- City & RTO

- Car Brand

- Car Model

- Car Fuel Type

- Car Variant

- Registration Year

-

Renew policy in 2 minutes*

-

21+ Insurers to choose

-

1.2Cr+ Vehicles Insured

We have found best plans for you!! Our advisor will get in touch with you soon.

- Home

- Motor Insurance

- Articles - MI

- Overview of Oriental Car Insurance Policy | PolicyBazaar

Overview of Oriental Car Insurance Policy

As you already know, having a car insurance plan comes with added benefits. Since the Motor Vehicles Act, 1988 has made it mandatory for all registered vehicles to have insurance, many car insurance companies have joined the race with attractive plans. Among them, Oriental Insurance Company has marked its existence by offering rewarding insurance services. They offer oriental car insurance online as well.

Let’s have a look at Oriental Car Insurance:

Oriental Insurance Car Insurance: In and Out

Car insurance offered by The Oriental Insurance Company is of two types:

Third Party Car Insurance: The policy provides coverage against any liability claims made by a third-party in the event of an accident. This plan includes liabilities arising out of an injury, death or property damage to a third-party, hence doesn’t cover the insured vehicle.

Comprehensive Motor Insurance: Apart from Third-Party Liability cover, this plan protects your vehicle in the following situations:

- Accidental damages.

- Fire, explosion, self-ignition, lightning.

- Natural calamities such as flood, earthquake, storm, landslide, rockslide, riots, strike, terrorist activity etc.

- In case of thievery

- Damages during transit.

- In-transit damages suffered by the vehicle

Features:

- Cashless Claim Settlement: The insured can avail cashless claim facility at the network garages across the country.

- It offers a discount of up to 5% on the premium of Own Damage against Automobile Association Membership.

- Accidental Cover /Customer Support: An additional discount of 25% on the TP Premium and OD Premium can be availed in case the car was manufactured prior to 31.12.1940 and is duly authorised by Vintage and Classic Cars Club of India.

What Are Covered Under Oriental Car Insurance

- Damage to your vehicle due to an accident

- The policy bears third-party liabilities arising out of injury, death or damage to a third-party and where the insured vehicle is at fault.

- Natural disasters like fire, lightning, explosion, flood, earthquake, landslide, rockslide, typhoon, hurricane, cyclone, tempest, hailstorm etc. are covered.

- Man-made calamities like theft, burglary, riot, terrorist activity, strike, accident by outer means, damage during transportation by rail, road or waterway, elevator, lift etc.

Exclusions- Incidents That Aren’t Covered By the Policy

- Damage owing to an accident when the driver is driving without a valid license, or driving under the influence of alcohol or other sedative drugs.

- Mechanical /electrical failure.

- Damage caused during the war, or nuclear attack.

- If the car value depreciates according to market scenarios or any damage due to other external factors.

- If the accident occurs outside India, the expenses incurred will not be covered. However, by paying an additional premium, you can cover the vehicle for Nepal, Bangladesh, Bhutan, Maldives and Pakistan.

- If tyre or tubes of the car are damaged (unless it is an accidental damage that assures up to 50% liability of the total value.)

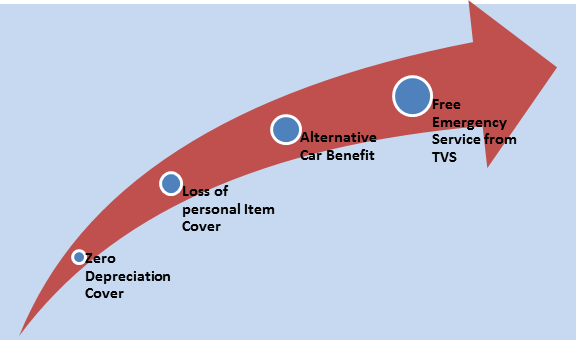

Additional Coverage from Oriental Insurance

Zero Depreciation Cover:

In case a claim is made for partial damages, with a zero depreciation cover, you will be reimbursed the full value of the damaged car parts without the calculation of depreciation rate.

Loss of Personal Items:

Maximum of Rs 5000 to Rs. 10,000 is payable against the loss of personal items. However, it excludes money, laptops, credit cards, electronic items etc. The list of losses covered by the policy is generally mentioned in the policy document, but the insured will be charged an additional premium to avail this.

Alternative Car Advantage:

In case of an accident, the insured will be facilitated with a replacement car which he/she can use for up to 15 days while the insured car is being repaired You can avail this facility only if the vehicle is damaged to at least 20% of IDV and is unable to function.

Avail Emergency Service Free of Cost:

If the car is insured at any of the offices of Oriental Insurance Company in NCR, Haryana, Punjab, Rajasthan, Himachal Pradesh, Mumbai, Kolkata or all South Indian states, you can avail emergency services free of cost as per the policy provision.

Car Insurance Premium & Factors Affecting the Premium Rate

There are a few factors that affect the premium of Oriental Car Insurance. They are:

Insured Declared Value or IDV of the Car:

Insured Declared Value, or IDV, is the present market value or the manufacturer’s listed selling price of the car. This is the maximum amount paid by the insurer to the insured when a total-loss claim is made. If you choose a higher IDV, you may have to pay a little more premium.

Capacity of the Car Engine: The cubic capacity of a vehicle’s engine plays an important role in deciding the premium. When IRDA decides the premium for third party liability insurance, it is done on the basis of the cubic capacity of the engine.

Zone of Registration of the Vehicle: The location where the car is registered is also influential. If the area of registration is prone to risks, the insurer may ask for a higher premium.

Age of the Car: Age factor matters a lot. The insurer demands a higher premium for the vehicle that is older than for a brand new car.

Final Word!

Apart from these, the insurance company decides car insurance premium by considering other factors as well. For accessories or any LPG/CNG kit that you recently got fitted in the car would lead to an extra premium. Add-on cover means you will have to bear an extra amount. But, if you are getting good benefits in return, then paying a little wouldn’t harm you. Remember, you should analyse your needs and opt for an insurance plan in a calculative way.

Find similar car insurance quotes by body type

Explore More Under Car Insurance

- Motor Insurance

- Car Insurance

- Zero Dep Car Insurance

- Compare Car Insurance

- Car Insurance Calculator

- Third Party Car Insurance

- Comprehensive Car Insurance

- IDV Calculator

- Car Insurance Companies

- Own Damage Car Insurance

- Electric Car Insurance

- Pay As You Drive Insurance

- Renew Expired Car Insurance

- Used Car Insurance

- NCB in Car Insurance

Car Insurance Articles

- Recent Article

- Popular Articles

Car Insurance Renewal in India: A Complete Guide

Have you found yourself delaying (and eventually forgetting) about

Read more

New Car Insurance Guide: What to Know Before...

More than 43 lakh new vehicles were sold in India in 2024 alone

Read more

Why There's a Rising Demand for Usage‑Based Car...

With the growing number of motorists in India demanding fairer

Read more

Car Insurance for Self-Driving or Autonomous...

Autonomous or self-driving vehicles are the future, as all major

Read more

All About Roadside Assistance in Car Insurance

The comprehensive car insurance package usually provides roadside

Read more

How to Get Your Duplicate Car Insurance Policy...

Losing your car insurance documents can be daunting, especially when you need them in an emergency or for a routine

Read more

How to Transfer Car Insurance Policy?

Buying a car, even second-hand, is a big decision, and often, people overlook the essential documentation involved

Read more

Get Vehicle Fitness Certificate from RTO...

A vehicle fitness certificate (FC) ensures that a motor vehicle is fit to be driven on roads. As per the Indian

Read more#Rs 2094/- per annum is the price for third-party motor insurance for private cars (non-commercial) of not more than 1000cc

*Savings are based on the comparison between the highest and the lowest premium for own damage cover (excluding add-on covers) provided by different insurance companies for the same vehicle with the same IDV and same NCB. Actual time for transaction may vary subject to additional data requirements and operational processes.

+Savings are based on the maximum discount on own damage premium as offered by our insurer partners.

##Claim Assurance Program: Pick-up and drop facility available in 1400+ select network garages. On-ground workshop team available in select workshops. Repair warranty on parts at the sole discretion of insurance companies. Dedicated Claims Manager. 24x7 Claim Assistance.