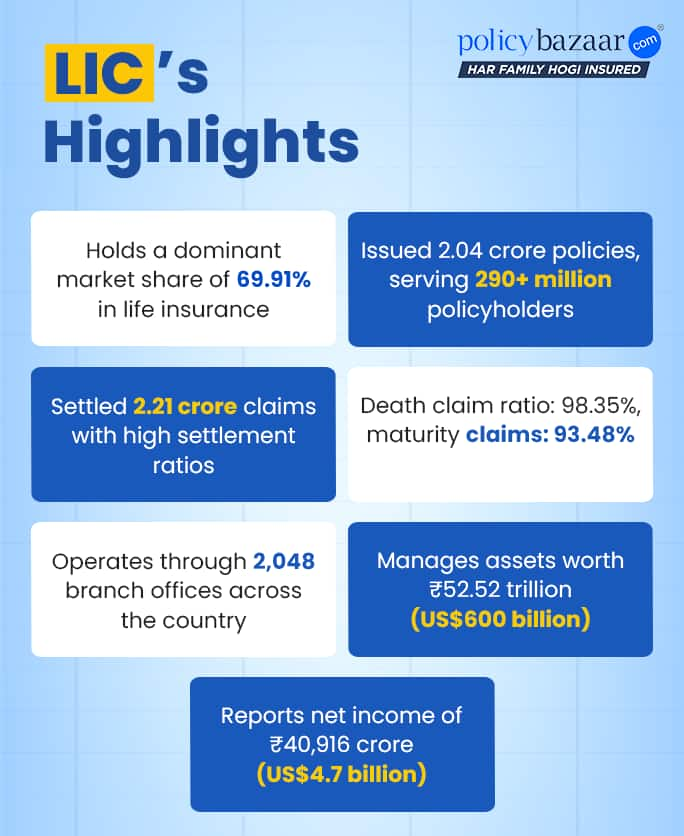

- Key Highlights

- Facts About LIC

- Why Should You Buy LIC Plans?

- LIC Of India- Plan List

- Life Insurance Corporation of India Riders

- Why Buy LIC from Policybazaar?

- Do’s & Don’ts of Buying a LIC Policy

- Choose the LIC Policy

- LIC E-Services

-

Page Progress

LIC of India - Life Insurance Corporation of India

The Life Insurance Corporation of India (LIC) is India's largest public-sector life insurance company, headquartered in Mumbai. Established in 1956, LIC of India has provided insurance coverage and a credible savings option to millions of individuals and families nationwide for nearly seven decades. With a wide range of insurance products and services, LIC of India has become a trusted name in the insurance industry in India. Life Insurance Corporation of India offers various types of insurance plans, including endowment, whole-life, term assurance, money-back, pension, ULIPs, micro-term and health insurance plans, that help you ensure the financial security of individuals and families.Read more

-

Home

- LIC of India

Life Insurance Corporation of India- An Overview

Life Insurance Corporation (LIC) is India's largest state-owned life insurance company. Established on September 1, 1956, through the nationalisation of 245 private insurers, it operates under the ownership of the Government of India. LIC offers a wide range of life insurance products, including term plans, ULIPs, endowment policies, money-back plans, whole-life coverage, and retirement insurance solutions.

LIC of India invests in diversified holdings across key sectors such as banking and finance, cement, power, infrastructure, FMCG, healthcare, IT, metals, automobiles, and logistics. These investments support national growth while strengthening LIC’s financial foundation, instilling long-term confidence among policyholders. LIC also holds strategic stakes in major subsidiaries like LIC Housing Finance (LIC HFL), LIC Mutual Fund, LIC Pension Fund, and LIC Cards Services, extending its reach across vital financial areas.

The Life Insurance Corporation of India (LIC) is currently led by R. Doraiswamy, who took charge as Managing Director and Chief Executive Officer on July 14, 2025, under the unified leadership structure established by the amended LIC Act. Supporting him are Managing Directors Ratnakar Patnaik and Dinesh Pant, both appointed on June 1, 2025. Sat Pal Bhanoo, who briefly served as interim CEO, continues as a Managing Director.

*Information sourced from LIC Report FY 2023-24

LIC of India- Interesting Facts to Know

From insuring millions to managing trillions in assets, LIC has crossed several impressive milestones. Here are a few record-breaking highlights worth noting.

- A Legacy Since 1956: Life Insurance Corporation of India (LIC) was born on 1st September 1956. It marked the beginning of a financial revolution in India.

- India's Largest Life Insurer: LIC leads India’s life insurance market with ₹4.75 lakh Cr. in premium income (2023–24), supported by 13.47 lakh agents nationwide.

- A Pillar of Public Trust: Fully owned by the Government of India, LIC has issued 2.043 crore policies in 2023-24.

- IPO Milestone in 2022: LIC made history by launching one of India’s largest-ever IPOs in May 2022, opening its doors to public investors while maintaining its strong government backing.

- A Global Footprint: In 2026, LIC ranks as the world’s 3rd strongest insurer, serving overseas customers across countries like Fiji, Mauritius, the UK, Singapore, Bangladesh, Sri Lanka, and Gulf nations.

- Video

- information

Buy LIC Plans

Why Choose LIC?

Life Insurance Corporation of India (LIC) is one of the leading life insurers in India and among the top global insurers, trusted by over 25 crore customers for its affordable and customer-friendly insurance solutions. Below are the reasons why LIC policies are the right choice for securing your future:

- India’s Most Trusted Life Insurer: With a dominant 65.83% share in policy sales, LIC is India’s most trusted and preferred life insurance provider. LIC has settled 2.21 crore claims, paying a total of ₹2,30,272 crore (as per IRDAI Annual Report 2022-23). Its wide reach and customer-first approach make LIC the top choice for millions of Indians.

- 68+ Years of Trust and Reliability: For nearly seven decades, LIC has built a reputation for trust and dependability. Its consistent performance and customer care have made it a reliable partner for families across India, offering financial security when it matters most.

- Government-Backed Security: The Central Government guarantees LIC policies under Section 37 of the LIC Act, 1956. This unique backing ensures your investments are safe and secure, giving you peace of mind.

- Impressive Claim Settlement Ratio: LIC's high claim settlement ratio of over 91.3% proves its trustworthiness and prompt claim processing. You can rely on LIC when it matters most.

- Tax Benefits on LIC Policies: LIC policies provide significant tax-saving benefits under the Income Tax Act, including:

- Section 80C: Deduction for premium payments

- Section 80CCC: Pension plan benefits

- Section 80D: Health insurance deductions

- Section 80DD: Benefits for disabled dependents

- Section 10(10D): Tax-free maturity proceeds

- Extensive Network Across India: Life Insurance Corporation of India has a robust PAN-India presence with:

- 1,580 satellite offices

- 2,048 computerized branch offices

- 113 divisional offices

- 8 zonal offices

- Simple Policy Purchase Process: LIC of India makes buying insurance easy, whether you choose online or offline. Online policy purchases offer additional benefits like special discounts and faster processing.

- Innovative Insurance Solutions: Life Insurance Corporation of India continuously introduces innovative products tailored for the community's needs. It pioneered micro-insurance plans in India, offering affordable insurance options for individuals below the poverty line.

- Advanced Technology for Convenience: Life Insurance Corporation of India leverages cutting-edge technology like LAN, WAN, IVRS, and EDMS for paperless and seamless processes, ensuring an easy and hassle-free customer experience.

- Wide Range of Insurance Products: Life Insurance Corporation of India offers a comprehensive portfolio of life and LIC health insurance plans to meet diverse needs:

- LIC Term Insurance Plans

- LIC Savings and Endowment Plans

- LIC ULIPs (Unit-Linked Insurance Plans)

- LIC Pension and Retirement Plans

- 24/7 Customer Support: LIC of India provides round-the-clock customer support to assist with queries, claims, or policy-related concerns, ensuring an exceptional customer experience.

- Video

- information

Buy LIC Plans

Who Should Consider Purchasing LIC Policy?

Life Insurance Corporation of India (LIC) offers various life insurance policies designed to cater to the financial needs of individuals across different life stages. Whether you are a young professional, a family person, or approaching retirement, LIC has a policy for every life stage and circumstance. Here's an overview of who can benefit from purchasing life insurance from LIC:

| Life Stage | How Will An LIC Policy Be Useful? |

|

Young Adults (18-25 years)

|

At this stage, LIC policies can help secure your future financial goals, such as saving for higher education or buying a home. Opting for a policy early ensures low premiums and high coverage. |

|

Starting a Family (25-35 years)

|

Purchasing an LIC policy ensures that your family’s financial needs are protected, especially if you are the primary income earner. It provides security for your partner and children in case of unexpected events. |

|

Caring for Elderly Parents (30-40 years)

|

An LIC policy can provide a financial cushion for your parents’ healthcare and living expenses if you are the primary caregiver, ensuring they are cared for even if you are no longer able to provide support. |

|

Planning for Children’s Future (35-50 years)

|

If you're planning for major milestones like your children’s education or wedding, an LIC policy can serve as a long-term savings tool, helping you meet these goals while also offering financial protection. |

|

Looking for Tax Benefits

|

LIC policies provide life coverage and tax deductions on premiums paid, making them a smart option for individuals seeking to save on taxes while securing their financial future. |

|

Preparing for Retirement (50-60 years)

|

As you near retirement, an LIC policy can help ensure a steady income post-retirement, giving you peace of mind and providing financial support for yourself and your spouse in your later years. |

|

Homeowners with Outstanding Loans

|

If you have loans or other debts, an LIC policy can help cover these liabilities, relieving your family from financial stress and ensuring that the house remains a secure home. |

How Much LIC Coverage Do You Need?

Determine the ideal life insurance coverage based on your financial goals, liabilities, and dependents' needs. Secure your family's future with the right protection.

- Coverage Calculator

Easily estimate the coverage amount of your policy that you need by considering your income, expenses, and future goals. Get personalized insights to make informed decisions. - Premium Calculator

Calculate your premium quickly by entering age, coverage, and policy term details. Find a plan that fits your budget effortlessly

Type of LIC Policy

| Type of LIC Policy | Coverage | Ideal For |

|---|---|---|

| LIC ULIP Plans | Offers dual benefits by combining life insurance coverage with market-linked investment opportunities. Ideal for those seeking protection along with wealth creation. | Individuals seeking life coverage along with long-term wealth creation through market-linked investments. |

| LIC Pension Plans | Provides life insurance coverage along with a systematic way to build a retirement corpus, ensuring financial independence and regular income in post-retirement years. | Those planning for a secure and stable retirement with regular post-retirement income. |

| LIC Endowment Plans | Combines life insurance protection with disciplined savings, paying out a lump sum either on maturity or to beneficiaries in case of untimely demise. | Individuals looking for a mix of life cover and guaranteed savings with maturity benefits. |

| LIC Whole Life Insurance | Offers life-long coverage, typically up to 100 years, providing a death benefit to the nominee whenever the policyholder passes away, along with bonus additions. | People seeking long-term financial legacy planning and lifelong coverage. |

| LIC Term Life Insurance | A pure protection plan that offers high life cover at low premiums for a specific term, with no maturity benefit, ensuring financial support to the family in case of the policyholder’s death during the policy term. | Budget-conscious individuals who want maximum life cover for family protection. |

| LIC Money Back Plans | A savings and protection plan that offers periodic returns during the policy term, along with life cover and a lump sum on maturity. | Those looking for regular payouts during the policy term along with life cover and maturity benefits. |

| LIC Group Plans | A group retirement savings plan that helps employers build long-term financial security for employees through flexible contributions, guaranteed returns, and life cover benefits. | Employers looking to build a retirement corpus for employees with guaranteed returns, flexible contributions, and life cover benefits. |

LIC Of India – Plan List

LIC of India provides diverse insurance and investment products catering to customer needs. From traditional life insurance to investment plans, they offer comprehensive financial solutions, ensuring individuals find tailored plans for their unique requirements. Let us take a look at the Best LIC Policy 2026:

LIC Unit-Linked Plans  Redirecton

Redirecton

LIC India ULIP Plans offer the dual benefits of insurance and investment. These ULIP plans provide life cover throughout the policy term while allowing policyholders to grow their money to help them achieve their financial goals.

Unit-linked insurance plans (ULIP) offered by the company are –

| LIC Unit-Linked Plans | Plan’s USP | Entry Age | Minimum Premium (in Rs.) | Maturity Age | |

| LIC Index Plus (873) | 1. Guaranteed Additions 2. Choice of 4 fund options for investment 3. Partial withdrawals after 5 years |

90 days- 60 years | 7 times of Annualized Premium | 85 years | |

| Nivesh Plus (749) | 1. Single premium ULIP plan 2. Life cover with investment growth 3. Partial Withdrawals after 5 years |

90 days- 70 years | Rs.1 Lakh | 85 years | |

| LIC SIIP(752) | 1. Non-participating ULIP offering life cover with savings. 2. Choose from 4 fund types; returns vary with NAV. 3. Life cover, guaranteed additions, refund of mortality charges on maturity. 4. Option to add Linked |

30 days- 65 years | Yearly: 42,000 Half-yearly: 21,000 Quarterly: 10,500 Monthly: 3,500 |

85 years | |

| LIC New Endowment Plus(735) | 1. Combines life insurance and long-term savings. 2. Four fund types based on risk appetite. 3. Flexible options to set premium, term, payout method; allows partial withdrawals. |

30 days- 50 years | Yearly: 42,000 Half-yearly: 21,000 Quarterly: 10,500 Monthly: 3,500 |

60 years |

LIC Pension Plans  Redirecton

Redirecton

The Life Insurance Corporation of India offers several pension plans to guarantee financial stability in old age. These plans are designed to provide income after the end of your earning years and ensure post-retirement financial independence.

Below-mentioned are the LIC pension plans offered by the company:

| LIC Pension Plan Name | Plan’s USP | Entry Age | Vesting Age | Minimum Purchase Price | |

| New Pension Plus (867) | 1. Unit-linked pension plan for retirement 2. Choice of 4 fund options 3. Loyalty additions for higher returns |

25 years -75 years | For Regular Premium Payment: Rs. 3,000 monthly For Single Premium Payment: Rs. 1,00,000 |

- | |

| New Jeevan Shanti (758) | 1. Single premium deferred annuity plan 2. Joint or single-life annuity options 3. Guaranteed lifetime income post deferment |

30 years -79 years | 80 years | Rs 1.5 Lakhs | |

| Jeevan Akshay –VII (857) | 1. Immediate annuity plan with 10 options 2. Guaranteed lifetime pension 3. Flexible premium payment options |

25 Years -85 years | - | Rs 1 Lakhs | |

| Smart Pension (879) | 1. Single Premium Immediate Annuity Plan 2. Joint or single-life annuity options 3. Incentives for higher Purchase Price |

18 Years -100 years | - | Rs 1 Lakhs |

LIC Endowment Plans Redirecton

Redirecton

The LIC of India endowment plans promise life coverage for the life assured and increased savings opportunities. These plans offer a guaranteed maturity benefit upon surviving the whole policy term and, therefore, can be used to save for the future.

Below-mentioned are the endowment plans offered by the Life Insurance Corporation of India:

| LIC Endowment Plan Name | Plan’s USP | Entry Age | Minimum Sum Assured (in Rs.) | Maturity Age | |

| LIC Nav Jeevan Shree Single Premium Plan | 1. Life cover and maturity benefits with a single premium. 2. Guaranteed payout at the end of the term. 3. Non-linked, non-participating plan, meaning no market risk and predictable returns. |

90 Days - 60 years for Option 1 40 years for Option 2 65 years for offline policies |

Rs. 1 Lakh | 18 years- 75 years for Option 1 60 years for Option 2 65 years for offline policies |

|

| LIC Nav Jeevan Shree 912 | 1. Choose between single or 5-year limited premium payment. 2. Ensures savings along with life cover. 3. Level or increasing sum assured as per need |

30 days - 60 years for PPT of 6, 8 and 10 years 59 years for PPT of 12 years 65 years (nearer Birthday minus policy term)- for offline policies |

Rs 5 Lakhs | 18 years- 75 years (last birthday) 65 years (nearer birthday)- for offline policies |

|

| Bima Jyoti (860) | 1. Guaranteed additions of ₹50 per ₹1,000 sum assured annually 2. Limited premium payment, with life cover 3. Lump-sum maturity benefit |

90 days-60 years | Rs. 1 Lakh | 70 years | |

| New Endowment Plan (714) | 1. Savings with life cover 2. Guaranteed and bonus payouts 3. Flexible premium and policy terms |

8 Years -55 years | Rs. 1 Lakh | 75 years | |

| Single Premium Endowment Plan (717) | 1. One-time premium payment 2. Life cover with maturity benefit 3. Bonus additions for enhanced returns |

90 days -65 years | Rs. 50,000 | 75 years | |

| New Jeevan Anand (715) | 1. Combines lifelong protection with savings 2. Flexible premium payment options and protection period 3. High-sum assured rebates for attractive premiums |

18 Years -50 years | Rs. 1 Lakh | 75 years | |

| Jeevan Labh (736) | 1. Rider Benefit for enhanced protection 2. Option to customize a plan |

8 Years -59 years | Rs. 2 Lakh | 75 years | |

| Jeevan Lakshya (733) | 1. Limited Premium Payment 2. Option to receive the death benefit in instalments 3. Loan Facility |

18 Years -50 years | Rs. 1 Lakh | 65 years | |

| LIC Amritbaal (774) | 1. Guaranteed maturity benefits with bonuses 2. Child-focused plan for future goals 3. Savings with insurance protection |

0 years-13 years | Rs. 2 Lakhs | 25 years | |

| LIC Bima Lakshmi (881) | 1. Designed exclusively for females providing protection, savings and survival benefits. 2. Auto cover facility after payment of three full years’ premiums. 3. LIC’s Female Critical Illness Benefit Rider |

18 - 50 years | Rs. 2 Lakhs | - |

LIC Whole Life Plans  Redirecton

Redirecton

Life Insurance Corporation of India also offers whole life insurance plans that cover the policyholder for their whole life. These plans are designed to provide the dual benefits of life protection and savings via cash value accumulation till 100 years of age.

Below-mentioned are the whole-life plans offered by the company:

| LIC Whole Life Insurance Plans | Plan’s USP | Entry Age | Minimum Sum Assured (in Rs.) | Maturity Age | |

| Jeevan Umang (745) | 1. Whole life plan with limited premiums 2. Guaranteed annual payouts after the premium term 3. 8% annual survival benefit |

90 days-55 years | Rs.2 Lakhs | 100 years | |

| Jeevan Utsav (771) | 1. Whole life plan with limited premiums 2. Choice of Regular or Flexi Income 3. Guaranteed Additions during the premium term |

90 days-65 years | Rs.5 Lakhs | NA |

LIC Term Insurance Plans  Redirecton

Redirecton

Term insurance plans provide financial protection to the family of the life assured at affordable premiums. These plans pay the death benefits to your nominees in case of the policyholder’s untimely death during the policy tenure. The LIC of India does not pay any maturity value with term plans if the individual outlives the policy tenure.

The LIC term insurance plans available in India are as follows:

| LIC term Plans | Plan’s USP | Entry Age | Maturity Age | Policy Term | |

| New Tech Term (954) | 1. Online pure term plan 2. High coverage at affordable premiums 3. Flexible payout options |

18 Years -65 years | 80 years | 10 to 40 years | |

| New Jeevan Amar (955) | 1. Offline term plan with flexibility 2. Option for regular or limited premiums 3. Life cover up to 80 years |

18 Years -65 years | 80 years | 10 to 40 years | |

| LIC Yuva Term (875) | 1. Term plan for young policyholders 2. Affordable premiums with high coverage 3. Opt for payment of benefit in instalments |

18 Years -45 years | 75 years | 15 to 40 years | |

| LIC Digi Term (876) | 1. Digital term insurance plan 2. Easy online application process 3. Flexible premium and payout options |

18 Years -45 years | 75 years | 15 to 40 years | |

| LIC Yuva Credit Life (877) | 1. Group term plan for young borrowers 2. Affordable premiums are linked to the loan term 3. Life cover for outstanding loan protection |

18 Years -45 years | 75 years | 5 to 30 years | |

| LIC Digi Credit Life (878) | 1. Digital group credit life plan 2. Coverage for borrowers against loan liability 3. Hassle-free, fully online process |

18 Years -45 years | 75 years | 5 to 30 years |

LIC Money Back Plans  Redirecton

Redirecton

LIC Money Back Plans offer both life cover and periodic payouts, that combine protection with savings. Policyholders receive a portion of the sum assured at set intervals, and a lump sum with bonuses at maturity. In case of death, the full sum assured plus bonuses is paid to the nominee.

The LIC Money Back Plans available in India are as follows:

| LIC Money Back Plans | Plan’s USP | Entry Age | Maturity Age | Min Sum Assured | |

| Bima Shree (748) | 1. Guaranteed Additions at a specified rate per Rs. 1,000 of Basic Sum Assured 2. Survival benefits at specified durations 3. Flexible policy terms for 14, 16, 18, and 20 years. |

18 - 55 Years | 69 years | Rs. 10 Lakhs | |

| New Money Back Plan- 20 Years (720) | 1. Get 20% of the basic sum assured at the end of the 5th, 10th and 15th years. 2. Limited Premium paying option. 3. The plan combines savings and protection components. |

13 - 50 Years | 70 years | Rs. 2 Lakhs | |

| New Money Back Plan- 25 Years (721) | 1. Enhance coverage by opting for Rider Benefits on payment of additional premium 2. Survival Benefits at specified Policy durations. 3. Offers a loan facility to take care of liquidity needs. |

13 - 45 Years | 70 years | Rs. 2 Lakhs | |

| New Children's Money Back Plan (732) | 1. Specially designed to meet the educational, marriage and other needs of growing children through Survival Benefits. 2. Option to defer Survival Benefits as per needs. 3. Option to opt for Premium Waiver Benefit Rider on payment of additional premium. |

0 - 12 Years | 25 years | Rs. 2 Lakhs | |

| LIC Jeevan Tarun (734) | 1. Child-specific plan with flexible payouts 2. Guaranteed survival benefits during term 3. Savings for education and other needs |

90 days - 12 years | 25 years | Rs. 75000 | |

| Bima Ratna (764) | 1. Limited premium paying plan with a loan facility 2. Guaranteed Addition throughout policy term for active policies 3. Attractive high sum assured rebates |

5 - 55 Years | 70 years | Rs 5 Lakhs |

LIC Micro Insurance Plans  Redirecton

Redirecton

Life Insurance Corporation of India (LIC) offers micro‑insurance plans designed specifically for low‑income segments. These plans aim to provide affordable life insurance cover with simplified features. They have lower sum assured, simpler features, minimal or no medical tests, and shorter policy terms.

Below-mentioned are the micro insurance plans offered by LIC:

| LIC Micro Insurance Plans | Plan’s USP | Entry Age | Min Sum Assured | Maturity Age | |

| Micro Bachat (751) | 1. Life insurance coverage at low, regular premiums. 2. Can be purchased without a medical examination. 3. Loan facility against policy to meet financial needs. |

18 years - 55 years | Rs. 1 Lakh | 70 years | |

| Jan Suraksha (880) | 1. Guaranteed Additions of 4% of the annualized premium each year during the policy term. 2. Low premiums and easy-to-understand features. 3. Auto-cover period is given to keep the policy active if future premiums are not paid on time. |

18 years-55 years | Rs. 1 Lakh | 70 Years |

Life Insurance Corporation of India Riders

Riders in LIC are the optional paid benefits you can add at nominal premiums to enhance the cover of your best LIC policy 2026. The premiums for the LIC riders can be paid alongside the base premium of the policy.

Here is the list of riders in LIC that the Life Insurance Corporation of India offers with its insurance policies:

LIC Fixed Deposit Scheme 2026- LIC HFL Sanchay FD Scheme

The LIC HFL Sanchay Fixed Deposit Scheme 2026 is a savings plan offered by LIC Housing Finance Limited (LIC HFL) that allows individuals to earn secure and guaranteed investment returns. It provides attractive interest rates, flexible tenures, and multiple payout options for different financial goals.

The LIC HFL scheme is ideal for those seeking low-risk, stable income through fixed deposits backed by a trusted financial institution like LIC and its subsidiary, LIC Housing Finance.

Government Schemes Offered by LIC of India

-

LIC Bima Sakhi Yojana

LIC Bima Sakhi Yojna (MCA Scheme) is a stipend-based initiative exclusively for women, aged 18 to 70, with a minimum 10th-grade qualification. This scheme offers an opportunity for women to work as agents, but it is not a salaried position. Performance norms must be met each year during the 3-year stipendary period.

-

Pradhaan Mantri MaanDhan Yojana

Pradhan Mantri Maandhan Yojana is a government-backed pension scheme for unorganized sector workers. It ensures a ₹3,000 monthly pension post-retirement at age 60. It requires a minimal monthly contribution, matched by the government, promoting financial security for eligible individuals aged 18-40.

-

Pradhan Mantri Jeevan Jyoti Bima Yojana

Pradhan Mantri Jeevan Jyoti Bima Yojana is a government-backed life insurance scheme offering affordable annual coverage of ₹2 lakh for individuals aged 18-50. It aims to provide financial security to families in case of the policyholder's untimely death, with an annual premium of just ₹436.

Why Buy LIC Policies from Policybazaar?

-

Convenience to Make Monthly Premiums

Policybazaar allows you to make monthly premium payments for your LIC policies, thus removing the stress of making a single lump sum premium payment.

-

Comprehensive Claim Assistance

In times of need, our dedicated team is always ready to guide you through the claim process. No matter the complexity, we ensure you receive the support and assistance required to make your claim hassle-free.

-

24/7 Customer Service

Our customer care team is always available to resolve your queries and concerns about your LIC policy details, LIC premium payment receipt, updating the details, and more.

-

Reliable and Secure

Purchasing a LIC policy from Policybazaar secures your financial future and offers peace of mind. Policybazaar ensures your insurance experience is smooth and worry-free and prioritises your security and satisfaction.

-

Easy and User-Friendly Process

Our platform is designed to be user-friendly, making the entire process effortless—from selecting a policy to managing your premiums. With Policybazaar, you can easily buy your LIC policy, pay your premiums, and renew your policy in a few minutes.

- Assess your financial goals: Choose coverage and policy type based on current and future needs.

- Pay premiums on time: Maintain active coverage with timely payments.

- Choose the right type of policy: Align your choice with financial goals, e.g., term, endowment, or others.

- Be honest about your health and habits: Disclose medical history and habits to validate claims.

- Provide false information: Avoid false details to ensure smooth claims processing.

- Make hasty decisions: Understand policy terms and benefits before buying.

- Focus solely on tax benefits: Prioritize coverage and features over tax savings.

- Cancel the policy without considering implications: Review surrender value and penalties before canceling.

How to Choose the Best LIC Policy?

To purchase a suitable LIC policy, you need to keep the following factors in mind:

- 1

Identify Needs & Choose Coverage Amount

- 2

Choose a particular type of insurance policy

- 3

Compare Different Plans & Their Features

- 4

Calculate the Premium & Maturity Amount Online

-

Step 1: Identify Needs & Choose Coverage Amount

Choose the insurance coverage amount (sum assured) wisely by considering your current income, savings, number of dependents, future goals, etc.

-

Step 2: Choose a particular type of insurance policy

Based on your future goals, pick a type of plan that can help you fulfill them. For instance, if your goal is retirement planning, look for pension schemes for senior citizens. Alternatively, explore ULIPs if you want to grow your wealth. We can broadly divide LIC products into six categories as follows:

-

LIC Unit-Linked Plans

-

LIC Endowment Plans

-

LIC Pension Plans

-

LIC Whole Life Insurance Plans

-

LIC Money-Back Plans

-

LIC Term Insurance Plans

-

-

Step 3: Compare Different Plans & Their Features

Now that you understand what you need, shortlist plans from that category that fall within your budget. Look for additional features that can increase your savings.

-

Step 4: Calculate the Premium & Maturity Amount Online

There are LIC maturity and premium calculators available online. You can use this tool to get to know the premium you have to pay regularly and the maturity amount you will get.

- Early Adulthood (20–30 years) Choose life insurance coverage of at least 10 times your annual income to cover debts and provide for dependents.

- Middle Adulthood (30–40 years) Opt for coverage of 15 times your annual income to account for future needs, inflation, and growing family responsibilities

- Late Adulthood (35–45 years) Ensure coverage of 15 to 20 times your income to cover children’s education, marriage, and retirement, while maintaining at least 10 times your income.

- Senior Citizens (50-60 years) Select coverage of 5 to 10 times your income for legacy planning and end-of-life expenses, especially if debts are reduced or paid off.

How to Buy LIC of India Plans?

You can now conveniently buy LIC of India plans for yourself and your family online via Policybazaar or the LIC’s official website.

Buy LIC plans From Policybazaar:

-

Step 1: Visit the Policybazaar homepage

-

Step 2: Select LIC Plans

-

Step 3: Fill in the form with your name and contact number, and click on View Plans

-

Step 4: After this, on the next page, fill in your age, current city and annual income

-

Step 5: Once done, you can check the plans available and customize the amount and policy tenure for your investments

-

Step 6: Choose the plan, and pay your premiums online.

Buy LIC plans from LIC’s Official Website:

-

Step 1: Visit the Official website of LIC of India

-

Step 2: Click on the “Buy Online” option on the plan you want to purchase

-

Step 3: Fill in your details such as Name, DOB, Contact number

-

Step 4: Customize the plan by choosing the sum assured, policy term, and premium frequency per your requirements. You can also add any rider for enhanced protection.

-

Step 5: Once you've done this, pay the premiums online. Once the payment is confirmed, your policy details and premium receipt will be sent to your personal email address.

Note: Policybazaar also provides door-to-door advisors to resolve your queries.

LIC e-Services

LIC e-services enable users to carry out insurance-related activities from the comfort of their homes through its official website or mobile application. Everything, given below, can be done in a few clicks, from policy registration to checking claim status.

-

Compare plans

-

Premium calculator and Benefit Illustration

-

Online premium payment

-

Review policy status

-

Loan application

-

Check claim status

-

Check policy revival price

-

Access to forms for various services

-

Grievance registration

Here is the range of services that customers and policyholders can access on LIC’s online platform.

LIC’s e-Services- Registration Guide

To use the services mentioned above, customers must register on LIC’s online customer platform. Here are the steps to do so.

-

Visit the Customer Portal on LIC's website and click on New User.

-

Choose User ID and password. Click on Submit.

-

Login to your account and choose Basic Services to add your policy.

-

To access LIC’s premier online services, fill up the Registration form and print it.

-

Sign this form; then scan it along with the PAN card or passport.

-

Upload the scanned images and click on Submit Request.

-

Once a Customer Zone Official verifies the details, you will receive an acknowledgement by email or SMS.

Other LIC of India services

-

Retired Employees Portal

-

Agent's Helpline

-

Merchant Portal

-

Agent/CLIA/Chief Organiser/IMF

-

eNACH(eMANDATE)

-

Group Customer/Annuitant Portal

-

Online Agent Mock Test Portal

-

ANANDA

-

LICA Portal

-

Online Loan

-

Bill Pay Enquiry

-

SSS PA Portal

-

Dev Officer Portal

What Are the LIC of India Mobile Apps?

LIC of India has several mobile applications to make insurance purchases convenient and less time-consuming. Find below the list of LIC applications that offer access to all its products, features, and services.

-

My LIC - This is the LIC app store that provides links to its other applications. Users can download whichever app they need through My LIC.

-

LIC Customer - This app offers detailed information about LIC's products and services. It includes everything from online premium payments to checking policy statuses to benefit illustrations and plan brochures.

-

LIC PayDirect - This application allows policyholders to repay loan amounts and pay renewal premiums and interest. You can use this app to make payments without registering for LIC online portal.

-

LIC Quick Quotes - This LIC app allows users to calculate premiums before actually purchasing a plan. This helps them understand how affordable a plan is. They can also see the death and maturity amount applicable under a plan. This information can be used for better financial planning.

How to Buy LIC Policy Online?

Here is a step-by-step guide on how to purchase a LIC policy through its online portals.

Step 1: Visit the website of LIC of India.

Step 2: Click on “Buy Online” at the top right corner of the window.

Step 3: Under the plan banner, select the policy type you want to choose.

Step 4: Click on “Know More” under the plan.

Step 5: You will be shown a list of the documents required. Ensure you have them handy and click on “Proceed”.

Step 6: Fill in a few basic details, such as your name, DOB, age, gender, email, contact, annual income and residential status (Resident Indian or NRI), city and zonal office. Click “Proceed”

Step 7: In the next window, answer the few questions under “Choose Your Needs”

Step 8: Click on Calculate Premium.

Step 9: When everything is in order, proceed to the premium payment.

Step 10: You will receive a confirmation in your mail or SMS once the transaction is successful.

How Can NRIs Secure Their Future with LIC Plans?

LIC’s Financial Need Analysis for NRIs is a tool designed to help Non-Resident Indians assess their financial needs and plan their investments accordingly. Follow the below steps to analyze your financial needs:

Step 1: Visit the LIC of India website, and click on Financial Needs Analysis from the drop-down menu.

Step 2: Enter personal details like name, DOB, gender, mobile number, risk category and life stage.

Step 3: Once done, add the family member details and then add goals from the drop down menu.

Step 4: On the next page, fill in the details related to your goal.

Step 5: Once done, you will get the desired goal amount based on the inputs provided by you.

How to Find The LIC Policy Number?

-

To find the LIC policy number, visit the LIC customer portal on the LIC website.

-

Click on the ‘Registered User’ option.

-

Login to your account using the user ID and password you set when registering for its services.

-

This will display the policy numbers of all the active LIC policies that you enrolled in on the portal.

How to Check LIC Policy Status Online?

You can check the LIC policy status online through its website or mobile application.

-

If you are a new user, you will have to register for its e-services.

-

You can then proceed to add your policies to your account.

-

Once the registration is successful, you can log in to view your LIC policy status.

-

If you are an already registered user, simply log in to your account for the same.

How to Check LIC Policy Status Without Registration?

You can use LIC’s SMS service to check LIC policy status without registration. All you have to do is -

SMS ASKLIC<policy number>STAT to 56767877 from your registered phone number. Other types of queries for which you can use the SMS service are:

-

Revival Sum - ASKLIC(Policy Number)REVIVAL

-

Bonus Additions - ASKLIC(Policy Number)BONUS

-

Installment premium - ASKLIC(Policy Number)PREMIUM

-

Status of Added Nominations - ASKLIC(Policy Number)NOM

-

Loan Sum Available - ASKLIC(Policy Number)LOAN

Another option is contacting LIC through its integrated voice response system (IVRS) at 022 6827 6827. Policyholders can also request that this information be faxed to them should they need it.

How to Make LIC Premium Payment Online?

LIC premium payment online can be done through the mobile app LIC PayDirect or its official website. The mobile application allows you to pay premiums by registering to its e-services portal.

Here are step-by-step guides on how to pay LIC premiums online through both mediums.

Through LIC Website

-

Register to LIC’s customer portal and enroll in your policies.

-

Login to your account using the user ID and password.

-

Click on Pay Premium Online.

-

You will see the list of policies for which premiums are due. Proceed to select one.

-

You will see different payment options, such as net banking, UPI, debit, and credit cards. Choose the one that is suitable for you.

-

You will be directed to the payment gateway for the option chosen.

-

Following a successful transaction, you will receive confirmation through an e-receipt.

Through LIC PayDirect

-

Install the application on your phone.

-

Click on Proceed.

-

Under the Pay Direct option, select Advance Premium Payment.

-

Click on Done.

-

Fill out the form with information on the policy number, installment premium amount without tax, your DOB, and contact details.

-

Click on Submit.

-

Enter the premium particulars in the next step.

-

Proceed to make the payment using a suitable gateway from the options presented.

Through WhatsApp

The Life Insurance Corporation of India has launched a new WhatsApp-based premium payment service, giving policyholders a convenient way to check dues, make payments, and receive receipts in the chat. This option save customers from repeatedly logging into portals or waiting in queues.

With just a few taps, your premium is paid and acknowledged. Here are the steps on how to use it:

Step 1: Start a Chat in the official WhatsApp Number

Send a “Hi” to 8976862090 (LIC WhatsApp bot number).

Step 2: Authenticate Yourself

Verify your mobile number registered with the LIC customer portal ensuring secure access to your policies.

Step 3: View Due Policies

Once verified, the bot will show a list of LIC policies that are due for premium payment.

Step 4: Select Payment Option

Choose the policy you want to pay for. You’ll get secure payment options like:

UPI, Net Banking, Debit/Credit Card, etc.

Step 5: Make Payment and Get Receipt

Complete the payment directly within WhatsApp. A digital receipt will be generated instantly.

Note: This feature is available only to users registered on LIC’s customer portal with an updated mobile number.

Through Policybazaar

Premium Payment of LIC Policy from Desktop

Step 1: Go to the Policybazaar LIC online payment page

Step 2: Fill in your Policy Details and DOB in the renewal form.

Step 3: Once done, you can scan the QR Code and be directed to the in-app Policy premium payment page or enter your mobile number to receive the payment link via text message or WhatsApp. The scanner will redirect to the LIC Policy premium payment details page on the Policybazaar app.

Step 4: Review the premium payment information, choose your preferred payment mode to pay the dues, and complete the process.

Step 5: Once you make the payment, you will receive the premium payment receipt at your registered email address.

Alternatively, you can use your mobile phone to pay premiums for your LIC Policy using Policybazaar application .

Step 1: Fill in the form with your policy number and DOB.

Step 2: Next, click continue, and you will be redirected to the Policybazaar’s in-app Policy premium payment page.

Step 3: Review the policy’s renewal information, choose the preferred payment mode, and pay your premium.

Points to Note While Making LIC Premium Payment Online

-

To use the net banking facility, you need to have a registered bank account with LIC’s listed bank affiliations.

-

Provide the correct details and valid contact number along with your email address.

-

The payment receipt will always be mailed to the email address provided.

-

It should be done by the policyholder only and should not involve a third party.

-

If the amount has been debited from your account but the screen displays an error, do not attempt to make a payment again. You should receive a confirmation receipt in your mail within 3 working days. You can also report such an incident to bo_eps1@licindia[dot]com.

-

The online portal accepts only domestic bank-issued cards. Any international cards will not be accepted.

You can also make LIC premium payments offline at the cash counter of the nearest LIC branch.

What is LIC Digital App?

The LIC Digital app or LIC ebiz app is LIC's official Adroid app from LIC Insurance Corporation of India. It is available for iOS and Android devices and is specifically designed to help LIC consumers conveniently manage their transactions and plans. This app also details policy details, loan management, LIC premium payments, and access to premium-related services.

How to Use the LIC Digital App?

Step 1: Download and install the app from the Apple App Store (iOS) or Google Play Store (Android).

Step 2: If you are a new user, register with your LIC policy details and create a user ID and password.

Step 3: Login to the LIC Digital app using your ID and password (registered)

Step 4: Check for various app features such as making ebiz LIC online payments, managing your policies, and getting details about the online services.

Note: It is advisable to download from the ebiz LIC login app official channels and pay through LIC’s verified channels.

How to Check the LIC Policy Status?

To check the LIC policy status online, follow the below steps:

Step 1: Visit the official LIC Website

Step 2: Click on the “Login to Customer Portal” option.

Step 3: If you are a new user, Click "New user" or "Sign Up."

-

Provide required details such as your policy number, instalment premium, date of birth, mobile number, and email ID.

-

Verify your mobile number and email as per the instructions.

-

Create a password following the password guidelines.

Step 4: After registration, log in using your credentials.

Step 5: Once logged in, navigate to the section for policy-related information to view your policy status and other details like premium payment, loan requests, and more.

How to Check LIC Maturity Amount?

If you want to keep a check on the LIC maturity amount after purchase, you must create an account on the LIC customer portal. This will give you access to all its online services.

-

Once registered, log in to your account using the newly created User ID and password.

-

Go to Policy Status. This will display all the policies enrolled in your account.

-

Click on the policy for which you want to check the LIC maturity amount.

-

This will display all the information related to the policy including the maturity amount.

If you haven’t bought an insurance policy yet, checking the maturity amount can help you plan your finances better. You can do this using the LIC maturity calculator, which offers a detailed illustration of the benefits to which you will be entitled. Here is a guide on how to do so.

-

Visit the LIC of India website or its application LIC Quick Quotes.

-

Scroll down to the LIC Premium Calculator tab.

-

This will take you to an external page for LIC e-services.

-

Enter your age, gender, DOB, and contact details.

-

Click on Next.

-

You can choose Quick Quotes or Compare Quotes.

-

Select the policy for which you want to calculate the maturity benefit amount.

-

Fill the form with desired policy-related details such as the sum you want to assure, the policy term, premium payment term, and premium paying frequency.

-

The next page will offer you premium quotes.

-

You will also see the option for benefit illustration.

A key advantage of the LIC maturity calculator is that it considers each user's unique needs. This helps customers make the right insurance decisions for themselves.

LIC Customer Service

LIC customer care service includes a range of networks (both online and offline) to facilitate a wider reach. You can contact the Life Insurance Corporation call center to use its customer services for information on the following:

-

Claim settlement

-

Updating contact details

-

Unclaimed amounts of policyholders

-

Policy guidelines and benefits

-

Policy purchase and premiums

-

Tax benefit

-

Bonus information

-

NRI Insurance

-

Change of address

-

Life certificate for pension policies

-

Application forms

-

Registration to LIC Customer Portal

LIC Claim Settlement Process

Claims settlement is one of the most important aspects of policyholder services. Therefore, LIC of India offers instant claim and single-day processing for both maturity and death claims.

Procedure for settling the LIC Maturity Claims

-

The branch office that serves the policy will send a letter that will inform the date on which the policy money is payable to the policyholder two months before the payment due date.

-

The policyholder is then requested to return a discharge form that is duly completed with the policy document.

-

After receiving the two documents, a post-dated cheque is sent by post in the policyholder's name before the due date.

-

With plans like a money-back plan, LIC will provide periodical payments to the policyholders only if the due premium within the policy is paid up to the due anniversary for the survival benefit.

In such cases, wherein the sum payable is less than Rs. 2,00,000, cheques are most likely released without calling for a policy document in the discharge receipt. If the amount is high, these two requirements will be insisted upon.

Procedure for settling the LIC Death Claims

-

Claim Form A is essentially the claimant's statement, which gives information about the claimant and the life assured.

-

Certified extract from the death register.

-

In case the age is not admitted then evidence to substantiate the same.

-

Proof of title to the deceased's estate in case the policy isn't assigned, nominated or issued within the MWP act.

-

The original papers of the policy document.

-

Documents such as the copy of the FIR, and report of the post-mortem are mostly insisted upon in case of death by accident.

Other forms may be requested if the demise occurs less than three years from the date of reinstatement/revival.

-

Claim Form B: A certificate of the medical attendant that the deceased’s medical attendant completes during the last illness.

-

Claim Form B1: In case the treatment in the hospital was received by the life assured.

-

Claim Form B2: This should be duly completed by the deceased life assured's medical attendant who treated them before their last illness.

-

Claim Form C: A certificate of identity and cremation or burial that is completed and signed by the person who is a known character or responsible.

-

Claim Form E: The employment certificate if the life assured was employed.

-

The copies of the post-mortem report, first information report, and the investigation report of police in case the demise was due to an unnatural cause or an accident.

LIC Online Nominee Changes

An individual can change the nominee as often as he/she wants. To do so, follow the below steps:

Step 1: Submit a notice to the Life Insurance Corporation of India in Form 3750.

Step 2: Endorse your nomination

Below are the documents required to complete the process

-

Relation proof with the nominated individual,

-

Policy Bond,

-

Form 3750,

-

Photocopy of LIC policy

LIC Online Renewal Process

With Policybazaar's online renewal portal, you can now easily renew your LIC policy in a few moments by following the below steps:

Step 1: Visit the official website of Policybazaar and click on Renewal.

Step 2: Select ‘Life Renewal’ from the Renewal drop-down list.

Step 3: Choose “LIC of India” from the list of insurers provided on the screen.

Step 4: Enter your Policy Number and Date of Birth as mentioned in the policy documents and click "Continue."

Step 5: Review the policy renewal information, choose the preferred payment mode, and pay your renewal amount.

Note: The amount will be settled with LIC in 3-5 business days after successful payment.

LIC Insurance Selector

LIC offers an insurance selector that will help you make an informed decision about which plan is right for you based on your age, income, occupation, and insurance requirements.

Get Advice from our IRDAI Certified Insurance Agents

Call on toll-free number: 1800-258-5970

LIC — Recent Stock Updates

As of recent updates, LIC has seen notable movements in its stock market performance following its initial public offering (IPO) in May 2022. The company's stock has experienced fluctuations influenced by broader market trends and sector-specific developments.

As of today, the current Life Insurance Corporation of India share price is Rs. 894.30

People also searched for

-

↗

How to do LIC Login?

-

↗

How to do LIC Online Payment?

-

↗

How to check LIC Policy Status?

-

↗

How to login on LIC Customer Portal?

-

↗

How to complete LIC Premium Payment?

-

↗

How to check LIC Policy Details?

LIC (Life Insurance Corporation of India) – FAQs

What is LIC used for?

Ans: LIC, or Life Insurance Corporation of India, is a state-owned insurance company providing coverage. It offers various insurance products to financially protect policyholders and their families against unfortunate events like death, disability, or critical illness.

What is the full form of LIC?

Ans: The full form of LIC is Life Insurance Corporation of India. It is India's largest and most trusted life insurance provider.

What are the best LIC plans to buy in 2026?

Ans. Here are some of the top LIC plans to consider in 2026:

- LIC New Jeevan Shanti – Ideal for post-retirement income security.

- LIC Jeevan Umang – Offers lifetime coverage with guaranteed survival benefits.

- LIC Nivesh Plus – A unit-linked insurance plan for investment and protection.

- LIC Jeevan Utsav – A celebration plan with lifelong financial security.

How can I buy LIC plans online?

Ans. You can easily buy LIC policies online by following these steps:

- Visit the official LIC website or a trusted insurance marketplace like Policybazaar.

- Enter your details such as name, age, and city.

- Click on “View Plans” to see available options.

- Choose a suitable plan and customize the premium or tenure.

- Make the payment online to complete the purchase.

How to pay LIC premium online?

Ans. You can pay your LIC premium online through multiple methods:

- LIC Official Website – Log in to the customer portal and pay via net banking, UPI, or debit/credit card.

- LIC Mobile App – Download and use the LIC Pay Direct app.

- UPI & Digital Wallets – Pay using Google Pay, PhonePe, Paytm, or BHIM UPI.

- Authorized Banks & Payment Partners – Use bank auto-debit, ECS, or insurance aggregator platforms.

How to check LIC policy details online?

Ans. To check your LIC policy details online:

- Visit the LIC e-Services portal.

- Register or log in with your credentials.

- Click on “View Enrolled Policies” to check details.

How can I change my address in LIC policy?

Ans. You can update your address in LIC policy by:

- Visit the nearest LIC branch office with proof of valid address.

- Submitting a written request for an address change.

- Log in to the LIC portal and update your details online.

How can I apply for a loan against LIC policy?

Ans. To avail a loan against your LIC policy:

- Visit the nearest LIC branch or log in to the LIC portal.

- Fill out the loan application form and submit the required documents.

- Upon verification, the approved loan amount will be credited to your bank account.

How to become a LIC agent?

Follow these steps to become a LIC agent:

- Visit the nearest LIC branch office and meet a Development Officer.

- Clear the branch manager’s interview.

- Complete a 25-hour training program covering LIC products and insurance regulations.

- Appear for the IRDAI Pre-Recruitment Exam and pass it.

- Receive your LIC agent appointment letter and ID card.

- Start selling LIC policies under the guidance of your development officer.

Eligibility: You must be at least 18 years old and have completed 10th standard.

How to check LIC policy status via SMS?

Ans: To check your LIC policy status via SMS:

- Send "ASKLIC <Policy Number>" to 9222492224.

- You will receive an SMS with your policy details.

What is LIC 149 maturity benefit?

Ans: LIC 149 maturity benefits are Sum assured +Bonus+ Final Additional Bonus that is paid at the end of the policy term.

What happens if I miss my LIC premium payment?

If you miss your LIC premium payment:

- A grace period is provided (15 days for monthly, 30 days for quarterly, half-yearly, and yearly payments).

- If not paid within the grace period, the policy may lapse.

- You may need to revive the policy by paying pending premiums with interest.

Is LIC premium tax-deductible?

Yes, LIC premiums qualify for tax deductions under Section 80C of the Income Tax Act, 1961.

Can I change my LIC premium payment frequency?

Yes, you can switch your payment frequency (monthly, quarterly, half-yearly, or yearly) by requesting a change at an LIC branch office or via the customer portal.

Is there a charge for LIC’s e-Services?

Ans. No, LIC’s e-Services are free of cost for policyholders.

How can I check the LIC Bonus Rate 2023-24?

You can check the LIC Bonus Rate for 2023-24 by:

- Visiting the LIC website.

- Contacting your LIC agent or nearest branch.

- Checking LIC’s official bonus announcements.

Will the LIC Bonus Rate affect my policy maturity amount?

Yes, bonus rates impact the maturity value of participating policies. A higher bonus rate means higher returns at policy maturity.

Are LIC shares available for public purchase?

Yes, LIC shares are publicly traded on stock exchanges. Investors can buy LIC shares via a Demat account.

What is the market cap of LIC?

Ans. As of September 19, 2024, LIC’s market capitalization is ₹6,32,721 Crores.

What is LIC’s 52-week high and low share price?

Ans. As of the latest data, Life Insurance Corporation of India share price has recorded a 52-week high of ₹1,222.00 and a 52-week low of ₹715.35. These figures reflect the highest and lowest trading prices of LIC stock over the past year on the stock exchanges.

How can I download the LIC mobile app?

Ans: You can download the LIC Digital App from the Google Play Store to manage policies, pay premiums, and access LIC services.

Does the Life Insurance Corporation of India have an official Facebook page?

Ans: Yes, LIC has an official Facebook page where policyholders can stay updated with the latest news, offers, and announcements. You can follow LIC's official Facebook page for information about new insurance plans, premium payment updates, and important notifications.

How to Get an LIC Tax Certificate Online?

To get your LIC tax certificate online:

- Visit the official website of Life Insurance Corporation of India.

- Login to the Customer Portal.

- Go to 'Premium Paid Statement' under 'Customer Services.'

- Select Financial Year and download the certificate.

How can LIC merchants log in to their portal?

Ans: LIC merchants can log in to their portal by following these steps:

- Visit the official website of Life Insurance Corporation of India.

- Click on 'Merchant Portal' under the 'Online Services’ section.

- Enter Login Credentials – Use your Merchant ID and password.

- Complete Security Verification – Enter the captcha code and click ‘Login.’

What is LIC MF?

Ans: LIC MF (Mutual Fund) offers various mutual fund plans and schemes. With LIC, you can invest in top-performing funds online to grow your wealth securely.

What is a 10 year policy in the LIC?

Ans: LIC single premium endowment plan is the 10 year policy. The premium payment mode is only a single premium and the minimum policy term is 10 years.

Does LIC have FD?

Ans: Yes, LIC have FD. The monthly option is a minimum deposit of Rs 2 Lakhs. The annual option is minimum of a Rs.10,000.

What is LIC Pay Direct, and how do I use it to pay my premium?

Ans: LIC Pay Direct is an online service provided by LIC that allows both registered and non-registered users to pay premiums directly—without logging into the customer portal. It’s a convenient way to make payments using your policy number and basic details.

Follow the below steps to pay premiums through LIC Pay Direct:

- Install the LIC PayDirect app on your smartphone or visit the official LIC PayDirect website.

- Click on "Proceed" under the Pay Direct option.

- Choose "Advance Premium Payment" or the type of payment you want (like Renewal, Loan Repayment, etc.).

- Fill in details such as:

- Policy number

- Installment premium amount (without tax)

- Date of birth

- Email ID and mobile number

- Click "Submit" and enter the premium details on the next screen.

- Pay using options like UPI, debit/credit card, or net banking.

- After a successful transaction, you'll get an e-receipt on your registered email.

What is LIC Housing Finance, and what types of loans does it offer?

Ans: LIC Housing Finance offers home loans for purchasing, constructing, or renovating a house, loans against property, plot loans, and balance transfers. It provides affordable interest rates, flexible repayment options, and quick processing for salaried and self-employed individuals.

What is the current LIC India share price?

Ans: The current Life Insurance Corporation of India share price is 894.30 INR.

What is the eligibility for the LIC AAO (Legal) Exam?

Ans: To be eligible for the LIC AAO (Legal) exam, candidates must have:

- A Bachelor's Degree in any discipline from a recognized Indian University or Institution,

- A professional qualification in Life Insurance (such as Fellowship of the Insurance Institute of India), and

- A minimum of 5 years of experience working in Life Insurance companies regulated by IRDAI.

How to download LIC AAO Admit Card 2025:

Ans: Follow these simple steps to download your LIC AAO Admit Card 2025:

- Step 1: Visit the official LIC website.

- Step 2: Go to the “Careers” section at the bottom of the homepage.

- Step 3: Click on the link for “Recruitment of AAO 2025.”

- Step 4: Find and click on the “Download Admit Card” option.

- Step 5: Log in using your registration/roll number and password/date of birth.

- Step 6: Your admit card will appear on the screen.

What is the LIC Golden Jubilee Scholarship Scheme 2026:

Ans: The LIC Golden Jubilee Scholarship Scheme 2026 helps bright students from financially weak families continue higher studies in India. For 2025–26, it supports students after Class 12 and includes a special category for girls after Class 10. The scholarship provides ₹20,000–₹40,000 per year, depending on the course chosen.

06 December 2025

LIC of India has launched two new insurance products named LIC Bima Kavach and LIC Protection Plus. These plans take effect on December 3, 2025. LIC Bima Kavach is a non-participating, non-linked pure risk life insurance plan designed to offer financial protection against unforeseen events, providing simple but essential coverage for individuals. Meanwhile, LIC Protection Plus is a non-participating, linked savings plan that combines life insurance with investment features, designed to support long-term financial planning for individuals and families.

With the launch of these 2 plans, LIC has solidified its presence in the life insurance segment by offering products that balance security and savings. Earlier, the insurer had also introduced LIC Jan Suraksha and LIC Bima Lakshmi to cater to diverse customer needs across the country.

06 December 2025

LIC of India has launched two new insurance products named LIC Bima Kavach and LIC Protection Plus. These plans take effect on December 3, 2025. LIC Bima Kavach is a non-participating, non-linked pure risk life insurance plan designed to offer financial protection against unforeseen events, providing simple but essential coverage for individuals. Meanwhile, LIC Protection Plus is a non-participating, linked savings plan that combines life insurance with investment features, designed to support long-term financial planning for individuals and families.

With the launch of these 2 plans, LIC has solidified its presence in the life insurance segment by offering products that balance security and savings. Earlier, the insurer had also introduced LIC Jan Suraksha and LIC Bima Lakshmi to cater to diverse customer needs across the country.

03 December 2025

Ramakrishnan Chander has officially taken charge as Managing Director of Life Insurance Corporation of India (LIC), effective December 1. A seasoned LIC veteran, Chander began his career in 1990 as an Assistant Administrative Officer and rose through multiple leadership roles, including Senior Divisional Manager, Regional Manager (Marketing and P&GS), and Head of International Operations. Most recently, he served as Executive Director (Investment – Front Office) and Chief Investment Officer, overseeing one of India’s largest investment portfolios.

His appointment comes as LIC reports strong financial performance. LIC posted a 31% year-on-year rise in consolidated net profit for Q2 at ₹10,098 crore and recorded steady growth in premium income.

29 October 2025

LIC’s Fixed Deposit (FD) Scheme by LIC Housing Finance Limited offers a safe option for those who want regular income and secure returns. The minimum investment is ₹1 lakh, with no upper limit. Interest rates range from 7.25% to 7.75% per year, and senior citizens get an extra 0.25%. Investors can choose a tenure between one and five years.

With this plan, an investment of ₹2 lakh can earn around ₹6,736 per month, credited directly to the investor’s bank account. The scheme also provides tax benefits under Section 80C for five-year deposits and allows premature withdrawals after three months, making it a reliable choice for people seeking steady, low-risk income.

15 October 2025

Life Insurance Corporation of India (LIC) has introduced a new microinsurance plan, LIC’s Jan Suraksha, to provide basic financial protection to individuals from economically weaker sections. The plan is a non-participating, non-linked individual life insurance savings product, meaning it is not tied to market performance and does not offer bonuses.

Jan Suraksha is structured with low premium requirements and simplified payment terms to improve accessibility. It focuses on essential coverage without complex features, making it suitable for those seeking straightforward life insurance options. The policy is designed to serve as a financial cushion in uncertain times, especially for underserved populations. Available in the domestic market from October 15, 2025, the plan supports LIC’s ongoing efforts to improve insurance reach among low-income segments through cost-effective and easy-to-understand offerings.

15 October 2025

Life Insurance Corporation of India has launched LIC Bima Lakshmi, a new individual life insurance plan combining savings and life cover. Classified as a non-participating, non-linked product, the plan offers fixed benefits not affected by market changes and does not include bonuses. Bima Lakshmi is designed to balance financial security and future savings through life coverage and a maturity payout. It targets individuals looking for predictable, long-term financial planning without the uncertainty of market-linked returns.

The product is part of LIC’s latest offerings aimed at diversifying its domestic portfolio with stable insurance options. Available from October 15, 2025, Bima Lakshmi focuses on delivering simple protection and savings benefits under a single policy, suited for individuals seeking reliability in their financial planning.

05 September 2025

The GST Council of India has announced a Goods and Services Tax (GST) exemption on individual life insurance policies. The exemption is applicable effective September 22, 2025. The GST on life insurance exemption applies to traditional individual life insurance policies, including term insurance, endowment plans, pension schemes, etc. With no GST on life insurance, premiums are expected to be more affordable. As a result, nationwide insurance penetration is expected among the common people.

Financial Impact on the Common Man

Previously, an 18% GST was levied on the premiums of most insurers, including LIC of India. With nil GST announced by Finance Minister Nirmala Sitharaman during the 56th GST Council meeting, new customers and existing policyholders will now be required to pay only the base premium for life insurance coverage and any add-on riders for enhanced protection, if applicable. With no GST on LIC premiums, the reduction in premium prices will encourage more individuals to invest in life insurance as part of their financial planning for themselves and their loved ones.

For e.g., If your base life insurance premium costs Rs 12000, a GST of 18% was charged earlier. The total amount you paid was Rs. 12,000 + Rs. 2160 (18% of 12,000) = Rs. 14,160. Now, with zero GST, the amount you need to pay is only Rs 12,000.

Industry Reactions and Outlook

Industry experts have welcomed the GST reduction from 18% to 0%, noting that many prospective policyholders often considered high life insurance premium GST rates a barrier while paying premiums. The exemption also aligns with the government's objective of improving financial security and promoting social welfare through increased insurance coverage.

The overall removal of GST on life insurance is expected to ease the financial burden on the common people, particularly those in middle- and lower-income groups of Tier-2 and Tier-3 regions. The reform of zero GST reduced from 18%, the common public can now prioritise enhancing their life insurance coverage with add-on riders.

03 September 2025

The Life Insurance Corporation of India (LIC) has paid a dividend of ₹7,324.34 crore to the Government of India for the financial year, the insurer announced on Friday, August 29, 2025. LIC CEO and MD R. Doraiswamy handed over the cheque to Union Finance and Corporate Affairs Minister Nirmala Sitharaman. The dividend represents the government’s share as approved by shareholders during the annual general meeting held on August 26.

Present at the event were Financial Services Secretary Nagaraju M, Joint Secretary Parshant Kumar Goyal, LIC Managing Directors Sat Pal Bhanoo, Dinesh Pant, Ratnakar Patnaik, and Northern Zone ZM (In-charge) J.P.S. Bajaj. LIC, currently in its 69th year of operations, reported an asset base of ₹56.23 lakh crore as of March 31, 2025, according to an official release.

02 September 2025

The Life Insurance Corporation of India (LIC), an essential foundation of the country’s financial system, completed 69 years of service on September 1, 2025. Founded in 1956 through the nationalization of over 240 private insurers, LIC has since evolved into India's largest life insurance provider, with over 30 crore active policyholders.

Over the decades, its offerings have expanded to include life cover, savings-linked plans, pension schemes, and health policies, reflecting shifting economic conditions and social needs. LIC’s policies have often served dual roles, offering both financial protection and tools for long-term planning.

Operating through a vast network of agents, branches, and digital platforms, LIC remains a key player in the formal financial inclusion of households across urban and rural India. As it begins its 70th year, LIC has outlined a focus on improving customer experience, adopting more digital tools, and continuing its efforts to make insurance accessible to a broader section of the population.

19 August 2025

The Life Insurance Corporation of India (LIC) has launched a special campaign to help customers revive their lapsed insurance policies. The campaign will run from August 18 to October 17, 2025. During this time, LIC offers up to 30% off on late fees, up to a maximum of ₹5,000, for eligible non-linked policies. For micro insurance policies, the late fee will be waived entirely.

Policies can be revived if they lapsed within the last five years and meet the required conditions. Only those policies that stopped during the premium-paying period (and not after the policy term ended) can be brought back.

However, there will be no discounts on medical or health-related requirements. LIC said this campaign is meant to support people who couldn't pay premiums due to difficult situations and help them regain their insurance coverage, emphasising its support for policyholders and their need for continued coverage.

29 July 2025

The Life Insurance Corporation of India (LIC) has revised its fixed deposit (FD) interest rates for August 2025, with a specific focus on senior citizens. The new rates include a 0.50% interest rate boost for retirees, enhancing returns on long-term savings.

As per the latest update, LIC now offers 7.30% on one-year deposits for senior citizens, compared to 6.80% for others. For two-year tenures, the rate is 7.50% (7.00% for regular investors), and three-year FDs offer 7.75% to seniors. The highest rate, 8.00%, is available for five-year deposits by senior citizens, also qualifying for tax deductions under Section 80C.

Investors can apply through LIC's official website or by visiting a local LIC branch with KYC documents. Early withdrawal may reduce returns, and TDS applies if interest exceeds ₹50,000 for senior citizens. These revised rates are effective from August 1, 2025, and apply to new and renewing fixed deposits across eligible tenures.

29 July 2025

The Life Insurance Corporation of India (LIC) has revised its fixed deposit (FD) interest rates for August 2025, with a specific focus on senior citizens. The new rates include a 0.50% interest rate boost for retirees, enhancing returns on long-term savings.

As per the latest update, LIC now offers 7.30% on one-year deposits for senior citizens, compared to 6.80% for others. For two-year tenures, the rate is 7.50% (7.00% for regular investors), and three-year FDs offer 7.75% to seniors. The highest rate, 8.00%, is available for five-year deposits by senior citizens, also qualifying for tax deductions under Section 80C.

Investors can apply through LIC's official website or by visiting a local LIC branch with KYC documents. Early withdrawal may reduce returns, and TDS applies if interest exceeds ₹50,000 for senior citizens. These revised rates are effective from August 1, 2025, and apply to new and renewing fixed deposits across eligible tenures.

15 July 2025

R Doraiswamy officially assumed charge as LIC’s CEO & MD on July 14, marking his elevation from Managing Director to the top executive role in the company. Under the amended LIC Act, which merged the top leadership positions to align LIC’s governance with listed-company norms, Doraiswamy becomes the first to serve a full three‑year term, ending by August 28, 2028, or upon turning 62, whichever comes earlier.

The Financial Services Institutions Bureau (FSIB) advanced his candidacy on June 11 after a thorough evaluation, and the Appointments Committee of the Cabinet approved his selection, awaiting the official notification. With nearly four decades of diverse experience at LIC, including senior roles in IT, marketing, and zonal leadership, he replaces interim MD Sat Pal Bhanoo, who had been steering the firm during the transition period.

07 July 2025

Life Insurance Corporation of India (LIC) has introduced two new insurance plans, Nav Jeevan Shree (Plan 912) and Nav Jeevan Shree Single Premium (Plan 911), aimed at helping younger policyholders achieve their financial goals while ensuring life protection.

Launched by CEO and MD Sat Pal Bhanoo on July 4, 2025, these non-linked, non-participating plans combine the dual benefits of guaranteed savings and life insurance.

Nav Jeevan Shree (Plan 912) is a regular premium plan designed for those who want to build wealth gradually while securing their family’s future. It offers flexible premium payment terms (6, 8, 10, or 12 years) with policy terms ranging from 10 to 20 years. Minimum sum assured is ₹5 lakh.

Nav Jeevan Shree Single Premium (Plan 911) suits those seeking a one-time investment with life cover. It offers guaranteed additions of ₹85 per ₹1,000 sum assured annually. The policy term is 5 to 20 years, and the minimum sum assured is ₹1 lakh. Both plans are available for individuals aged 30 days to 60 years.

These new plans reflect LIC’s commitment to meeting the evolving financial needs of a younger, more future-focused generation. Whether you prefer systematic savings or a one-time investment, LIC’s Nav Jeevan Shree plans offer a dependable path toward long-term financial security.

30 June 2025

LIC policyholders can now access complete policy details without stepping out of their homes. The Life Insurance Corporation of India provides a user-friendly digital platform that allows users to check their policy status, premium due dates, bonus information, maturity value, and loan eligibility in just a few clicks.

Registered users can simply log in to the LIC customer portal to see all their policy information. New users must sign up by entering key details like policy number, premium amount, and date of birth to activate their accounts. LIC also offers an SMS service for those who may not prefer the online method. By sending ASKLIC [Policy Number] to 9222492224 or 56767877, users will receive an SMS with essential policy information. This 24x7 digital service is part of LIC's ongoing efforts to enhance customer convenience and reduce dependency on physical visits.

26 June 2025

Life Insurance Corporation of India (LIC) has emerged as a leader in brand strength and advertising across media platforms. Ranked 4th among India's most valuable brands in the Brand Finance India 100 report for 2025, LIC's brand value rose to $13.6 billion, a significant 35% jump from last year. It also retained its position as India's top insurance brand and was ranked the world's third strongest insurer.

LIC's presence was felt strongly across advertising media. It led the BFSI sector in TV, print, and radio ads, commanding 12%, 25%, and 27% shares respectively. On the radio, its campaign "LIC Jeevan Utsav" made a remarkable leap from 306th to 2nd place.

Financially, LIC posted a 38% rise in profits, reaching ₹19,039 crore, and declared a ₹12 dividend per share. It also reported a 10% increase in new business premiums in May.

24 June 2025