*T&C Applied.

IFSC Code

List of IFSC Code, MICR Code and Addresses of all Banks in India

Find IFSC Code for Banks in India

IFSC Codes By Popular Banks

SBI New Delhi IFSC Code

Bank: SBI Bank

IFSC Code: SBIN0001706

MICR Code: 110002054

Branch: Janakpuri

District: New Delhi

State: Delhi

Address: B-9&10, Community Centre, Janakpuri, New Delhi

SBI Gurgaon IFSC Code

Bank: SBI Bank

IFSC Code: SBIN0001565

MICR Code: 110002190

Branch: Mehrauli Road Gurgaon

District: Gurgaon

State: Haryana

Address: Meharauli Road, Gurgaon, Haryana

SBI Maharashtra IFSC Code

Bank: SBI Bank

IFSC Code: SBIN0007483

MICR Code: 400002089

Branch: Antop Hill

District: Greater Bombay

State: Maharashtra

Address: C-19 By 13-14, SBI Officers Quarters, Kalpak Estate, Antop Hill

SBI West Bengal IFSC Code

Bank: SBI Bank

IFSC Code: SBIN0000004

MICR Code: 700002002

Branch: Alipore

District: Kolkata

State: West Bengal

Address: 24 By 1 By 1 Alipore Road, Kolkata, West Bengall

SBI IFSC Code: State Bank of India MICR Code & Branch Addresses

SBI IFSC Code is a distinctive code assigned to all SBI bank branches nationwide. It allows SBI Bank account holders to both send & receive money online. SBI Bank IFSC Code is allotted by Reserve Bank of India to each SBI branch as it helps carry out RTGS and NEFT transactions easily.

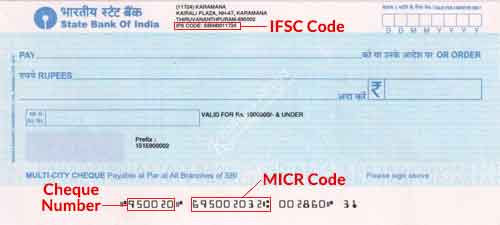

SBI IFSC Code is a unique 11 characters long alpha-numeric code, which is used for online fund transfers. This code is used to initiate a NEFT, RTGS, or IMPS transfer.. The first 4 letters stand for the bank’s name. For State Bank of India (SBI) IFSC Code, 'SBIN' will be the first four letters. It is an 11 digit code with numeral 0 in the middle, which is set aside for future use. The last 6 letters uniquely identify the specific branch code.

For example, the SBI IFSC code of Rajouri Garden, New Delhi SBI branch is SBIN0032277, while that for Janakpuri, New Delhi branch is SBIN0070837. Here, 032277 & 070837 are the branch code of SBI Rajouri Garden bank and SBI Janakpuri bank, respectively. And, in order to initiate a wire transfer from SBI Janakpuri branch to SBI Rajouri Garden branch, one must have the State Bank of India IFSC code of SBI Rajouri Garden along with the receiver's name and account number. It is required to have the IFSC code for fund transfers from one bank to another bank.

The Required Information for Transferring Funds Using Any Mode of Payment

While initiating a NEFT/RTGS transaction, State Bank of India accountholders have to provide the information mentioned below.

- Amount of remittance

- SBI Bank's account number

- Bank name of the beneficiary

- Name of the beneficiary

- Account number of the beneficiary

- Sender to receiver information

- Beneficiary bank branch's IFSC code

How to Search SBI IFSC Code and MICR Code?

If you are looking for State Bank of India IFSC & MICR code of your branch, then you can easily & quickly find it out. Like, if you have an account with State Bank India, then you can see SBI IFSC Code of your home branch in your cheque book as well as on the front page of your bank pass book. You can use SBI IFSC code for wire transfer via any mode RTGS, NEFT & IMPS at your convenience. Similarly, you can get State Bank of India (SBI) MICR code printed on the front page of your bank pass book. If you don't have a cheque book or bank pass book with you, then use drop-down menu shown at the top of the page & get SBI IFSC Code for any State Bank of India (SBI) branch.

After Rationalization, Revised SBI IFSC Code for its Branches

One of India’s largest public sector banks, SBI is undergoing a step-by-step process of rationalization, since SBI has merged with a few other banks in 2017.

As a part of this process, approximately 125 branches have been shifted and bank staff has also been engaged. In a few cases, the merged banks have been absorbed by other SBI branches.

While the bank has made changes to the IFSC codes of its concerned branches, it has rationalized approximately 1000 branches during around April 2017 - September 2017 post merger with Bharatiya Mahila Bank and 5 associate banks including State Bank of Mysore, State Bank of Travancore, State Bank of Bikaner and Jaipur, Bank of Patiala.

State Bank of India has internally updated its IFSCs, after replacing the old ones, for a smooth banking process. The accountholders must apply for fresh checkbooks, since the old ones have become invalid.

|

Associated Bank |

Old IFSC Code |

New Code (IFSC) |

|

State Bank of Mysore |

SBMY0040001 (Main Branch of Mumbai – Nariman Point) |

SBIN00440001 |

|

State Bank of Hyderabad |

SBHY0020001 (Nariman Point Branch) |

SBIN0020001 |

|

SBBJ |

SBBJ0010001 (Guwahati) |

SBIN0031001 |

|

State Bank of Patiala |

STBP0000001 (Ghaziabad/) |

SBIN0050001 |

|

State Bank of Travancore |

SBTR0000001 (Main Branch Mumbai) |

SBIN0070001 |

How can I transfer money using SBI Bank NEFT, RTGS, IMPS processes?

SBI offers various processes to ensure safe financial transactions to other SBI Bank branches as well as other bank branches across India. Clients can make use of NEFT, RTGS, and IMPS for transferring money.

National Electronic Funds Transfer (NEFT)

SBI has introduced the e-Monies National Electronic Funds Transfer. It is an electronic facility for transferring funds that allows hassle-free, convenient and easy money transfer. NEFT transactions for the SBI branches don't have any maximum limit. When it comes to net banking transactions, the account holder has to set a daily limit at Rs. 1 to Rs 10 lakh. For processing online NEFT transactions, SBI follows a fixed time schedule.

Real Time Gross Settlement (RTGS)

Real Time Gross Settlement or RTGS is a super quick method of transferring money and the transfers are done in real time. These transactions have faster settlement cycles due to the absence of clearing house/ inter-bank settlement issues.

RTGS transactions aren't restricted to the Indian geography. There aren't any transaction limits for transactions done through the home branch.

Immediate Payment Service (IMPS)

Immediate Payment Service is a smooth bank-to-bank electronic funds transfer service which is offered by SBI. With IMPS, the accountholders can send or receive funds on weekdays as well as Sundays and bank holidays with an ease. In IMPS transfers, the money funds get credited in the account of the beneficiary in a matter of seconds.

The minimum and maximum sum for RTGS and NEFT transactions as per the retail internet banking is mentioned below.

|

RTGS |

NEFT |

|

|

Minimum |

Rs. 2 lakh |

No limit as such |

|

Maximum |

Rs. 5 lakh |

Rs. 5 lakh |

The minimum and maximum amount for NEFT/ RTGS transactions as per corporate internet banking is mentioned below.

|

Type |

Minimum |

Maximum |

|

NEFT |

No limit as such |

For Vyapaar- Rs. 50 lakh For Vistaar- Rs. 500 crores |

|

RTGS |

Rs. 2 lakh |

For Vyapaar- Rs. 50 lakh For Vistaar- Rs. 500 crores |

RTGS/ NEFT/ ECS Fees and Charges

|

S. No. |

Particulars |

Transaction Amount |

Charges |

|

1. |

NEFT |

||

|

Up to Rs. 10,000 |

Rs. 2.50 |

||

|

Up to Rs.1 lakh |

Rs.5 |

||

|

Between Rs.1 lakh and Rs.2 lakh |

Rs.15 |

||

|

More than Rs.2 lakh |

Rs.25 |

RTGS Customer Transactions Details R-41 (Functional during weekdays only)

|

Time of settlement at the RBI |

Transaction Amount |

Charges |

|

|

From |

To |

||

|

9 a.m. |

12 p.m. |

Rs. 2 lakh - Rs. 5 lakh |

Rs. 25 |

|

Rs. 5 lakh and above |

Rs. 51 |

||

|

12 p.m. |

2.30 p.m. |

Rs. 2 lakh - Rs. 5 lakh |

Rs. 26 |

|

Rs. 5 lakh and above |

Rs. 52 |

||

|

2.30 p.m. |

4.30 p.m. |

Rs. 2 lakh - Rs. 5 lakh |

Rs. 31 |

|

Rs. 5 lakh and above |

Rs. 56 |

||

RTGS Inter-Bank Transactions Details R-41 (Functional during weekdays only)

|

Time of settlement at the RBI |

Transaction Amount |

Charges |

|

|

From |

To |

||

|

9 a.m. |

12 p.m. |

Rs. 2 lakh - Rs. 5 lakh |

Rs. 25 |

|

Rs. 5 lakh and above |

Rs. 51 |

||

|

12 p.m. |

2.30 p.m. |

Rs. 2 lakh - Rs. 5 lakh |

Rs. 26 |

|

Rs. 5 lakh and above |

Rs. 52 |

||

|

2.30 p.m. |

4.30 p.m. |

Rs. 2 lakh - Rs. 5 lakh |

Rs. 31 |

|

Rs. 5 lakh and above |

Rs. 56 |

||

About State Bank of India:

State Bank of India is one of the pioneering public sector banks in India with an extensive network of more than 24000 branches across the country. As per 2017 record, SBI had assets worth over USD 500 billion. The bank has its international presence in 36 abroad countries to serve the financial needs of its international customers. Among the various products, the bank is well known for its personal banking services including the types of accounts designed to cater to the various needs of the customers.

Types of SBI Accounts

State Bank of India offers multiple accounts to meet the various needs of the customers such as to save, to transact, to earn interest and grow money etc. With its 9,000 branches spread in various parts of the country, SBI enables its customers to choose a convenient way of banking with various account options where people can park their money. The types of accounts available with SBI include:

| Accounts | Rate of Interest |

| SBI Savings Account |

|

| SBI Current Account |

|

| SBI NRE Account |

|

| SBI Corporate Account | - |

| SBI Fixed Deposit Account |

|

| Recurring Deposit |

|

Eligibility Criteria to Apply

To be eligible to open an account with SBI, the following requirements have to be met:

- You must be a citizen of India

- The minimum eligibility age is 18 years

- The minor accounts can be opened under the guardianship of any of the parents

- Valid government approved identity proof is required

Upon submission of the aforementioned documents or further to fulfilling all the requirements, you can make an initial deposit depending on the type of account you have chosen.

Documents to be Submitted

The following documents need to be submitted while applying for an account with SBI:

- Proof of identity - Aadhaar Card, Passport, Driving license, Voter’s ID card,

- Proof of address - Aadhaar Card, Passport, Driving license, Voter’s ID card,

- Form 16 (only if PAN card is not available)

- Recent passport size photographs

- PAN card

How to Open Savings Account with State Bank of India

Opening SBI account is simple and hassle-free. SBI account can be opened either online or offline.

Offline Account Opening Process

- Visit the nearby SBI branch

- Collect the account opening form by approaching the bank executive

- Fill the form with relevant information such as the name of the applicant, address of the applicant, signature or thumb impression and various related credentials of the applicant. The second part of the form needs to be filled if you don’t have a PAN number.

- Make sure the information provided by you is all true to its nature and in the correct format.

- If you want to activate internet banking, you can fill the separate form as well to gain access for the same.

- Once the application process is completed, an initial deposit of money depending on the type of account is required to open the account

- Once the bank completes the verification of the application form, you will receive the welcome kit. It is a properly sealed packet, which consists of

- Debit/Credit card

- An envelope containing PIN for the card

- Passbook

- Pay-in slips

- A chequebook

- Internet Banking details

- Guidebook on how to operate the account

Online SBI Account Opening Process

Log on to the State Bank of India’s official webpage

- Select the type of account of your preference

- Fill the application form online by providing details such as name, address, date of birth or other related information

- Submit the form along with the documents of proof of identity such as PAN Card, Adhaar Card, Voter ID, Driving License etc.

- The bank will verify the submitted details and further convey its decision whether it is approved or rejected. On approval, the respected account will be ready to be operated.

SBI Nomination Process

As per the rule set by the Government, all savings account holders are authorised to nominate a beneficiary. The nominee should be someone from blood relation who can operate the account if any untoward happens. The beneficiary nominating process takes place at the time of account opening by filling a nominee form. In case the nominee is a minor, he/she can operate the account only after attaining the age 18 years. It is recommended because, in case of the untimely death of the account holder, the nominee can operate the account.

FAQs

Question 1: Can one SBI account have two IFSC codes?

Answer: No. Every SBI branch has a unique IFSC code and you cannot have the same a/c number in two bank branches so one account cannot possess more than one IFSC code.

Question 2: Which SBI IFSC code should one use?

Answer: If you are going to transfer money to the SBI account of a beneficiary, then you should use the IFSC code of the branch wherein he/she holds an account.

Question 3: Where to use the IFSC code of SBI?

Answer: The IFSC code is used for transferring money electronically such as through RTGS or NEFT. It is mandatory for the electronic system of payment from one branch of bank to another. In this way, every bank branch has a unique IFSC code.

Question 4: Do the IFSC code change after the merger of Associate Banks of SBI with SBI?

Answer: Yes, the associate banks of SBI have different IFSC codes after their merger with SBI.

Question 5: Is the SBBJ’s IFSC code the same after its merger with SBI?

Answer: No, SBBJ’s old IFSC code has become invalid after its merger with SBI. Now all the branches of SBBJ have new codes (IFSC codes). For example, the Guwahati branch of SBBJ has a new IFSC code, which is SBIN0031001.

Question 6: After SBI and SBM merger, can we use the old IFSC code for electronic transactions, or do we need new ones?

Answer: After the merger, only the new codes (IFSC codes) are valid for all the online transactions.

Latest SBI News

GharSeBanking: SBI Successfully Leverages Facebook Messenger to Drive App Downloads

The State Bank of India (SBI) has successfully managed to drive people to download and adopt applications like YONO app, SBI Quick, YONO Lite, BHIM SBI Pay, etc. under its ‘GharSeBanking’ campaign after joining hands with Facebook Messenger.

Over half a million people have interacted on Facebook Messenger to access SBI’s virtual banking services via the conversational artificial intelligence (AI), the social media giant said. The conversational marketing on Facebook Messenger has led to a rise in SBI’s digital banking app downloads as the AI gave people the option to download these apps.

Ever since the launch of SBI’s ‘GharSeBanking’ campaign, India’s largest bank has been using digital mediums and social media to encourage people to download its digital banking apps like YONO. The YONO (or You Only Need One) app enables its users to access financial services, online banking and use other services, such as online shopping, travel bookings, buying groceries, medicines, etc.

The ‘GharSeBanking’ campaign was started during the lockdown to allow customers to stay in touch with the SBI Bank for their daily banking needs while maintaining social distancing.

SBI Shareholding in Yes Bank Drops to 30% Post FPO

The State Bank of India (SBI) shareholding in Yes Bank has reduced to 30% after a recent follow-on public offering (FPO). Previously, the SBI held a stake of 48.21 per cent in Yes Bank, India’s largest lender said.

The FPO of Yes Bank was open from 15-17 July 2020, in which the SBI invested Rs 1,760 crore. With the latest FPO, Yes Bank has doubled its share capital from Rs 1255 crore to Rs 2505.4 crore at a face value of Rs 2 per share each.

The shareholding of SBI reduced in the private sector lending as 12 anchor investors collectively invested Rs 4,098 crore in the FPO. These investors included HDFC Life, Jupiter India Fund, Bay Tree India Holdings and Amansa Holdings among others.

The FPO was being organised to strengthen Yes Bank as part of the RBI’s ‘Yes Bank Reconstruction Scheme 2020’. So far, Yes Bank has managed to raise Rs 14,267 crore through the FPO, which is over 90 per cent of total required subscription of Rs 15,000 crore.

According to this Reserve Bank of India’s supervised scheme, the SBI shareholdings cannot fall below 26 per cent before completing three years from the date of investing the capital.

Earlier in March 2020, the State Bank of India invested Rs 6,050 crore in Yes Bank to acquire 48.21 per cent shareholdings.

State Bank of India (SBI) to Host an e-auction of 11 Accounts on November 7

India’s largest public sector bank State Bank of India will be hosting an e-auction of 11 loan accounts in order to recover dues around Rs. 466.49 cr. In line with the guidelines of regulatory authority, the bank is supposed to place 11 accounts for sale to ARCs/banks/NBFCs and FIs.

The NPA or non-performing asset accounts to be auctioned include Bhatia Global Trading with outstanding amount Rs. 177.02 crore, Bhatia Coal Washeries with Rs 12.58 crore), Bhatia Coke & Energy Ltd. with Rs. 104.15 crore) and Asian Natural Resources Ltd. with Rs 2.18 crore outstanding dues. Maharastra Steels Pvt Ltd, Vidhata Metals and Anshul Steel Ltd. follow the list with outstanding amount Rs 40.51 crore, Rs 36.98 crore and Rs 37.70 crore respectively. The auctions will be held on November 7, 2019.

SBI’s Head Rajnish Kumar as New Chairman of Indian Banks Association

SBI is delighted to announce Rajnish Kumar as the Chairman of the banking industry lobby Indian Bank Association for the financial year 2019-20. The association which serves the bank’s interest with the government and regulators has three top bankers as its deputy chairmen from different banks such as S S Mallikarjuna Rao of Punjab National Bank, G Rajkiran Rai from Union bank of India and Madhav Kalyan from JP Morgan Chase Bank. On the other hand, IDBI Bank’s Chief and managing director Rakesh Sharma will represent as the secretary of the body.

In a career spanning over 36 years with State Bank of India, Mr. Kumar had held multiple receptive positions including Managing Director (Compliance & Risk), Head of SBI Capital Markets, Chief General Manager of North Eastern Circle of SBI, held key positions at Mid-Corporate Group and Project Finance.

SBI Plans to Eliminate Debit Cards From Banking System

State Bank of India (SBI) is planning to eliminate the use of debit cards from the Indian banking system. The bank wishes to replace these plastic cards with digital payment solutions like SBI’s Yono platform.

Speaking at FIBAC 2019 conference on Monday, Chairman of State Bank of India Rajnish Kumar said that the bank wishes to eliminate debit cards and is confident that they can make it possible. FIBAC is the annual banking conference organized jointly by the Indian Banks’ Association (IBA) and the Federation of Indian Chambers of Commerce & Industry (FICCI).

He said that digital payment solutions like SBI’s Yono can help make India a debit card-free country even though there are about 90 crore debit cards and 3 crore credit cards being used at present.

The Yono platform allows its user to withdraw cash from an ATM and make payments at a retailer without using a card. It also allows its users to take credit for purchasing certain items, plummeting the need of a credit card.

Kumar added that the SBI has already established around 68,000 Yono Cashpoints in India and aims to increase it to more than one million in the next 18 months.

The SBI Chairman predicted a decline in the use of plastic cards in the next five years. He declared the QR Code as the most affordable way of making payments at present and envisaged virtual coupons as the future.

SBI is the largest public sector bank in India offering services to more than one-fifth population of the country.

SBI Slashes Down Charges For Maintaining Minimum Balance

Like every other bank, SBI too imposes penalty charges on its customers for not maintaining the fixed amount of minimum balance in their bank accounts. However, you would be glad to hear its latest news stating that the bank has finally reduced its penalty charges, effective since April 1st’ 2018.

The AMB (Average Monthly Balance) prescribed by SBI is Rs 3,000 in metro cities; whereas in urban areas, Rs 2000 and Rs 1000 in rural areas. The bank has slashed charges by a whopping 75 percent and the latest charge will affect over 25 crore customers across the country.

The Jan Dhan Yojana accounts together with salary accounts (also known as no-frills accounts) are already out of the penalty charges’ league and hence, customers having these accounts don’t have to pay any penalty charges.

SBI Reduces Average Monthly Non-Maintenance Charges for Savings Account

India’s largest public sector bank- SBI has decided to reduce the charges on non-maintenance of monthly balance in savings accounts by up to 70% w.e.f from April 1. It is expected that the decision will benefit 25 crore SBI account holders across India. For Metro and Urban cities, the monthly updated charges are 15 rupees + GST, for Semi-Urban centers, it’s 12 rupees + GST, and for Rural centers, it’s 10 rupees + GST.

Upon the revelation that SBI had more generated revenue from levying penalties on non-maintenance of minimum balance than actual profits, the decision to update non-maintenance charges was made. While informing about the recent developments, SBI clarified that its accountholders can now easily convert their savings bank account into a basic savings bank account without paying any extra charges.

The Merger of Associate Banks is Responsible for the Higher Accounts Closure- SBI

SBI has clarified that the reason behind a high number of closed accounts is the merger of its associate banks. SBI further added that minimum balance maintenance had nothing to do with the closure of these accounts. SBI got a lot of flake after reports stated that it had generated a higher revenue due to non-maintenance of minimum balance as compared to the profits earned.

After that, the SBI reduced the minimum balance non-maintenance charges by approximately 75 percent, w.e.f. April 1, 2018.

It has been informed that during the current financial year, 21 million SBI savings bank accounts, inclusive of 11 Pradhan Mantri Jan Dhan Yojana accounts, had been opened.

SBI Bank Accounts Shifted to Other Branches without a Prior Notice, Leading to Unhappy Customers

If you haven’t checked the status of your SBI account recently, it is high-time you cross check your bank’s address. You might be surprised to find that your bank account is shifted to some other branch.

In a recent move, SBI has shifted many of its customers’ accounts to different branches without sending any prior notice to them. The affected customers have received a text message from the bank about the change in their bank accounts’ address and the respective IFSC code. As expected, most of the affected customers are unhappy about the changes, as they preferred to perform transactions at their chosen bank branches.

Moreover, there is also a lack of consent from the customers’ part, which is creating further dissatisfaction among them. Though the senior management hasn’t responded to any query, the information gathered from different branches has revealed that this step was taken in respect to the recent merger and to reduce the operational expenses of the bank.

Now, it will take time to see and tell if the affected customer base of SBI copes-up with the latest changes or not.

SBI Offers ‘No Min Balance’ Accounts

You no longer need to fret about keeping a minimum balance in your SBI savings account. India’s one of the largest bank, State Bank of India, had introduced its Basic Savings Bank Account with no minimum balance requirement last year. It frees the account holder from the trouble of maintaining a minimum balance in the account.

Even those who are holding normal savings account in SBI can get their account converted into a Basic Savings Bank Deposit Account, free of cost.

The applicable interest rate is also the same as other savings account with SBI. Currently, SBI offers 3.5% yearly interest rate on savings accounts deposits of up to a sum of INR 1 crore.

Mentioned below are a few important things that you must know before opening a minimum balance savings account with SBI

1. You can open Basic Savings Account with any SBI Branch across India.

2. The account doesn’t require a minimum balance and also doesn’t have any upper limit restrictions.

3. It will be a KYC compliant account, as mentioned on their site.

4. You can open a joint or single Basic Savings Account by SBI.

5. After opening the account, you will get a RuPay ATM debit card issued without any costs involved. No annual maintenance charges are applied to this card.

6. As per SBI guidelines, if you are using SBI Basic Savings Account then you can withdraw money only 4 times a month. This limitation applies to ATM withdrawals, NEFT, RTGS, online transfer, cash withdrawals from the bank branch, among others.

7. The bank doesn’t levy any charges on closure and opening of inoperative Basic Savings Bank Account.

Note - As per SBI guidelines, anyone who has a Basic Savings Bank Deposit Account with SBI cannot hold any other Savings Account. If you have any other Savings Account, it must be closed within a month of opening a Basic Savings Deposit Account.

SBI Deadline to link Aadhaar Extended up to March 31, 2018

To link their Aadhaar card with their savings account, SBI account holders can use net banking, SBI app, and ATMs. Furthermore, they can visit their respective bank branch and link their accounts. The deadline to link Aadhaar has been extended to March 31, 2018.

If you want to link your account using the SBI Anywhere app, you can log in and click on the ‘Requests’ tab to initiate the linking process.

SBI Relentlessly Backs the Digital India Campaign

State Bank of India (SBI), the largest public sector bank, has been proactively supporting the Digital India campaign, launched by Narendra Modi, Honorable Prime Minister of India, by encouraging people to adopt what the adopt what the campaign emphasizes on.

Both SBI customers and merchants have various UPI-enabled, digital payment mobile apps, such as BHIM SBI Pay, BHIM Aadhaar, and Bharat QR. These apps are quite popular these days, as they do not require a customer’s details like Account No. and IFSC code to receive money. Instead, the sender has to only add the receiver’s virtual payment address or VPA.

SBI Rath is another initiative by the State Bank of India to pave the way for its customers to make it to the digital path.

SBI to Offer Affordable Credit Facilities to Farmers

The State Bank of India may soon issue credit cards to farmers in order to provide them the much-needed access to credit facilities at affordable prices.

As a part of the pilot project, this initiative will be introduced in Gujarat, Madhya Pradesh & Rajasthan. Reportedly, the SBI has received credit card applications from different states and might launch this initiative in other states on the basis of the response of the pilot project.

These cards will enable farmers to buy farming products online.

SBI to Allow Non-Resident Indians to Transfer Money to Indian accounts

The State Bank of India has joined hands with an America-based company to launch a tech platform that would enable NRIs to remit to Indian bank accounts with ease. This facility will make the money transferring process easy and convenient as funds can be transferred to any bank account in India with the help of SBI’s network.

Latest SBI IFSC Codes: Has Your Branch's IFSC Code Changed? Here is how to Find Out

Recently, it was noted that SBI changed its IFSC codes and the names of its branches in various cities with New Delhi, Mumbai, Bengaluru, Hyderabad, Chennai, Lucknow and Kolkata and among the others.

State Bank of India (SBI) made these changes to around 1,300 of its branches across the country. This is the direct result of the merger of State Bank of India with 6 of its associate banks, namely- State Bank of Bikaner and Jaipur (SBBJ), State Bank of Travancore (SBT), State Bank of Patiala (SBP), State Bank of Mysore (SBM), and State Bank of Hyderabad (SBH) and Bharatiya Mahila Bank -which happened in April 2017. SBI, the apex bank of India, has nearly 23,000 branches across the country.

How to Find Out Changed SBI Branch IFSC Code

The changes in the branch name and IFSC code can be easily found on their website (sbi.co.in) with the branch locator tool. This is a simple process; you can access information based on your state, district, branch code, PIN code etc.

State Bank of India (SBI) to Install More ATMs in AP

In an initiative to increase ATM penetration in various districts of Andhra Pradesh, almost 151 ATMs have been installed by the State Bank of India.

The official unveiling of these ATMs in Andhra Pradesh was done by Mani Palvesan, Chief General Manager, State Bank of India (SBI). In order to provide better customer services, SBI will install more ATMs in the state by the end of the month.

Following SBI, Customers are going to Enjoy Decreased Lending Rates by Other Top Banks

Amid the increasing competition in the market, most of the top-notch banks in India are likely to cut down their lending rates in order to correspond to those of State Bank of India (SBI). Private Banks like ICICI Bank, HDFC Bank, etc. are likely to follow the footprints of SBI, which is the apex bank of India.

A decision in this regard is likely to come soon from the bank authorities. As the lending rate will be linked with the base rate, the new decreased rates are surely going to be good news for the existing customers. However, the criteria may differ for the new borrowers.

Former State Bank of India Associate Banks Accounts Holders Need To Apply For New Cheque Books

All the account holders of SBI’s former 6 associate banks and Bharatiya Mahila Bank have to apply for fresh checkbooks, since all the previously issued checkbooks have become invalid since 31 December 2017. The notice had been issued after the government decided to merge State Bank of India with its associated banks and the Bharatiya Mahila (BM) Bank. After this merger, SBI is one of the top 50 banks across the globe in terms of assets.

Recently, State Bank of India changed the IFSC codes of approximately 1300 of its branches. The request for fresh chequebooks can be made using mobile banking, net banking, or by visiting the home branch. The IFSC code is a combination of alphabets and numbers is required to receive/ send money from one bank to another.

Aadhaar Linking: How to Link Aadhaar with SBI Savings Account

SBI, India’s largest lender, offers various options to its account holders to link their Aadhaar with their SBI accounts. Aadhaar number is a 12-digit Unique Identity Number and it is mandatory to be linked with bank accounts. As the deadline is approaching, lenders including State Bank of India have offered various options to link Aadhaar card with SBI accounts.

Here is how SBI customers can link their Aadhaar number with their bank accounts through SMS.

Link your Aadhaar with SBI Account through SMS service

You can seed your Aadhaar number with your SBI account by sending a text message with your registered mobile number to 567676 in this particular format. < Account number>.

In case your mobile number isn’t registered or if your Aadhaar is linked already with your account, a reply will be sent to your mobile number.

In case your mobile number is already registered, you will get a confirmation via SMS regarding the successful LINKING of your Aadhaar number.

SBI Customers can Earn Reward Points for Every Transaction

The State Bank of India is offering reward points for specific transactions through their State Bank Rewardz app, revelaed various online media sources.

SBI customers will be qualified for particular reward points for a variety of transactions including opening a savings, current or demat account, making loan payments, using SBI debit card at POS (point of sale), etc. The rewards points earned can be availed to book flight tickets, movie tickets, shopping vouchers or to pay utility bills.

SBI account holders can register for the services simply by downloading the State Bank Rewardz app and entering their account details such as CIF or debit card number, completing OTP verification and creating their usernames and passwords.

State Bank Of India Increase Interest Rates On Bulk Deposits

India’s largest money lender SBI has increased its interest rates by 1 percentage point for bulk deposits greater than 1 Crore Rupees across all the maturities. The interest rates for deposits lesser than 1 Crore Rupees remain unchanged. These rates were reduced by 25 basis points on 1 November.

One basis point equals to one-hundredth of a percentage point.

After the latest revision in the interest rate, the deposits higher than 1 crore Rupees for a minimum tenure of 365 days stands at 5.25 percent. Senior citizens will get an additional 50 basis points for all the all maturities. SBI decided to increase interest rates in order to be even with the interest levels of its competitors.

Deposit growth in the bank has decreased to 8.14 from 15 percent as compared to the previous year.

SBI Launches YONO App

The State Bank of India has launched a digitally integrated banking and lifestyle platform- YONO.

YONO stands for You Need Only One. It can be easily assessed on mobile phones as well as on web browsers. YONO is the first ever integrated digital portal that caters to everything regarded as financial services. It was launched by Arun Jaitley, Finance Minister and it will let the customers meet their lifestyle related needs across 14 services from paying for medical bills to booking cabs with the help of a tab.

YONO offers a variety of services such as bank account opening in a jiffy, funds transfer, availing pre-approved paperless personal loans, availing overdraft facility against fixed deposits and many more.

State Bank of India in partnership with e-commerce giants such as Amazon, Myntra, Jabong, Shoppers Stop, Uber, Ola, Cox & Kings, Yatra, Airbnb, Thomas Cook, Byju’s and Swiggy to provide discounts and offers to its customers.

As per Rajnish Kumar, Chairman, the platform has been specially designed to offer maximum convenience to its customer. The portal has been developed using predictive analysis, machine learning and artificial intelligence. The portal has been designed to make the purchase of investment products with minimum clicks possible and access the services seamlessly.

YONO app is available for Android as well as iOS platform.

Link Aadhaar Card with your SBI Account before December 31

All SBI account holders will now have to compulsorily link their Aadhaar card number with their bank accounts and furnish their Permanent Account Number details latest by December 31, 2017, report various online sources.

According to a government notification, all account holders have been requested to seed their Aadhaar card number with their bank accounts by 31st December 2017. In order to effectively notify its account holders, State Bank of India shared an announcement via its Twitter handle, stating that its account holders must submit their Aadhaar details before December 31, 2017; failing to do so may lead to accounts getting freezed.

SBI account holders have various options available at their disposal to link their bank accounts with Aadhaar. Some such options include SMS, ATMs, or net banking. Alternatively, SBI account holders can do so by visiting one of their nearest SBI branches.

SBI is Likely to Expand its Overseas Operations

The State Bank of India is all set to expand its overseas operations. The bank is looking to add more countries to its network, revealed sources in the online media.

If news in the online media is anything to go by, SBI will soon be opening more number of branches in several countries including Vietnam, Nepal, etc. This move is part of a three-year goal to strengthen its international operations for minimum 15 percent of its operations.

SBI is amongst the 50 leading banks across the globe that have global branches. SBI has already registered its presence in 35 plus countries and it has 206 offices in Asia alone.

Sources further reveal that SBI aims to open 100 offices in Nepal alone.

It would be interesting to see how many countries does SBI add to its existing network. But one thing is for sure the banking giant from India is soon going to ensure a widespread presence to ensure easy operations for its customers and patrons worldwide.

No Need to Maintain Minimum Balance- State Bank of India

The State Bank of India doesn’t necessitate its account holders to maintain a minimum balance in selected kinds of accounts. State Bank of India offers a special kind of savings account- Basic Savings Bank Account. It is excluded from the requirement of maintaining minimum account balance.

Apart from the basic savings bank account, other categories excluded from maintaining the monthly average balance include No frill Accounts, financial inclusion accounts, small accounts and salary package accounts.

Being a savings bank account, the eligibility criteria for regular savings bank account is applied to Basic Savings Account. Any individual can open the account if (s)he has legitimate KYC documents. Primarily, it is meant for poorer sections of our society, and has been formulated to encourage them to cultivate the habit of saving without any load of fees or charges.

IFSC CODE BY BANK

- SBI

- Bank of Baroda

- Axis Bank

- ICICI Bank

- Indian Bank

- Canara Bank

- Bank of India

- HDFC Bank

- Andhra Bank

- Central Bank of India

- Allahabad Bank

- Punjab National Bank

- Syndicate Bank

- Bank of Maharashtra

- Citi Bank

- UCO Bank

- Dena Bank

- Corporation Bank

- IDBI Bank

- United Bank of India

- Indian Overseas Bank

- Kotak Mahindra Bank

- SBT Bank

- SBM Bank

- Vijaya Bank

- Federal Bank

- Yes Bank

- Indusind Bank

- State Bank of Patiala

- State Bank of Hyderabad

Search by IFSC Code

Find Bank Branch Details, Address & MICR Code by IFSC Code